What’s in Store for 2012? Seven Global Market Structure Trends

As 2011 drew to a close and we at Instinet pondered what’s to come for traders, it seemed that 2012 would not so much see an emergence of entirely new trends but instead a continuation of many of the same developments from the past few years. The environment is unquestionably challenging. There are, however, some pockets of opportunity in which competition will be fierce. In what follows, we offer you our thoughts on what we believe will be the most important global market structure trends of 2012.

1. This is Crunch Time: Consolidation, Stripping Capacity, Low Investment

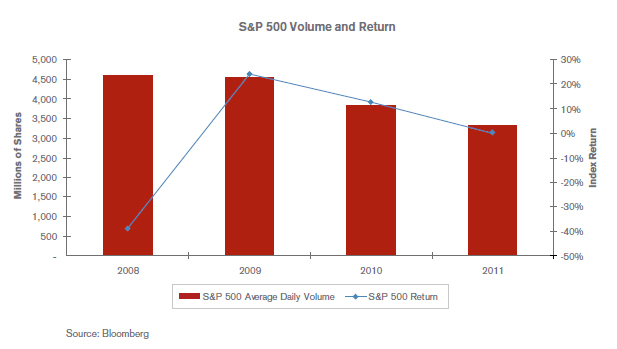

It should be news to no one that equity returns have been lackluster to terrible, depending on the region. Although 2009 and 2010 were good years for equity returns overall, macroeconomic dominance has not relaxed since 2008 and as a follow-on effect, trading volumes have not picked up (see graph). Correlation between individual equities is high, with global events dominating equity returns.

The buy side has had a difficult but not traumatic year with respect to assets. According to the Investment Company Institute, mutual fund assets as of October 2011 were down about four percent from December 2010. Turnover, however, has plummeted. Macroeconomics weigh on every decision and high daily volatility has been a deterrent to short term trading. With commission spending lower, the buy-side trading function is getting leaner and more selective, and the sell side is experiencing the crunch.

Simultaneously, the cost of technology and regulatory compliance has skyrocketed. Capital requirements and the implementations of /preparations for the Volcker Rule, the Market Access Rule and the Large Trader Identification Program have been and will continue to be expensive. And with technological innovation and improvement sure to continue, keeping up is crucial and at the same time expensive. Margins are being squeezed from every angle.

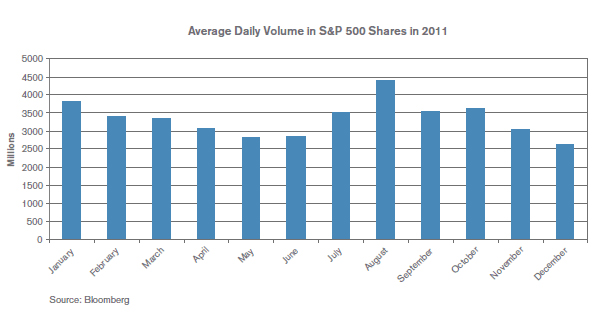

Headcount and investment reductions may not be enough, however. We have already seen consolidation—in Europe, Altium Capital has closed its securities division and Evolution Group, Merchant Securities, Arbuthnot Securities and Collins Stewart Hawkpoint have accepted takeover offers—and additional consolidation of buy-side firms, brokers or high-frequency shops would not be surprising. Without the volume spike in August (see graph), we would almost certainly have seen even more reductions in 2011 as capacity cannot be maintained indefinitely, particularly as volumes show no signs of picking up. The challenge here is that to consolidate, one party must have either cash or stock that is not totally devalued, and neither of those are easily found at the moment. The picture is not particularly pretty.

There will be pockets of opportunity, however: areas of growth include new markets such as private share trading and the development of countries with minimal electronic trading penetration (see trend #7). But even with those growth opportunities, all of us in the industry will have to work harder and adjust to new compensation realities.

2. Politicization of Regulatory Debate Continues

In Europe and the United States in particular, market structure debate has become the stuff of headlines. While articles with attention-grabbing headlines noting “high frequency trading” attract eyeballs and clicks, they are most often inflammatory and include misinformation. The resulting debate can often sound ludicrous to a practiced ear. The larger perception of tension between “Wall Street” and “Main Street” also adds to the rhetoric. Motivated by attention (media) and re-election (politicians), there can be little incentive to take the time to understand what is truly at stake in these debates.

Transparency and Testing

One impact of the politicization of the market structure debate is in the area of transparency and testing. Requirements to provide regulators with more information–for example, the Large Trader Identification Program, the proposed Consolidated Audit Trail, or the suggestion that HFTs be required to provide their algorithmic code–seem like good ideas on the surface. However, there comes a point at which this information cannot be processed and the cost of obtaining the information is not justified. The same is true of testing requirements. Trading firms have tremendous economic incentive to fully vet their strategies, but even with the testing they perform, problems occasionally arise. Adding a bureaucratic layer of “proving that testing has been done” only increases paperwork while doing little to address the core issues of market orders, price protection mechanisms and order-driven markets, which we believe have already been well addressed in most regions.

Threshold Regulation

The politicization of the debate also gives air to proposals that sound good but would have dire impacts on capital markets in practice. Examples include:

- speed limits on orders;

- minimum order duration; and

- regulatory charges on message traffic (in contrast to charges per trade).

We cannot hold ourselves back as an industry, as technological advancement will continue regardless. In addition, the enforcement of many of these proposals is just not feasible.

Another example is the financial transaction tax. Such a levy would directly impact the investment returns of end-investors through the passing on of these charges, while the resulting reduction in market liquidity would likely dramatically increase transaction costs.

HFT/Electronic Surveillance and Enforcement

2011 saw a number of enforcement actions taken against electronic market participants. It is encouraging that the importance of supervising and managing technology risk is recognized, and that in each of these very different cases, the regulatory response has been particular and in proportion to the events. Electronic trading surveillance is being conducted and sanctions for violations enforced, but the regulators are proving that they understand the marketplace and are not allowing political debates to cloud their judgment on the enforcement side. In addition, many of the enforcement actions taken—such as those against Pipeline Trading Systems and Swift Trade—have proven to be responses to age-old issues (market manipulation and lack of transparency/honesty) rather than new issues brought about by technological advancement.

3. Execution Management Systems: The Providers and the Product Continue to Evolve

One by one, the bulge bracket firms are rethinking their approach to the EMS business; consider Barclays’ sale of RealTick to ConvergEx, Citi’s sale of the Lava EMS to TradingScreen (and its separate sale of the ColorPalette OMS to FlexTrade) and, most recently, BofA Merrill Lynch’s white labeling of TORA’s Compass in Asia. We expect this restructuring to continue in 2012, with the EMS space left to vendors and agency-only brokers for whom agnosticism and neutrality are core tenets of the value proposition.

With that being the case, EMS development is more customer driven than ever. Many users are asking for even tighter integration between the EMS and their trading work flow. Others are looking for improvements such as increased analytics functionality and more robust options and futures offerings. Automation of the trading process is also becoming a key theme, with buy-side traders looking for efficient ways to integrate their trading decision process with their trading investment process.

4. Maturation of High Frequency Trading

With the business continuing to mature, the days of outsized profits for HFT firms are over. Margins are being squeezed, and firms are being forced to seek out new ways to make money. For example:

- Institutional Trading Services: In 2011 GETCO Execution Services launched GETAlpha, an institutional algorithmic suite, and GETRouted, a smart order router. The services join the previously launched GETMatched dark pool. While the dark pool has attracted considerable flow, the success of this latest effort is an open question: Does the buy side want trading algorithms provided by one of the best trading firms on the Street? Or are they wary of providing GETCO with information about their trading practices? Regardless, harnessing institutional and retail liquidity through algorithms, routers and marketplaces will be a focus for some HFT firms in 2012.

- Market Making: Both GETCO and Virtu have recently augmented their NYSE market making businesses through acquisition. These acquisitions are additional examples of HFT firms further moving into “mainstream” capital markets services by using their market structure know-how and technological expertise to do so more efficiently than some legacy players.

We expect 2012 to see continued consolidation in the HFT space, with larger firms acquiring smaller counterparts that are constrained by increasingly high regulatory and technology costs. We also expect to see HFT firms continue to poach talent from traditional broker dealers, whose businesses are generally not growing and are constrained by regulations such as Dodd-Frank.

5. Complex Spread Trading Technology

Spread trading volumes and demand for spreads is increasing rapidly. In addition, in the past 18 months, the number of Complex Order Books (COBs) for spread trading has increased from two to five (AMEX, ARCA, CBOE, ISE and PHLX). With this fragmentation comes the need for a set of tools such as smart routing to assist traders in executing spreads. While these tools are challenging to develop given the complexities and sheer volume of options market data and the highly fragmented marketplace, brokers have begun introducing both Smart Order Routing for spreads and automated strategies that allow users to set customized levels of “leg risk,” similar to a pairs strategy for equities. The obstacles are significant but not insurmountable and we are likely to see continued sophistication in complex spread trading.

6. Let’s Align: Merger Failures and Resource Constraints Lead To Innovative Global Alliances

With the exception of the proposed NYSE Euronext/Deutsche Bourse merger, which is due to be approved or rejected by the European Commission in the first quarter of 2012, 2011 saw the high-profile failure of a number of proposed exchange mergers: ASX/SGX, TMX/LSE and NASDAQ/ICE/NYSE. However, while they’ve avoided the spotlight to a large extent, there are a number of innovative global alliances in the works. These alliances and innovations allow for the globalization of equity trading and take advantage of particular synergies without the complications and regulatory hurdles of a combination.

For example:

- Korea Stock Exchange and Tokyo Stock Exchange have agreed to work together on data, listings and technology cost management;

- BRIC + South African exchanges have established an alliance to list each others’ stock index futures and index options contracts in local currencies;

- ASEAN Trading Link: Singapore, Malaysia, Philippines, Vietnam and Indonesia; and

- Andean Exchange Link/Mercado Integrado Latino Americano (MILA): Chile, Columbia, Peru and Mexico.

7. Competition Evolves In New Markets: Australia, Brazil and Korea

Australia

It was a long time coming, but with the launch of Chi-X Australia on October 31 true competition has officially arrived in Australia. While there have been high frequency exchange members in Australia for some time, fragmentation is likely to attract more electronic trading strategies to the country. Although clearing costs are relatively high due to the vertical silo owned by the ASX, a global exchange operator looking to expand could possibly launch a venue there. Another possibility would be a joint venture between a broker and a vendor that would provide a liquidity partnership to support the venue and an alternative to an internalized pool as a way of monetizing flow.

Brazil

The Brazilian central regulator has publicly supported competition and the BM&FBovespa (BVMF) has taken the approach of proactively courting electronic and high frequency trading while fighting the possibility of true competition. Infrastructure is being built, fees have been cut and co-location facilities have been introduced. In December, the government removed the financial transactions tax (IOF) of 200 basis points on short-term foreign capital, which had been a key deterrent to high frequency trading.

There are no ATS rules in Brazil, so any venue would have to register as an exchange. This process is untested and likely to be bureaucratic. Regardless, Direct Edge and BATS have both signaled their intention to launch a marketplace in Brazil, but the major potential stumbling block relates to clearing and settlement. The BVMF controls both of these functions, and has stated that it will not provide clearing and settlement to a competing exchange. Clearing costs are a critical component to the evolution of electronic trading in any country and thus while Brazil will be much discussed in 2012 and the Exchange’s efforts may bear fruit in creating volume, we do not expect to see off-exchange trading in Brazil in 2012 without enforced interoperability.

Korea

Korea is currently the focus of much attention. This is a retail-heavy market with extremely high turnover and low trade sizes. The large minimum tick size means that spreads are wide. ETF trading has grown exponentially over the past year. The KOSPI 200 index derivatives market is the most active in the world and derivative trading transaction fees are low.

Korean names are highly correlated with the Chinese economy but are easier to access, making Korea an ideal proxy for Chinese investment exposure. IPO volumes have been growing quickly and the Korea Stock Exchange (KRX) has been able to attract new listings from other Asian countries.

In July, the Financial Services Commission proposed a change to the Capital Markets Act that would provide licenses for new trading systems for the first time. The KRX has taken a number of important initiatives to support its growth in an electronic age. However, the major impediment to the evolution of Korean equity trading is the 30 basis point stamp tax, payable by the seller. Another major concern is the ID-based market structure, which is transparent by ID on both a pre- and post-trade basis.

Even with these potential hurdles, the supportive exchange and regulator, active retail trading and strong economic prospects, particularly relative to the region, make Korea an important country to watch.