GlobalData has announced the latest Legal and Financial Adviser League Tables, based on the total value and volume of merger and acquisition (M&A) deals they advised on in Asia-Pacific (APAC) region in H1 2023.

Legal Advisers

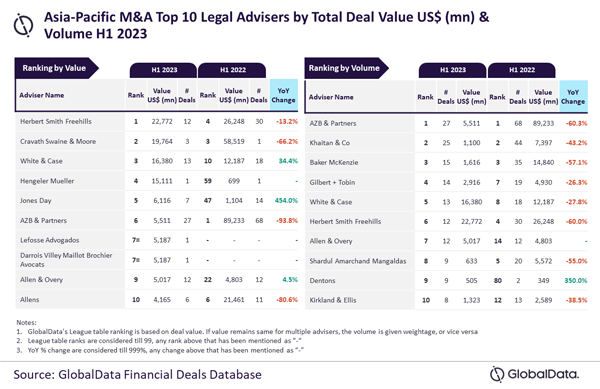

Herbert Smith Freehills, AZB & Partners top M&A legal advisers by value and volume in APAC region in H1 2023

Herbert Smith Freehills and AZB & Partners were the top mergers and acquisitions (M&A) legal advisers in the Asia-Pacific (APAC) region during the first half (H1) of 2023 by value and volume, respectively, according to the latest Legal Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Herbert Smith Freehills achieved its leading position in terms of value by advising on $22.8 billion worth of deals. Meanwhile, AZB & Partners led in terms of volume by advising on a total of 27 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Herbert Smith Freehills advised on three billion-dollar deals*, which also included a mega deal valued more than $10 billion. Moreover, it was the only firm that managed to surpass $20 billion in total deal value during H1 2023. Apart from leading by value, it also occupied the sixth position by volume. Interestingly, AZB & Partners, which led the chart by volume, also occupied the sixth position by value.”

Cravath Swaine & Moore occupied the second position in terms of value, by advising on $19.8 billion worth of deals, followed by White & Case with $16.4 billion, Hengeler Mueller with $15.1 billion, and Jones Day with $6.1 billion.

Meanwhile, Khaitan & Co occupied the second position in terms of volume with 25 deals, followed by Baker McKenzie with 15 deals, Gilbert + Tobin with 14 deals, and White & Case with 13 deals.

*Deals valued more than or equal to $1 billion

Financial Advisers

JP Morgan, UBS top M&A financial advisers by value and volume in APAC region in H1 2023

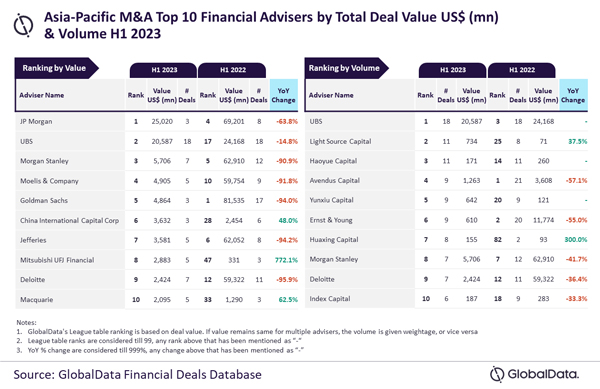

JP Morgan and UBS were the top mergers and acquisitions (M&A) financial advisers in the Asia-Pacific (APAC) region during the first half (H1) of 2023 by value and volume, respectively, according to the latest Financial Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that JP Morgan achieved its leading position in terms of value by advising on $25 billion worth of deals. Meanwhile, UBS led in terms of volume by advising on a total of 18 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “UBS was shy of only two deals from touching 20 deals volume in H1 2023. Moreover, UBS managed to advise on some big-ticket deals. In fact, UBS and JP Morgan were the only two firms with more than $20 billion in total deal value with none of their peers even close to this level. Resultantly, apart from leading by volume, UBS also occupied the second position in terms of value with $20.6 billion.”

Cravath Swaine & Moore occupied the second position in terms of value, by advising on $19.8 billion worth of deals, followed by White & Case with $16.4 billion, Hengeler Mueller with $15.1 billion, and Jones Day with $6.1 billion.

Meanwhile, Khaitan & Co occupied the second position in terms of volume with 25 deals, followed by Baker McKenzie with 15 deals, Gilbert + Tobin with 14 deals, and White & Case with 13 deals.

*Deals valued more than or equal to $1 billion

Financial Advisers

JP Morgan, UBS top M&A financial advisers by value and volume in APAC region in H1 2023

JP Morgan and UBS were the top mergers and acquisitions (M&A) financial advisers in the Asia-Pacific (APAC) region during the first half (H1) of 2023 by value and volume, respectively, according to the latest Financial Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that JP Morgan achieved its leading position in terms of value by advising on $25 billion worth of deals. Meanwhile, UBS led in terms of volume by advising on a total of 18 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “UBS was shy of only two deals from touching 20 deals volume in H1 2023. Moreover, UBS managed to advise on some big-ticket deals. In fact, UBS and JP Morgan were the only two firms with more than $20 billion in total deal value with none of their peers even close to this level. Resultantly, apart from leading by volume, UBS also occupied the second position in terms of value with $20.6 billion.”