GlobalData has announced the latest Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the oil & gas sector during Q1-Q3 2025. See the rankings and findings below.

Financial Advisers

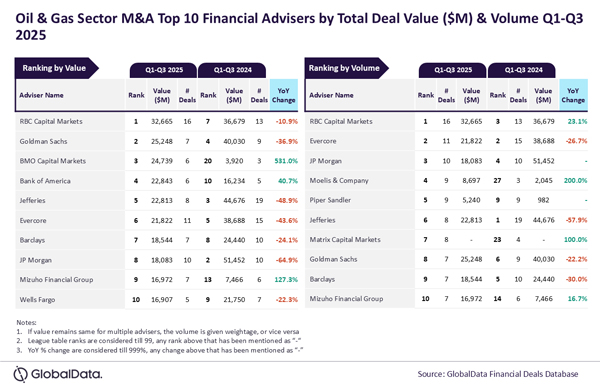

RBC Capital Markets top M&A financial adviser in oil & gas sector during Q1-Q3 2025

RBC Capital Markets was the top mergers and acquisitions (M&A) financial adviser in the oil & gas sector during the first three quarters (Q1-Q3) of 2025 by both value and volume, according to the latest financial advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that RBC Capital Markets achieved the leading position having advised on 16 deals worth $32.7 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “RBC Capital Markets recorded year-on-year (YoY) improvement in deal volume but decline in deal value during Q1-Q3 2025. Despite this, it rose to the top position in both categories, up from third by volume and seventh by value in Q1-Q3 2024. Notably, seven of the top 10 advisers by value saw a YoY decline in total deal value during the same period.”

Goldman Sachs occupied the second position in terms of value, by advising on $25.2 billion worth of deals, followed by BMO Capital Markets with $24.7 billion, Bank of America with $22.8 billion and Jefferies with $22.8 billion.

Meanwhile, Evercore occupied the second position in terms of volume with 11 deals, followed by JP Morgan with 10 deals, Moelis & Company with nine deals and Piper Sandler with nine deals.

Legal Advisers

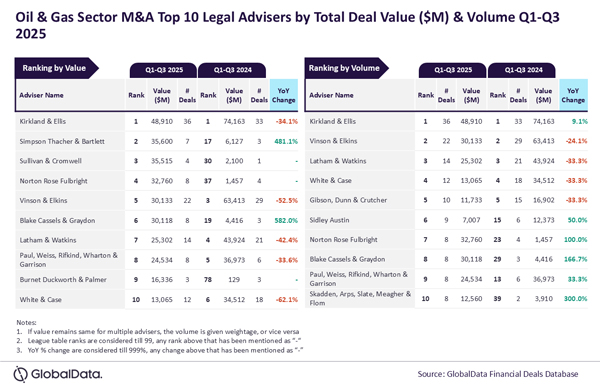

Kirkland & Ellis top M&A legal adviser in oil & gas sector during Q1-Q3 2025

Kirkland & Ellis was the top mergers and acquisitions (M&A) legal adviser in the oil & gas sector during the first three quarters (Q1-Q3) of 2025 by both value and volume, according to the latest legal advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Kirkland & Ellis achieved the leading position having advised on 36 deals worth $48.9 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Kirkland & Ellis was the top adviser by both volume and value during Q1-Q3 2024 as well. The US-based law firm not only led by both the metrics but also remained significantly ahead of its peers during Q1-Q3 2025. In fact, despite registering a year-on-year (YoY) fall in the total value of deals advised during Q1-Q3 2025, the firm outpaced its peers by a notable margin in terms of value.

“During Q1-Q3 2025, the law firm advised on 13 billion-dollar deals* that also included a mega deal valued more than $10 billion. The involvement in these big-ticket deals helped it maintain a significant lead by value over peers.

Simpson Thacher & Bartlett occupied the second position in terms of value, by advising on $35.6 billion worth of deals, followed by Sullivan & Cromwell with $35.5 billion, Norton Rose Fulbright with $32.8 billion and Vinson & Elkins with $30.1 billion.

Meanwhile, Vinson & Elkins occupied the second position in terms of volume with 22 deals, followed by Latham & Watkins with 14 deals, White & Case with 12 deals and Gibson, Dunn & Crutcher with 10 deals.

*Value ≥ $1 billion