Japan Exchange Group, Inc. (JPX) is pleased to announce that it celebrates the 40th anniversary of its Japanese Government Bond (JGB) Futures market.

10-year JGB Futures have been attracting large numbers of investors, both in Japan and abroad. They originally started trading on the Tokyo Stock Exchange on October 19, 1985, marking the beginning of financial futures trading in Japan, and were subsequently transferred to the Osaka Exchange in March, 2014.

Over the four decades since 10-year JGB Futures were launched, JPX has strived to diversify its line-up by introducing products such as Options on 10-year JGB Futures , as well as 20-year JGB Futures and mini 10-year JGB Futures. It has also implemented system reforms that include extending trading hours and replacing trading systems.

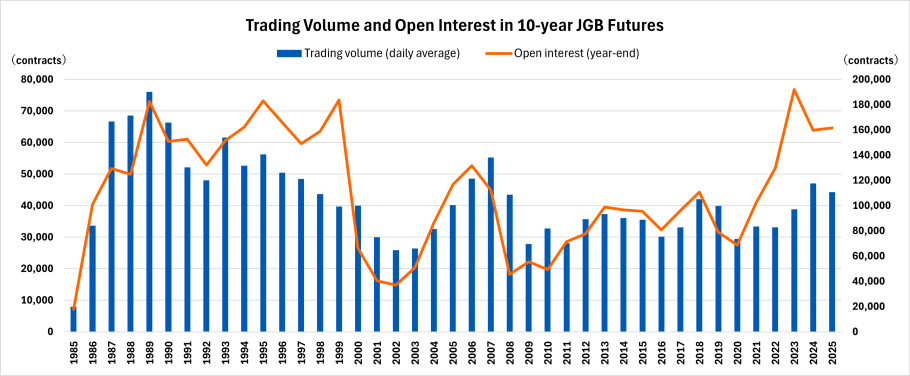

In addition, trading volume in JGB and interest rate futures has been steadily increasing in recent years as investors reaffirm the importance of these products in light of the changing direction of interest rates and other environmental shifts.

JPX remains committed to enhancing convenience in the derivatives market and contributing to the development of Japan’s financial markets.

Comment from Yokoyama Ryusuke, President & CEO, Osaka Exchange, Inc.

We are delighted to celebrate the 40th anniversary of the JGB Futures market and it is thanks to the cooperation of our investors and other market stakeholders that we have reached this milestone.

Since it first began trading, the JGB Futures market has been evolving in tandem with Japan’s financial markets. Over this period, I believe that by offering JGB Futures as a means to hedge against risk in JGB spot trading , we have aided the stable distribution of JGBs on the primary market and their smooth trading on the secondary market and, ultimately, have contributed to stability in Japanese financial markets overall.

With Japan now moving away from zero interest rates, the role of JGB Futures and interest rate futures is changing. We will continue striving to ensure stable market operations and enhance convenience for all market stakeholders.

Data Source: Japan Exchange Group (until the end of September 2025)