GlobalData has announced the latest Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the South & Central American region during Q1-Q3 2025. See the rankings and findings below.

Financial Advisers

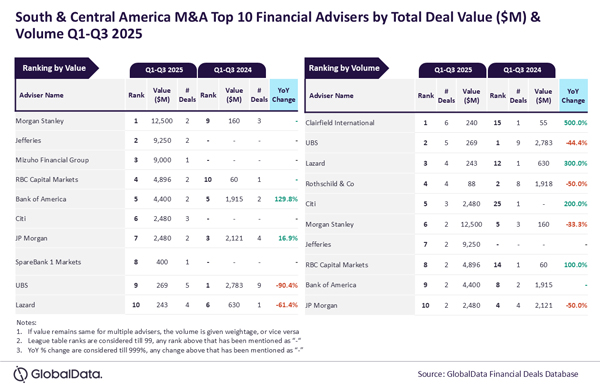

Morgan Stanley and Clairfield International top M&A financial advisers in South & Central America during Q1-Q3 2025

Morgan Stanley and Clairfield International were the top mergers and acquisitions (M&A) financial advisers in the South & Central American region during the first three quarters (Q1-Q3) of 2025 by value and volume, respectively, according to the latest financial advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Morgan Stanley achieved the leading position in terms of value by advising on $12.5 billion worth of deals. Meanwhile, Clairfield International led in terms of volume by advising on a total of six deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “There was an year-on-year (YoY) increase in the total number of deals advised by Clairfield International during Q1-Q3 2025 and subsequently its ranking by volume improved from 15th to the top position.

“Morgan Stanley registered a massive YoY jump in the total value of deals advised by it during Q1-Q3 2025 due to the involvement in big-ticket deals. In fact, it was the only financial adviser to surpass $10 billion total deal value mark during Q1-Q3 2025. It is noteworthy that the two deals advised by the firm during Q1-Q3 2025 were billion-dollar deals*.”

Jefferies occupied the second position in terms of value, by advising on $9.3 billion worth of deals, followed by Mizuho Financial Group with $9 billion, RBC Capital Markets with $4.9 billion and Bank of America with $4.4 billion.

Meanwhile, UBS occupied the second position in terms of volume with five deals, followed by Lazard with four deals, Rothschild & Co with four deals and Citi with three deals.

*Valued ≥ $1 billion

Legal Advisers

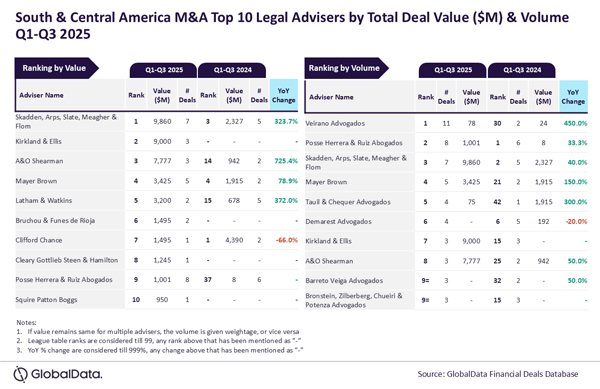

Skadden, Arps, Slate, Meagher & Flom and Veirano Advogados top M&A legal advisers in South & Central America during Q1-Q3 2025

Skadden, Arps, Slate, Meagher & Flom and Veirano Advogados were the top mergers and acquisitions (M&A) legal advisers in the South & Central American region during the first three quarters (Q1-Q3) of 2025 by value and volume, respectively, according to the latest legal advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Skadden, Arps, Slate, Meagher & Flom achieved the leading position in terms of value by advising on $9.9 billion worth of deals. Meanwhile, Veirano Advogados led in terms of volume by advising on a total of 11 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Veirano Advogados was the only legal adviser to hit double-digit deal volume during Q1-Q3 2025. As a result, the Brazil-based firm registered a massive jump in its ranking by volume from the 30th position during Q1-Q3 2024 to the top spot during Q1-Q3 2025.

“Meanwhile, the total value of deals advised by Skadden, Arps, Slate, Meagher & Flom registered more than 4x year-on-year jump and subsequently its ranking by this metric improved from the third position to the top position. Three of the seven deals advised by Skadden, Arps, Slate, Meagher & Flom during Q1-Q3 2025 were billion-dollar deals*. The involvement in these big-ticket deals helped it lead the table by value.”

Kirkland & Ellis occupied the second position in terms of value, by advising on $9 billion worth of deals, followed by A&O Shearman with $7.8 billion, Mayer Brown with $3.4 billion and Latham & Watkins with $3.2 billion.

Meanwhile, Posse Herrera & Ruiz Abogados occupied the second position in terms of volume with eight deals, followed by Skadden, Arps, Slate, Meagher & Flom with seven deals, Mayer Brown with five deals and Tauil & Chequer Advogados with four deals.

*Valued ≥ $1 billion