- First financial institution in Europe to issue a bond dedicated to the defence sector

- €750 million senior unsecured bond with a five-year maturity

- High-level of oversubscription (€2.8 billion in the order book)

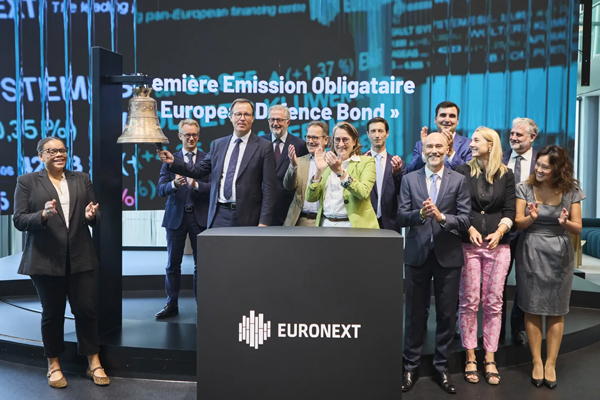

Euronext today congratulates Groupe BPCE on the admission of the first bond issued by a financial institution in Europe dedicated to the defence sector, granted with the Euronext European Defence Bond Label. The €750 million senior unsecured bond issued by Groupe BPCE was listed on Euronext on 5 September 2025.

Euronext introduced the new European Defence Bond Label on 10 July 2025. This label is a voluntary, market-driven initiative for listed bonds aimed at directing private capital towards eligible defence and security projects in Europe. Developed in close consultation with investors, issuers and financial institutions, the European Defence Bond Label offers clear eligibility criteria based on the use of proceeds. It is used for the issuance of European defence bonds on Euronext markets and serves as the basis for granting the fast-track admission process announced earlier in May 2025 to qualifying bonds.

On 5 September 2025, Groupe BPCE successfully listed on Euronext the first European Defence bond issued by a financial institution in Europe. The placement of this €750 million senior unsecured bond with a five-year maturity was arranged by BPCE and distributed by Natixis Corporate & Investment Banking (Natixis CIB).

The funds raised will be used to finance and refinance assets of companies active in the European defence and security sector across the entire value chain, as well as contracts related to the development, manufacturing or production of specialised equipment in these areas.

The success of the issuance is testament to the market's strong interest in this pioneering initiative, with an oversubscribed order book of €2.8 billion and demand from more than 140 investors. It reflects the confidence placed in Groupe BPCE’s signature and Groupe BPCE's commitment to the European defence and security sector.

Jérôme Terpereau, Chief Executive Officer responsible for Finance at Groupe BPCE, said: “BPCE's issuance of the first European Defence Bond, benefiting from the Euronext Label, marks a new milestone in the financing of companies in the defence and security sector. Thanks to this issuance, which generated strong interest from investors, Groupe BPCE reaffirms its commitment to this strategic area, which is essential for national and European sovereignty, as well as its quality as a pioneer in the bond market.”

Caption: Jérôme Terpereau, Chief Executive Officer responsible for Finance at Groupe BPCE rang the bell during a ceremony today to celebrate the listing of the first bond issued by a financial institution in Europe dedicated to the defence sector and granted with Euronext’s European Defence Bond Label.