The Securities and Futures Commission (SFC) has reprimanded and fined State Street Global Advisors Asia Limited (SSGA) $4 million for its failure to comply with regulatory requirements in the management of Tracker Fund of Hong Kong (Fund) (Notes 1 & 2).

An SFC investigation found that from 1 December 2008 to 30 June 2013 (Relevant Period), the cash balances of the Fund that were deposited with State Street Bank and Trust Company’s (SSBT) demand deposit account did not earn any interest because SSBT’s deposit rates on Hong Kong dollars were zero. SSBT was the Fund’s trustee and an affiliate of SSGA. SSGA did not check the rate of interest offered by other banks.

According to the SFC’s investigation findings, the prevailing commercial interest rates on Hong Kong dollars (HKD) for a deposit of the same size and term as the Fund’s cash balances were above zero during the Relevant Period (Note 3).

The SFC considers that SSGA had failed to ensure that interest received on the Fund’s Hong Kong dollar cash balances from its connected person was at a rate not lower than the prevailing commercial rate for a deposit of that size and term as required by the Code on Unit Trusts and Mutual Funds (UT Code).

The SFC also found that SSGA’s internal procedures on the management of the Fund’s cash balances were inadequate. By not following the requirements of the UT Code and the Trust Deed when depositing the Fund’s cash balances with SSBT, SSGA had failed to manage and minimise the conflict between the interests of the Fund’s investors and the interests of SSGA/SSBT.

The SFC further found that SSGA had wrongly represented in six interim and annual reports of the Fund that the Fund’s cash balances were placed in a non-interest bearing current account when in fact the cash was deposited with SSBT in an interest bearing account earning zero interest.

In deciding the sanctions, the SFC took into account that SSGA:

- co-operated with the SFC in resolving the SFC’s concerns;

- agreed to make a voluntary payment of $318,315 into the Fund (Note 4);

- agreed to engage an independent reviewer to conduct an internal controls review of the cash management policy and procedures of SFC-authorized funds managed by SSGA; and

- has a clean disciplinary record in relation to its regulated activities.

End

Notes:

- SSGA is licensed under the Securities and Futures Ordinance (SFO) to carry on Type 1 (dealing in securities), Type 2 (dealing in futures contracts), Type 4 (advising on securities), Type 5 (advising on futures contracts), and Type 9 (asset management) regulated activities.

- SSGA acted as the investment manager of the Fund. The Fund is an exchange-traded fund and its units have been listed on The Stock Exchange of Hong Kong Limited since 1999. Its investment objective is to provide investment results that closely correspond to the performance of the Hang Seng Index.

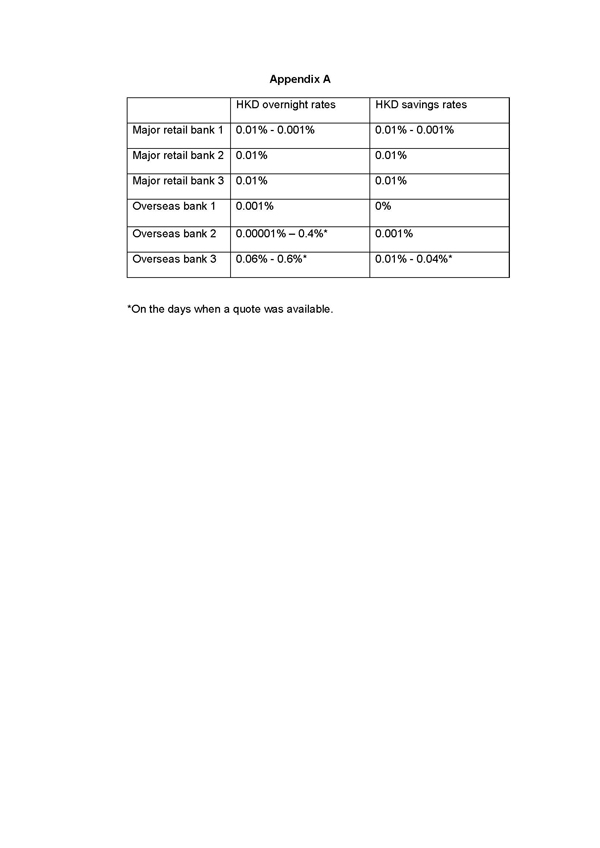

- The SFC collected evidence on HKD overnight rates and HKD savings rates on deposits that were of the same size and term as the Fund’s cash balances during the Relevant Period from six banks in Hong Kong, including three major retail banks and three overseas banks that have branches in Hong Kong. The interest rates that these banks offered are set out at Appendix A.

- SSGA determined the amount of the voluntary payment by applying an interest rate of 0.01% to the Fund’s cash balance for the Relevant Period and from the end of the Relevant Period to the date when the majority of the Fund’s cash balance was transferred out of SSBT’s demand deposit account.

A copy of the Statement of Disciplinary Action is available on the SFC website