GlobalData has announced the latest updates to its financial and legal adviser league tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the power sector during Q1-Q3 2023. See the rankings and findings below.

Financial Advisers

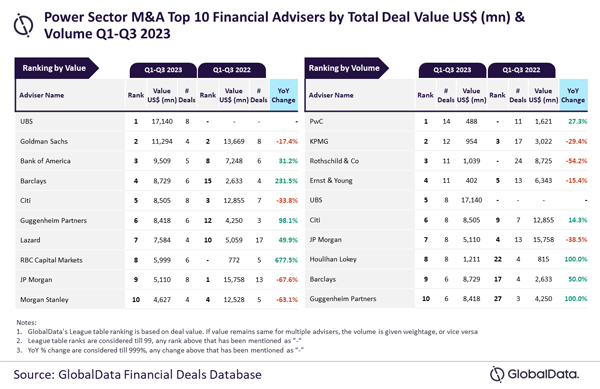

UBS and PwC top M&A financial advisers in power sector by value and volume during Q1-Q3 2023

UBS and PwC were the top mergers and acquisitions (M&A) financial advisers in the power sector during the first three quarters (Q1-Q3) of 2023 by value and volume, respectively according to the latest financial advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that UBS achieved the leading position in terms of value by advising on $17.1 billion worth of deals. Meanwhile, PwC led in terms of volume by advising on a total of 14 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “PwC registered growth in the number of deals advised by it during Q1-Q3 2023 compared to Q1-Q3 2022. It’s ranking by volume also improved from 11 in Q1-Q3 2022 to the top position in Q1-Q3 2023.

“Meanwhile, although UBS was among the only two advisers that managed to surpass $10 billion in total deal value during Q1-Q3 2023, it was much ahead of the adviser occupying the second position by value. Its involvement in the $15 billion deal to acquire Toshiba by TBJH was pivotal for UBS in securing the top spot by value during Q1-Q3 2023.”

Goldman Sachs occupied the second position in terms of value, by advising on $11.3 billion worth of deals, followed by Bank of America with $9.5 billion, Barclays with $8.7 billion and Citi with $8.5 billion.

Meanwhile, KPMG occupied the second position in terms of volume with 12 deals, followed by Rothschild & Co with 11 deals, Ernst & Young with 11 deals and UBS with eight deals.

Legal Advisers

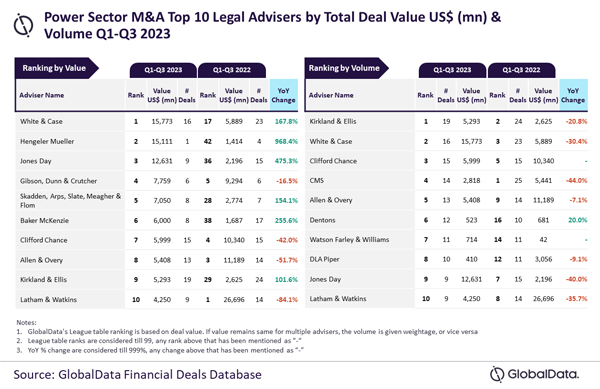

White & Case and Kirkland & Ellis top M&A legal advisers in power sector by value and volume during Q1-Q3 2023

White & Case and Kirkland & Ellis were the top mergers and acquisitions (M&A) legal advisers in the power sector during the first three quarters (Q1-Q3) of 2023 by value and volume, respectively according to the latest legal advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that White & Case achieved the leading position in terms of value by advising on $15.8 billion worth of deals. Meanwhile, Kirkland & Ellis led in terms of volume by advising on a total of 19 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Due to the involvement in $15 the billion deal to acquire Toshiba by TBJH, the total value of deals advised by White & Case as well as its ranking by value took a major jump in Q1-Q3 2023 compared to Q1-Q3 2022. However, it faced close competition for the top spot by value from Hengeler Mueller.

“Apart from leading by value, White & Case also occupied the second position by volume during Q1-Q3 2023. Similarly, Kirkland & Ellis, which led by volume, also occupied the ninth position by value.”

Hengeler Mueller occupied the second position in terms of value, by advising on $15.1 billion worth of deals, followed by Jones Day with $12.6 billion, Gibson, Dunn & Crutcher with $7.8 billion and Skadden, Arps, Slate, Meagher & Flom with $7.1 billion.

Meanwhile, White & Case occupied the second position in terms of volume with 16 deals, followed by Clifford Chance with 15 deals, CMS with 14 deals, and Allen & Overy with 13 deals.