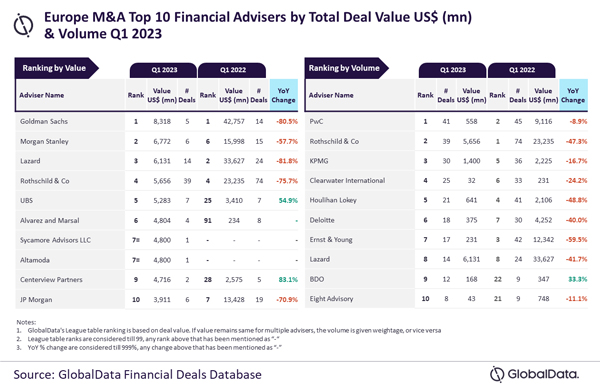

Goldman Sachs and PwC were the top mergers and acquisitions (M&A) financial advisers in Europe region during the first quarter (Q1) of 2023 by value and volume, respectively, according to the latest financial advisers league table by GlobalData, a leading data and analytics company.

GlobalData’s Financial Deals Database reveals that Goldman Sachs achieved its leading position in terms of value by advising on $8.3 billion worth of deals. Meanwhile, PwC led by volume by advising on a total of 41 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Goldman Sachs suffered setback in terms of value in Q1 2023. The total value of deals advised by the firm fell by 80.5% from $42.8 billion in Q1 2022 to $8.3 billion. However, this did not deter the company from retaining its leadership position by value as none of the advisors were able to touch $10 billion in total deal value in Q1 2023 as market conditions remained volatile.

“Meanwhile, Akin to most of its peers, PwC also witnessed decline in deals volume in Q1 2023 compared to Q1 2022. However, the decline was relatively much lesser. Resultantly, it went ahead from occupying the second position by volume in Q1 2022 to lead the chart by this metric in Q1 2023.”

An analysis of GlobalData’s Financial Deals Database reveals that Morgan Stanley occupied the second position by value, by advising on $6.8 billion worth of deals, followed by Lazard with $6.1 billion, Rothschild & Co with $5.7 billion and UBS with $5.3 billion.

Meanwhile, Rothschild & Co occupied the second position in terms of volume with 39 deals, followed by KPMG with 30 deals, Clearwater International with 25 deals and Houlihan Lokey with 21 deals.

*Deals value more than or equal to $1 billion