Dr. Obaid Saif Al Zaabi:

"Workshops are organized for the representatives of brokerage companies to discuss the requirements for the provision of investment services according to a roadmap that ensures diversification of corporate income sources and improves the service delivered to investors."

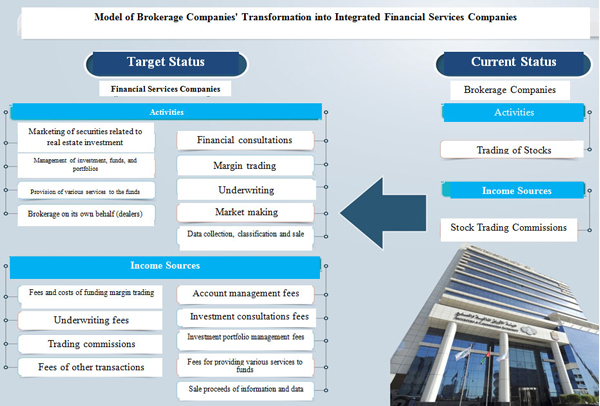

The Securities and Commodities Authority (SCA) organized several workshops for the representatives of the brokerage companies in the UAE with a view to discuss the tools and techniques that ensure the application of the new concept of the brokerage companies, which would enhance their role and functions to transform into a model of integrated financial services companies, especially with the introduction of an integrated methodology to upgrade the UAE financial markets to the rank of developed markets in accordance with the UAE Government's Strategy 2021, which aims at laying the foundations for a competitive environment for the financial services companies to ensure the achievement of the highest criteria of excellence, which would allow investors to opt for the most excellent, committed and capable financial service provider that can provide outstanding, transparent and decent services, and contribute to attaining record levels of institutional development of the financial services companies so that they live up to the competition with their counterparts in the developed markets, and can diversify their sources of income and stop relying on trading proceeds as a sole source of income, as well as diversifying the operational risks, and conform with governance, systemic risks and disclosure requirements, especially where related to money laundering and terrorism financing.

Dr. Obaid Saif Al Zaabi, CEO of the SCA, stated that the workshops tackled many topics, including the diverse activities practiced by the brokerage companies in many developed markets, as identified by a study of the best international practices. Such activities are represented in financial consultations, margin trading, underwriting, market making, collection, compiling and selling of data, marketing of securities related to real estate investments, investment, funds and portfolios management, provision of different services to the funds and brokerage on its own behalf (dealers).

Dr. Al Zaabi added that the discussions with the representatives of the brokerage companies examined the issue of “diversifying the income sources of brokerage companies” so that such income is not limited to the commissions collected from selling and buying stocks, but it goes beyond this source to include revenue generated by such companies from the account management fees, investment consultation fees, investment portfolio management fees, fees for providing various services to the funds, proceeds from the sale of information and data, fees and charges of margin trading finance, underwriting fees, trading commissions, and fees of other transactions.

He pointed out that a brokerage company must meet the mandatory requirements in order to become an approved integrated securities company. The company must have professional cadres qualified in the field of brokerage, investment management and other financial services. Furthermore, the company must have the adequate capital to cover the volume of trades, in addition to bank guarantees; and must provide an undertaking to comply with the regulations and laws of the SCA.

Dr. Al Zaabi noted that under the new concept of brokerage companies, such companies should be proactive in performing the role assigned to them in marketing their products and services and raising the awareness of investors in financial markets. They must carry out promotion endeavors in the financial markets within the UAE and abroad, through multiple activities that include campaigns to market their services and products through the social media and SMS, and advertising additional services with special features that can be provided by the brokerage companies to encourage the clients and investors to engage in the financial market, in addition to holding seminars and events to raise the awareness of customers.

The SCA welcomed the proposal submitted by the representatives of the brokerage companies who participated in the workshop to hold one-to-one meetings with each company during the upcoming period in order to listen to feedback from representatives concerning the new approach and the prerequisites for its application, and their views in this regard.