GlobalData has announced the latest updates to its Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the North American region during Q1 2025. See the rankings and findings below.

Financial Advisers

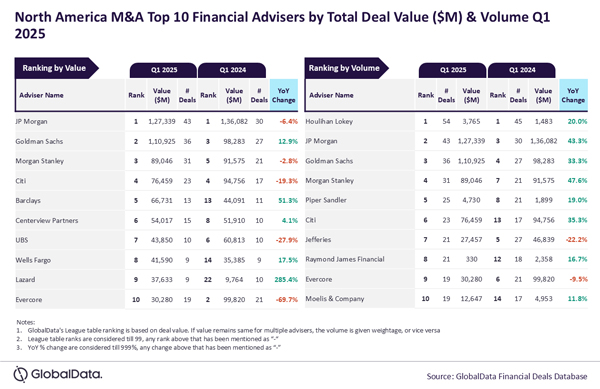

JP Morgan and Houlihan Lokey top M&A financial advisers in North America during Q1 2025

JP Morgan and Houlihan Lokey were the top mergers and acquisitions (M&A) financial advisers in North America during the first quarter (Q1) of 2025 by value and volume, respectively, according to the latest financial advisers league table by GlobalData, which ranks financial advisers by the value and volume of M&A deals on which they advised.

Based on its Deals Database, the leading data and analytics company has revealed that JP Morgan achieved its leading position in terms of value by advising on $127.3 billion worth of deals. Meanwhile, Houlihan Lokey led in terms of volume by advising on a total of 54 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Both JP Morgan and Houlihan Lokey were the top advisers by value and volume in Q1 2024 and retained their respective leadership positions in Q1 2025 as well. Houlihan Lokey was the only adviser to have advised on more than 50 deals during Q1 2025. Meanwhile, JP Morgan was among the only two advisers that managed to surpass the $100 billion mark in total deal value during the review period, but still it was comfortably ahead of the firm occupying the second position by value.”

“More than half of the deals advised by JP Morgan during Q1 2025 were billion-dollar deals* and involvement in these big-ticket deals helped it secure the top position by value. During Q1 2025, it advised on 25 billion-dollar deals that also included four mega deals valued more than or equal to $10 billion.”

An analysis of GlobalData’s Deals Database reveals that Goldman Sachs occupied the second position in terms of value, by advising on $110.9 billion worth of deals, followed by Morgan Stanley with $89 billion, Citi with $76.5 billion, and Barclays with $66.7 billion.

Meanwhile, JP Morgan occupied the second position in terms of volume with 43 deals, followed by Goldman Sachs with 36 deals, Morgan Stanley with 31 deals, and Piper Sandler with 25 deals.

*Valued more than or equal to $1 billion

Legal Advisers

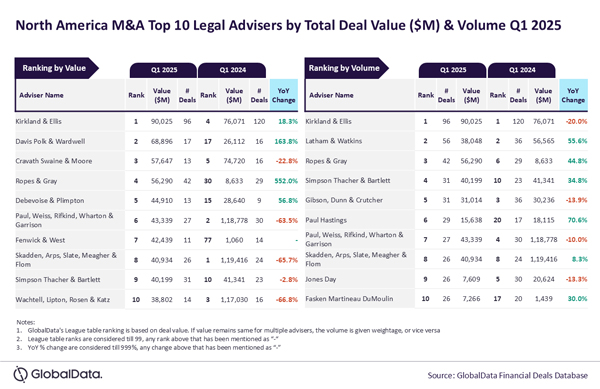

Kirkland & Ellis top M&A legal adviser in North America in Q1 2025

Kirkland & Ellis was the top mergers and acquisitions (M&A) legal adviser in the North American region during the first quarter (Q1) of 2025 by both value and volume, according to the latest legal advisers league table by GlobalData, which ranks legal advisers by the value and volume of M&A deals on which they advised.

Based on its Deals Database, the leading data and analytics company has revealed that Kirkland & Ellis achieved its leading position having advised on 96 deals worth $90 billion during Q1 2025.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Kirkland & Ellis was the clear winner, outpacing its peers by a significant margin in terms of deal volume as well as value during Q1 2025. It just fell shy of hitting the triple-digit deal volume during Q1 2025. It is also interesting to note that Kirkland & Ellis was also the top adviser by volume in Q1 2024.

“Kirkland & Ellis also stayed much ahead of its peers in terms of value as well. It went ahead from occupying the fourth position by value in Q1 2024 to top the chart by this metric in Q1 2025 as there was a significant growth in the total value of deals advised by it driven by some big-ticket deals. During Q1 2025, it advised on 18 billion-dollar deals* that also included two mega deals valued more than $10 billion. Its significance can be understood from the fact that these 18 deals collectively accounted for more than $83 billion.”

An analysis of GlobalData’s Deals Database reveals that Davis Polk & Wardwell occupied the second position in terms of value, by advising on $68.9 billion worth of deals, followed by Cravath Swaine & Moore with $57.6 billion, Ropes & Gray with $56.3 billion, and Debevoise & Plimpton with $44.9 billion.

Meanwhile, Latham & Watkins occupied the second position in terms of volume with 56 deals, followed by Ropes & Gray with 42 deals, Simpson Thacher & Bartlett with 31 deals, and Gibson, Dunn & Crutcher with 31 deals.

*Valued more than or equal to $1 billion