Although volatility experienced a comeback in 2015, the turmoil was insufficient to draw traders back to the U.S. options market. TABB Group’s latest research, “2015 US Options Market in Review: Higher Volatility, Stagnant Volume,” reveals that from 2012 to 2014, the industry may have inaccurately pinned slowing volume growth on the lack of volatility with claims that the calm environment eliminated trading opportunities.

The year-end data analyzed by TABB Group indicates that argument cannot be applied to 2015’s trading slump. “In 2015, traders were dealt the most volatility since the European debt crisis and the CBOE VIX Index climbed to its highest levels since 2011. This turbulence didn’t jump-start trading as expected and the sustained volatility couldn’t bring traders back to the market either,” explains TABB analyst and report author Callie Bost. “Volume dropped off even more as additional options series were introduced, suggesting more choices for investors is not the cure to re-ignite trading.”

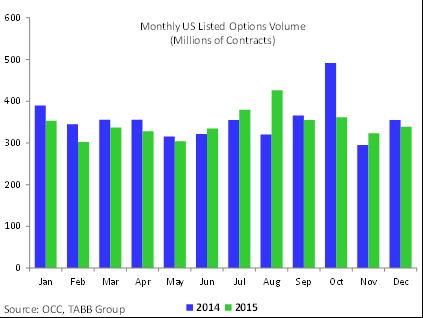

Despite conventional wisdom on volatility’s impact, the December 2015 TABB Options LiquidityMatrix™ finds that only 4.14 billion contracts were exchanged in 2015, a 2.9% drop from 2014 totals, while the options market posted lower year-over-year volumes in eight of 12 months last year. A prime example, December’s U.S. listed options volumes totaled 338.8 million contracts, 4.8% higher than November’s total, but 4.5% lower than December 2014.

“The upside in volume data for 2015 comes from the encouraging growth in broad-market ETF and index products,” continues Bost. “Volume in ETF options increased to 37.4% of total volume from 35.2% in 2014, while volume traded in index options climbed to 10%. Still, investors’ use of single-stock options declined to 52.6% of total volume from 54.9% in 2014.”

The two U.S. listed options research reports are now available for download by TABB derivatives clients and pre-qualified media at https://research.tabbgroup.com/search/grid. For more information or to purchase the reports, contact info@tabbgroup.com.