1) Bitcoin’s Volatility Declines

We are seeing a flight to safety and the ultimate sanctuary in this climate has been the U.S. dollar drawing capital from emerging market countries - with those whose economies reliant on natural resources left especially vulnerable. The Fed printing dollars to have a balance sheet of over $6 trillion as well as the IMF offering SDR's means that dollar supply is going up.

- Year-to-date, the S&P 500 is down 13.9%

- Over the same period, Bitcoin is down 3.3%

- Gold moved up 13.6% since the year started

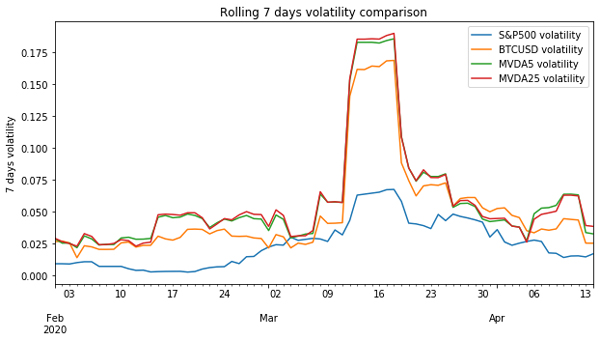

The charts below are showing the crypto market is down more than the S&P which is off its peak by 20%. Volatility shows the clustering effect and correlation amongst cryptocurrencies with 7-day volume sharply jumping. The bitcoin volume jump is not as bad as the CryptoCompare MVIS 5 index which itself has less volatility than the CryptoCompare MVIS 25 Index.

2) Inflation is Coming

When the tide goes out, all boats sink and that's what we have seen in this initial phase of the crisis. Bitcoin and digital currencies have been affected to a similar degree in the short term as traditional equity markets. But in the mid to long term, we might see some shifts when investors start to look at future scenarios as the dust settles. One thing is clear - inflation is coming. So TIPs, gold and utilities are the traditional ports of call - bitcoin also fits the mould.

Highly leveraged companies will be in trouble in the short term without the ability to pass through rising costs. So the S&P will be a mixed bag where some companies will be caught with declining margins and others with demand rebounds and the Feds cash injection stimulating demand will have the ability to pass through their costs and increase revenues.

Bitcoin could see some use in cross-border transactions as we start to see emerging market currencies fail. The strong draw to the dollar will see increased restrictions on capital flows that will compel some citizens to look for other routes to preserve and move wealth. Higher sovereign risk premia and ratings downgrades are on the cards.

3) What is Money?

This crisis is raising the question of what exactly is money - governments are being forced to open the doors to modern monetary theory (MMT) which removes the mirage of fiat. It might be difficult to go back from this unveiling, but what choice do governments have - there are the ghosts of Hayek and Keynes in these arguments.

Under these circumstances, we may see a shift to assets that cannot be perpetually diluted instead of papering over the cracks. For the moment, cash is the only port in the storm but that may prove to be a false hope in the mid to long term.

Its risk-off across the markets - Bitcoin is still novel and is great as a means of transferring value quickly, person to person, but bad at holding value. The theory is that, with time, this will change but quite clearly it has nascent fragmented markets at present and isn’t fulfilling the digital gold story.