- GPW was Europe’s third biggest market by the number of IPOs in 2017 (on a par with the Spanish exchange BME)

- The total value of IPOs on GPW was over EUR 1.8 billion in 2017, the highest since 2011

- The IPO of Play Communications SA on GPW was the eighth biggest European IPO in 2017

27 Initial Public Offerings (IPO) were successfully completed on the Warsaw Stock Exchange in 2017, including eight IPOs on the Main Market and 19 IPOs on NewConnect. According to PwC’s IPO Watch Europe Report, GPW ranked third, on a par with the Spanish exchange, by the number of IPOs and eighth by the value of IPOs. The IPO of Play Communications SA worth EUR 1.0 billion was the eighth biggest IPO in Europe in 2017.

“The strong macroeconomic conditions in Europe, the appreciation of the Polish currency and investors’ positive perception of the Polish economy have contributed to the growth of capital raised by companies on the public market. We welcome the strong position of GPW in Europe by the number and value of IPOs, especially in view of the fact that companies floated on GPW offer more and more globally scalable products. Capital market institutions are increasingly complementary. Companies from portfolios of funds supported by the National Capital Fund are floated on GPW. They have a huge growth potential, which may generate future profits for investors,” said Marek Dietl, President of the Management Board of the Warsaw Stock Exchange.

Table 1. Number and value of IPOs on European exchanges in 2017

|

IPOs in 2017 |

||

|

Exchange |

Number of IPOs |

Value of IPOs [EURm] |

|

London Stock Exchange Group |

135 |

17 634 |

|

Nasdaq Nordic |

98 |

3 996 |

|

Warsaw |

27 |

1 811 |

|

BME (Spanish Exchange) |

27 |

3 696 |

|

Euronext |

20 |

3 258 |

|

Deutsche Boerse |

13 |

2 525 |

|

Oslo Børs&Oslo Axess |

11 |

1 099 |

|

Six Swiss Stock Exchange |

5 |

3 853 |

|

Bucharest Stock Exchange |

4 |

256 |

|

Irish Stock Exchange |

3 |

3 756 |

|

Borsa Istambul |

3 |

278 |

|

Wiener Boerse |

1 |

1 680 |

|

Budapest |

1 |

73 |

|

Prague |

0 |

0 |

|

Luxembourg |

0 |

0 |

|

Sofia |

0 |

0 |

|

Total |

348 |

43 915 |

Source: PwC, IPO Watch Europe, 2017 report

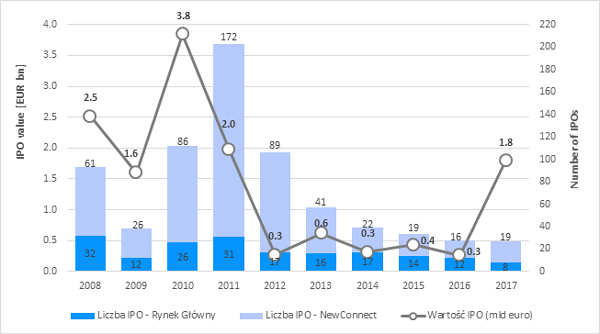

Figure 1. Polish IPO market since 2008

Source: PwC, IPO Watch Europe, 2017 report

GPW reported a significant improvement in the value of listed companies in 2017. The market value of companies newly listed on the GPW Main Market and NewConnect was PLN 16.7 billion at the end of 2017, which was more than double the market value of delisted companies (PLN 8.2 billion). The capitalisation of 14 companies delisted following tender offers was PLN 6.4 billion (over PLN 10 billion less than the capitalisation of new companies listed on the GPW stock markets).

Table 2. New listings v. delistings on GPW Main Market and NewConnect in

|

Year |

Number of new listings |

Number of delistings |

Number of delistings following tender offers |

Capitalisation of new listings (PLNbn) |

Capitalisation of delistings (PLNbn) |

Capitalisation of delistings following tender offers (PLNbn) |

|

2017 |

27 |

28 |

14 |

16.7 |

8.2 |

6.4 |

|

2016 |

28 |

42 |

13 |

5 |

7.7 |

5.8 |

Source: GPW