GlobalData has announced the latest Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the power sector during H1 2025.

Financial Advisers

JP Morgan and Rothschild & Co top M&A financial advisers in power sector in H1 2025

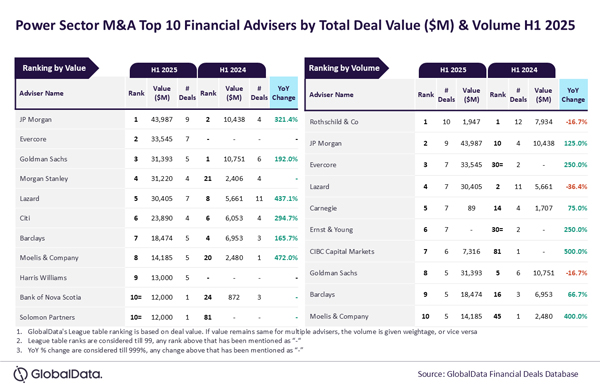

JP Morgan and Rothschild & Co were the top mergers and acquisitions (M&A) financial advisers in the power sector during the first half (H1) of 2025 by value and volume, respectively according to the latest financial advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Deals Database revealed that JP Morgan achieved the leading position in terms of value by advising on $44 billion worth of deals. Meanwhile, Rothschild & Co led in terms of volume by advising on a total of 10 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Rothschild & Co was the top adviser by volume in H1 2024 and managed to retain its leadership position by this metric in H1 2025 as well.

“Meanwhile, there was an improvement in JP Morgan’s ranking by value from the second position in H1 2024 to the top spot in H1 2025. This was due to involvement in big-ticket deals, which resulted in a massive jump in terms of value. During H1 2025, JP Morgan advised on five billion-dollar deals* that also include three mega deals valued more than $10 billion.”

Apart from leading by value, JP Morgan also held the second position by volume in H1 2025 with nine deals, followed by Evercore with seven deals, Lazard with seven deals and Carnegie with seven deals.

Meanwhile, Evercore occupied the second position in terms of value, by advising on $33.5 billion worth of deals, followed by Goldman Sachs with $31.4 billion, Morgan Stanley with $31.2 billion and Lazard with $30.4 billion.

*≥ $1 billion

Legal Advisers

White & Case and Kirkland & Ellis top M&A legal advisers in power sector in H1 2025

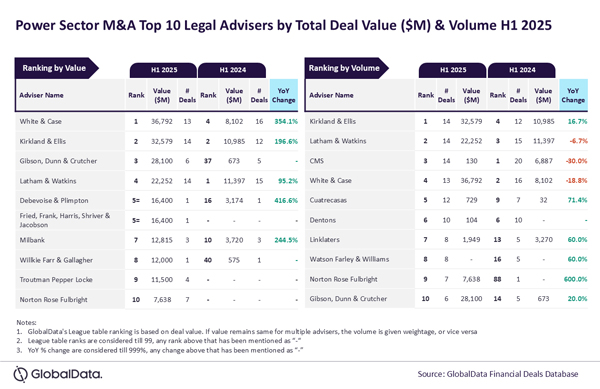

White & Case and Kirkland & Ellis were the top mergers and acquisitions (M&A) legal advisers in the power sector during the first half (H1) of 2025 by value and volume, respectively according to the latest legal advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Deals Database revealed that White & Case achieved the leading position in terms of value by advising on $36.8 billion worth of deals. Meanwhile, Kirkland & Ellis led in terms of volume by advising on a total of 14 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Interestingly, White & Case and Kirkland & Ellis showcase a lot of similarities. Both held the fourth position by value and volume, respectively, in H1 2024 and their rankings jumped to the top spot by these metrics in H1 2025. Moreover, White & Case and Kirkland & Ellis showed improvement in the value and volume of deals advised by them in H1 2025 compared to H1 2024, respectively.

“Another similarity is that they both had double-digit deal volumes and some of which were big-ticket deals. During H1 2025, White & Case advised on four billion-dollar deals* that also included two mega deals valued more than $10 billion, while Kirkland & Ellis advised on the same number of billion-dollar deals and mega deals. Resultantly, Kirkland & Ellis, apart from leading by volume, also held the second position by value in H1 2025.”

Kirkland & Ellis occupied the second position in terms of value, by advising on $32.6 billion worth of deals, followed by Gibson, Dunn & Crutcher with $28.1 billion, Latham & Watkins with $22.3 billion and Debevoise & Plimpton and Fried, Frank, Harris, Shriver & Jacobson jointly holding the fifth position with $16.4 billion.

Meanwhile, Latham & Watkins occupied the second position in terms of volume with 14 deals, followed by CMS with 14 deals, White & Case with 13 deals and Cuatrecasas with 12 deals.

*≥ $1 billion