GlobalData has announced the latest updates to its Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the North American region during 2025. See the rankings and findings below.

Financial Advisers

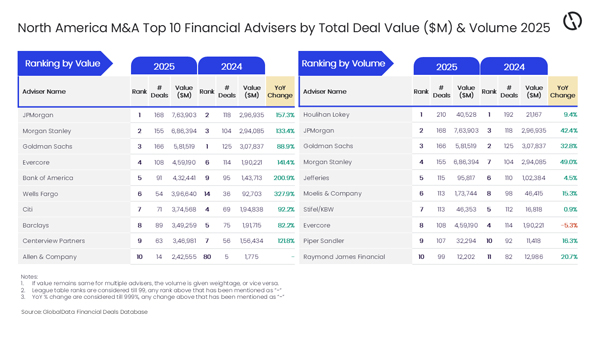

JPMorgan and Houlihan Lokey top M&A financial advisers in North America by value and volume in 2025

JPMorgan and Houlihan Lokey were the top mergers and acquisitions (M&A) financial advisers in the North American region in 2025 by value and volume, respectively, according to the latest financial advisers league table by GlobalData, a leading intelligence and productivity platform.

GlobalData’s Financial Deals Database revealed that JPMorgan achieved its leading position in terms of value by advising on $763.9 billion worth of deals. Meanwhile, Houlihan Lokey led in terms of volume, advising on a total of 210 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Houlihan Lokey and JPMorgan were the clear winners, having outpaced their peers by a significant margin in terms of volume and value in 2025. Houlihan Lokey was also the top adviser by volume in 2024.

“Meanwhile, JPMorgan improved its ranking by value from the second position in 2024, at there was more than a double-fold jump in the total value of deals advised by it due to involvement in big-ticket deals. During 2025, JPMorgan advised on 90 billion-dollar deals* that also included 17 mega deals valued more than $10 billion. It also held the second position by volume in 2025 with 168 deals.”

An analysis of GlobalData’s Deals Database reveals that Goldman Sachs occupied the third position in terms of volume with 166 deals, followed by Morgan Stanley with 155 deals, and Jefferies with 115 deals.

Meanwhile, Morgan Stanley occupied the second position in terms of value, by advising on $686.4 billion worth of deals, followed by Goldman Sachs with $581.5 billion, Evercore with $459.2 billion, and Bank of America with $432.4 billion.

*Deals valued more than or equal to $1 billion

Legal Advisers

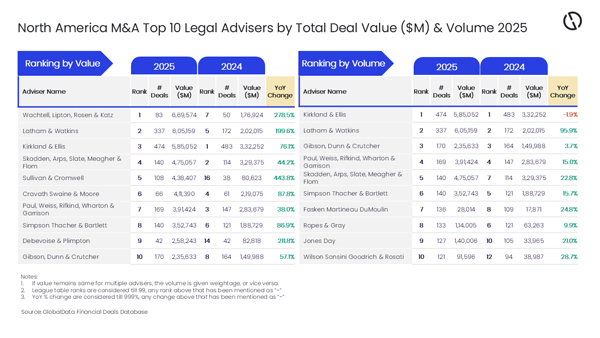

Wachtell, Lipton, Rosen & Katz and Kirkland & Ellis top M&A legal advisers in North America in 2025

Wachtell, Lipton, Rosen & Katz and Kirkland & Ellis were the top mergers and acquisitions (M&A) legal advisers in North America in 2025 by value and volume, respectively, according to the latest legal advisers league table by GlobalData, a leading intelligence and productivity platform.

GlobalData’s Financial Deals Database revealed that Wachtell, Lipton, Rosen & Katz achieved its leading position in terms of value by advising on $669.6 billion worth of deals. Meanwhile, Kirkland & Ellis led in terms of volume by advising on a total of 474 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Kirkland & Ellis, which was the top adviser by both value and volume in 2024, managed to retain its leadership position by volume in 2025 but lost the top spot by value to Wachtell, Lipton, Rosen & Katz. Kirkland & Ellis held the third position in 2025 deal value rankings.

“Despite advising on relatively much lesser number of deals, Wachtell, Lipton, Rosen & Katz managed to lead the chart by value due to its involvement in big-ticket deals. During 2025, the company advised on 45 billion-dollar deals* that also included 15 mega deals valued more than $10 billion.”

An analysis of GlobalData’s Deals Database reveals that Latham & Watkins occupied the second position in terms of value, by advising on $605.2 billion worth of deals, followed by Kirkland & Ellis with $585.1 billion, Skadden, Arps, Slate, Meagher & Flom with $475.1 billion, and Sullivan & Cromwell with $438.4 billion.

Meanwhile, Latham & Watkins occupied the second position in terms of volume with 337 deals, followed by Gibson, Dunn & Crutcher with 170 deals, Paul, Weiss, Rifkind, Wharton & Garrison with 169 deals, and Skadden, Arps, Slate, Meagher & Flom with 140 deals.

*Deals valued more than or equal to $1 billion