GlobalData has announced the latest Legal and Financial Adviser League Tables, based on the total value and volume of merger and acquisition (M&A) deals they advised on in technology, media, and telecom sector in H1 2023.

Legal Advisers

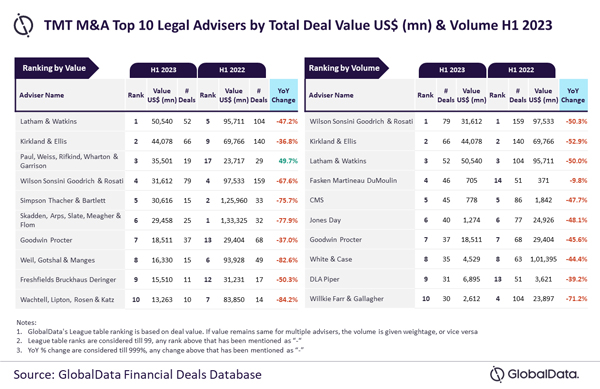

Latham & Watkins, Wilson Sonsini Goodrich & Rosati top M&A legal advisers by value, volume in technology, media, and telecom sector in H1 2023

Latham & Watkins and Wilson Sonsini Goodrich & Rosati were the top mergers and acquisitions (M&A) legal advisers in the technology, media, and telecom sector during the first half (H1) of 2023 by value and volume, respectively, according to the latest Legal Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Latham & Watkins achieved its leading position in terms of value by advising on $50.5 billion worth of deals. Meanwhile, Wilson Sonsini Goodrich & Rosati led in terms of volume by advising on a total of 79 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Most of the top 10 advisers by value witnessed decline in the total value of deals advised by them during H1 2023 compared to H1 2023. Latham & Watkins also witnessed decline, but it was relatively lesser compared to most of its peers. Resultantly, it went ahead from occupying the fifth position by value in H1 2022 to top the chart by this metric in H1 2023. In fact, it was the only firm to surpass $50 billion in total deal value during H1 2023. Latham & Watkins advised on eight billion-dollar deals*, which also included two mega deals valued more than $10 billion.

“Meanwhile, Wilson Sonsini Goodrich & Rosati, despite registering a decline in deals volume in H1 2023 compared to H1 2022, managed to retain its leadership position by this metric. Apart from leading by volume, it also occupied the fourth position by value in H1 2023. Similarly, Latham & Watkins also occupied the third position by volume in H1 2023.”

Kirkland & Ellis occupied the second position in terms of value, by advising on $44.1 billion worth of deals, followed by Paul, Weiss, Rifkind, Wharton & Garrison with $35.5 billion, Wilson Sonsini Goodrich & Rosati with $31.6 billion, and Simpson Thacher & Bartlett with $30.6 billion.

Meanwhile, Kirkland & Ellis occupied the second position in terms of volume with 66 deals, followed by Latham & Watkins with 52 deals, Fasken Martineau DuMoulin with 46 deals, and CMS with 45 deals.

*Deal value ≥ $1 billion

Financial Advisers

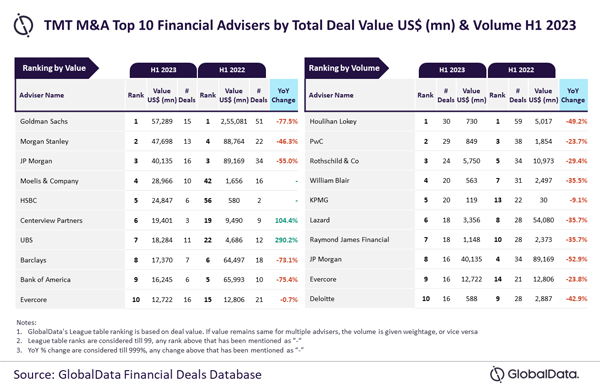

Goldman Sachs, Houlihan Lokey top M&A financial advisers by value, volume in technology, media, and telecom sector in H1 2023

Goldman Sachs and Houlihan Lokey were the top mergers and acquisitions (M&A) financial advisers in the technology, media, and telecom (TMT) sector during the first half (H1) of 2023 by value and volume, respectively, according to the latest Financial Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Goldman Sachs achieved its leading position in terms of value by advising on $57.3 billion worth of deals. Meanwhile, Houlihan Lokey led in terms of volume by advising on a total of 30 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Goldman Sachs and Houlihan Lokey led the chart by value and volume, respectively, in H1 2022 and are able to retain their leadership position in H1 2023 as well.

“Meanwhile, Houlihan Lokey led by volume in H1 2023 but lagged in terms of value and did not feature among the top 10 advisers by value. On the other hand, Goldman Sachs, despite advising on half the number of deals advised by Houlihan Lokey, managed to top the chart by value due to its involvement in big-ticket deals. Goldman Sachs advised on eight billion-dollar deals*, which also included two mega deals valued more than $10 billon.”

Morgan Stanley occupied the second position in terms of value, by advising on $47.7 billion worth of deals, followed by JP Morgan with $40.1 billion, Moelis & Company with $29 billion and HSBC with $24.8 billion.

Meanwhile, PwC occupied the second position in terms of volume with 29 deals, followed by Rothschild & Co with 24 deals, William Blair with 20 deals and KPMG with 20 deals.

*Deal value ≥ $1 billion