High-value* venture capital (VC) activity during the first three quarters (Q1-Q3) of 2025 remained overwhelmingly clustered within the world’s top 10 investment markets, with the US extending its dominance across both deal volume and value. The sharp concentration of mega-deals signals a maturing late-stage funding landscape, where capital increasingly flows toward established ecosystems, reshaping competitive positioning and leaving other markets with a shrinking share of global investor attention, according to GlobalData, a leading data and analytics company.

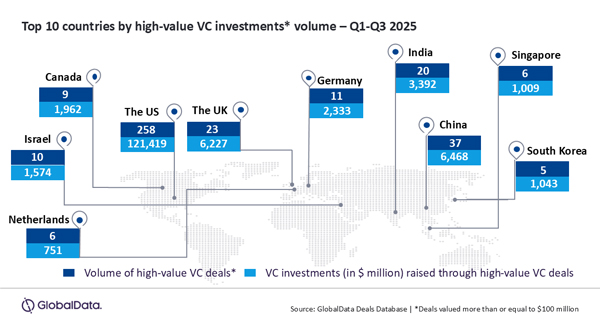

An analysis of GlobalData’s Deals Database shows that the US saw the announcement of 258 high-value VC deals totaling $121.4 billion in Q1-Q3 2025, capturing about 60% of global deal volume and nearly 80% of total value. In fact, it was the only market with triple-digit high-value VC deal volume during the review period.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The US is setting the pace for high-value VC investments globally. The sheer volume of deals not only reflects the robust health of the US startup ecosystem but also indicates a growing confidence among investors in the potential for high returns in the market.”

The US is distantly followed by China that saw the announcement of 37 high-value VC deals of worth $6.5 billion during Q1-Q3 2025. The UK, India, Germany, and Israel followed with 23, 20, 11 and 10 high-value VC deals respectively, raising $6.2 billion, $3.4 billion, $2.3 billion and $1.6 billion.

Canada, Singapore, the Netherlands and South Korea were among the other countries in the top 10 list. During Q1-Q3 2025, these top 10 countries collectively attracted more than 90% of the total number of high-value VC investments announced globally. In terms of value, the combined share of these markets stood at around 94%.

Bose concludes: “As US mega-deals continue to dominate, we expect capital to concentrate further in sectors and companies demonstrating clear path-to-scale, driving premium valuations and intensifying competition for late-stage assets. On the other hand, other markets need stronger policy support and ecosystem development to stay competitive. The gap may widen unless other regions accelerate their innovation and funding pipelines.”

* ≥ $100 million

Note: Historic data may change in case some deals get added to previous months because of a delay in disclosure of information in the public domain.