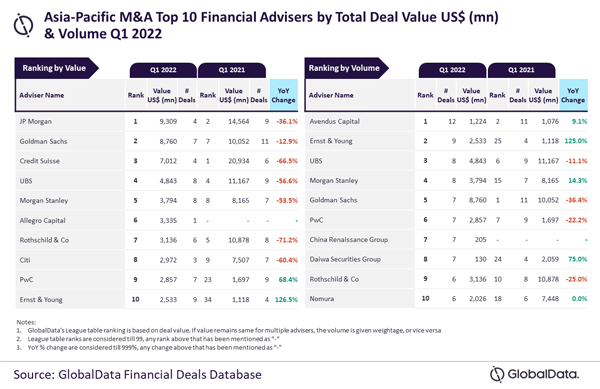

JP Morgan and Avendus Capital were the top mergers and acquisitions (M&A) financial advisers in the Asia-Pacific (APAC) region for Q1 2022 by value and volume, respectively. JP Morgan advised on four deals worth US$9.3bn, the highest among all the advisers. Meanwhile, Avendus Capital led in volume terms having advised on 12 deals worth US$1.2bn, according to GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that a total of 1,904 M&A deals were announced in the region during Q1 2022.

GlobalData’s report, ‘Global and Asia-Pacific M&A Report Financial Adviser League Tables Q1 2022’, shows that the deal value for the region increased by 38% from US$126.8bn in Q1 2021 to US$175bn in Q1 2022.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Avendus Capital was the only firm that managed to advise on double-digit deal volume during Q1 2022. However, it lagged behind in terms of value and did not feature in the top 10 list by this metric due to involvement in relatively low-value transactions.

“Similarly, despite leading by value JP Morgan did not feature among the top 10 advisors by volume. However, the company managed to top by value due to its involvement in high-value transactions. While the average size of deals advised by JP Morgan stood at US$2.3bn, it stood at US$102m for Avendus Capital.”

Goldman Sachs occupied the second position in terms of value with seven deals worth US$8.8bn followed by Credit Suisse with four deals worth US$7bn, UBS with eight deals worth US$4.8bn and Morgan Stanley with eight deals worth US$3.8bn.

Ernst & Young with nine deals worth US$2.5bn occupied the second position in terms of volume followed by UBS, Morgan Stanley and Goldman Sachs.