|

When will the reclassification take place?

On June 25th, 2019 MSCI announced the reclassification of the MSCI Kuwait Index to emerging market status. This reclassification was subject to two conditions targeted at international investors. The conditions were that omnibus account structures as well as National Investor Number (NIN) cross trades will be made available to international investors by the end of November 2019. Following this, MSCI will communicate its final decision by December 31st, 2019.

Three weeks earlier on November 6th the Boursa Kuwait CEO, Mr. Mohammed Saud Al Osaimi, announced via a Bloomberg TV interview that these changes had been completed, and the required conditions met. An announcement from MSCI is expected imminently as to the completion of these conditions.

The opinion among local decision makers is that this upgrade is too important economically and politically for there to be any hesitation regarding the implementation of the changes.

Furthermore, both the omnibus structure as well as NIN cross trades are already available for local investors. Hence, fulfilling MSCI’s requirements does not mean reinventing the wheel but rather just introducing some tailored mechanisms and relevant rules and regulations.

As one of Kuwait’s main goals is to be considered the financial hub and capital of the Middle East, failure is not an option, especially considering that Saudi Arabia, the United Arab Emirates and Qatar have already been upgraded by MSCI. Taking all this into account, we expect that the MSCI December decision will be positive.

What will be the impact of the inclusion for Kuwait?

Assuming MSCI reaffirms its decision to upgrade Kuwait, investors will want to consider the impact this will have on Kuwait equities. The most predictable effect will come from passive inflows into those stocks that will be newly included in the MSCI Emerging Market Index during its rebalance in May 2020. Boursa Kuwait estimates these flows at USD 2.6 to 3.0 billion. In addition, to passive flows, active investors will aim to position themselves too. Estimates for such active flows amount to USD7.5 billion.

The Saudi precedent

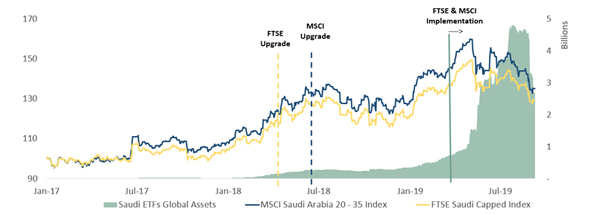

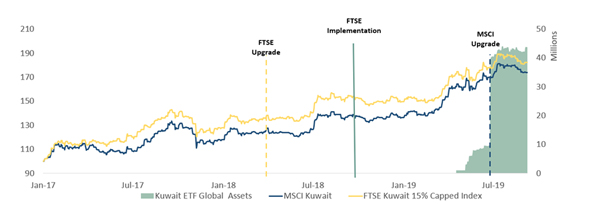

Looking at Saudi Arabia as a case study, the market showed discernible positive price impacts both in anticipation of the reclassification announcement as well as during the months leading up to the implementation. Using this comparison, Kuwait might experience a similar performance boost in the first half of 2020 due to the discussed buy side pressure prompted by the MSCI implementation. A similar pattern was also observable in asset flows into Saudi ETFs. Investors’ allocations started to significantly increase in January 2019, rising from USD 250 million to almost USD 5 billion by mid-year. Considering that assets in Kuwait ETFs currently stand at $90 million, there seems considerable room to grow, further supporting Kuwaiti stock prices.

It is also worth mentioning that Qatar and the UAE went through the same upgrade process in 2013. Both markets experienced significant positive equity price performance ahead of the implementation. Qatar’s market rose by 42% and UAE’s by 44%.

Source: FTSE Russell, MSCI, Bloomberg

Source: FTSE Russell, MSCI, Bloomberg

Abdullah Albusairi is Director of KMEFIC, which sponsor the KMEFIC FTSE Kuwait Equity EUCITS ETF. The fund tracks the FTSE KuwaitAll Cap 15% Capped Index. An index of large, mid and small cap securities trading on the premier or main market of Kuwait Stock Exchange. The fund seeks to provide targeted exposure to an emerging market with significant growth potential.

Abdullah Albusairi is presenting a webinar on ‘Kuwait MSCI Emerging Market Inclusion -A tactical solution for investors in 2020?’ on December 5th 2019 at 10am GMT.

HANetf’s range of thematic ETFs:

The content in this document is issued by HANetf Limited (“HANetf”), an appointed representative of Mirabella Advisers LLP, which is authorised and regulated by the Financial Conduct Authority (“FCA”). For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included on this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided on this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements.

|