GlobalData has released the latest Legal and Financial Adviser League Tables, in terms of the total value and volume of merger and acquisition (M&A) deals they advised on, during Q1-Q3 2022. See the findings below.

Legal Advisers

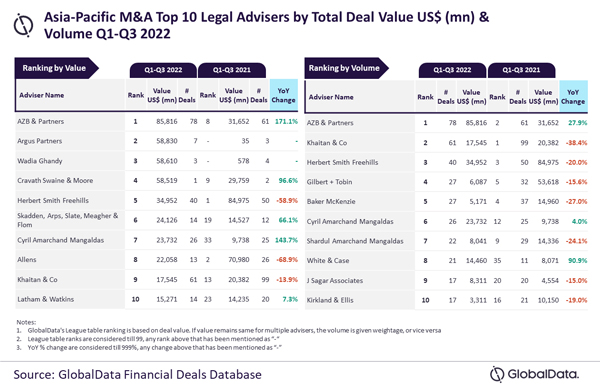

AZB & Partners tops list of M&A legal advisers in Asia-Pacific during Q1-Q3 2022

AZB & Partners has emerged as the top mergers and acquisitions (M&A) legal adviser in the Asia-Pacific region for Q1-Q3 2022, in terms of value as well as volume, finds GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘Global and Asia-Pacific M&A Report Legal Adviser League Tables Q1-Q3 2022’, a total of 5,812 M&A deals worth $459.8 billion were announced in the region during Q1-Q3 2022.

An analysis of GlobalData’s Financial Deals Database reveals that AZB & Partners has topped the list by advising on 78 deals worth $85.8 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “AZB & Partners remained much ahead of its peers in terms of value as well as volume. The total deals value for the firm occupying the second spot by value was $27 billion lesser compared to AZB & Partners. Similarly, the total number of deals advised by the firm occupying the second spot by volume was 17 deals lesser compared to AZB & Partners.

Argus Partners occupied the second position by value, by advising on $58.8 billion worth of deals, followed by Wadia Ghandy with $58.6 billion, Cravath Swaine & Moore with $58.5 billion, and Herbert Smith Freehills with $35 billion.

Meanwhile, Khaitan & Co occupied the second position in terms of volume with 61 deals, followed by Herbert Smith Freehills (40 deals), Gilbert + Tobin (27 deals), and Baker McKenzie (27 deals).

Financial Advisers

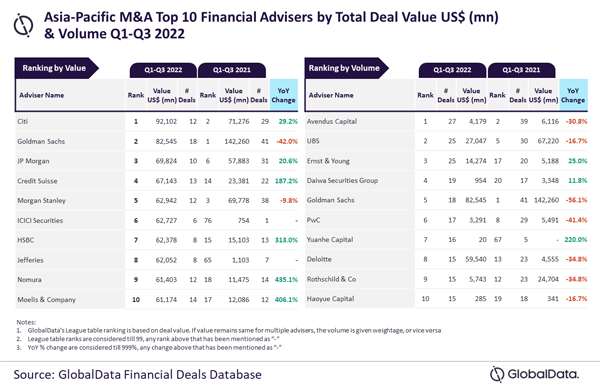

Citi, Avendus Capital top M&A financial advisers by value, volume in Asia-Pacific for Q1-Q3 2022

Citi and Avendus Capital have emerged as the top mergers and acquisitions (M&A) financial advisers in the Asia-Pacific region for Q1-Q3 2022 by value and volume, respectively.

Citi achieved its leading position by value by advising on $92.1 billion worth of deals. Meanwhile, Avendus Capital led by volume by advising on a total of 27 deals.

GlobalData’s report, “Global and Asia-Pacific M&A Report Financial Adviser League Tables Q1-Q3 2022,” reveals that a total of 5,812 M&A deals worth $459.8 billion were announced in the region during Q1-Q3 2022.

Bose adds: “Avendus Capital led by volume but lagged in terms of value due to the involvement in low-value transactions and did not feature among the top 10 by value. The average size of deals advised by Avendus Capital stood at $154.8 million.

“Similarly, Citi led by value but did not feature among the top 10 by volume. Despite advising on relatively fewer deals, Citi managed to top by value due to its involvement in high-value transactions, with its average deal value standing at $7.7 billion. The firm advised on six billion-dollar deals (≥ $1 billion) that also included two mega deals valued more than $10 billion.”

Goldman Sachs occupied the second position by value, by advising on $82.5 billion worth of deals, followed by JP Morgan ($69.8 billion), Credit Suisse ($67.1 billion) and Morgan Stanley ($62.9 billion).

Meanwhile, UBS occupied the second position in terms of volume with 25 deals, followed by Ernst & Young (25 deals), Daiwa Securities Group (19 deals) and Goldman Sachs (18 deals).