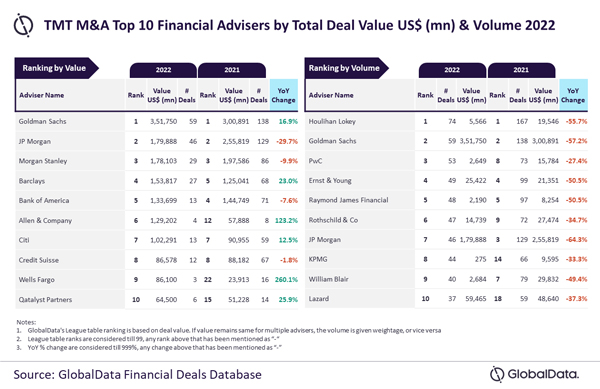

Goldman Sachs and Houlihan Lokey were the top mergers and acquisitions (M&A) financial advisers in the technology, media, and telecom (TMT) sector in 2022 by value and volume, respectively, according to the latest financial advisers league table by GlobalData.

Based on its Financial Deals Database, the leading data and analytics company has revealed that Goldman Sachs achieved its leading position in terms of value by advising on $351.8 billion worth of deals. Meanwhile, Houlihan Lokey led in terms of volume by advising on a total of 74 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Goldman Sachs managed to advise on 26 billion-dollar deals* during 2022, of which 11 were mega deals valued more than $10 billion. This helped it remain far ahead of its peers in terms of value. It was also among the only three firms to advise on more than 50 deals in 2022. Resultantly, it also managed to occupy the second position by volume.

“Meanwhile, Houlihan Lokey, despite leading by volume, did not feature among the 10 advisers by value due to its involvement in low-value transactions. The average size of deals advised by Houlihan Lokey stood at $75.2 million, whereas it stood at $6 billion for Goldman Sachs.”

An analysis of GlobalData’s Financial Deals Database reveals that JP Morgan occupied the second position in terms of value, by advising on $179.9 billion worth of deals, followed by Morgan Stanley with $178.1 billion, Barclays with $153.8 billion and Bank of America with $133.7 billion.

Meanwhile, PwC occupied the third position in terms of volume with 53 deals, followed by Ernst & Young with 49 deals and Raymond James Financial with 48 deals.

*Deals valued more than or equal to $1 billion