GlobalData has announced the latest Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the metals & mining sector during 2024. See the rankings and findings below.

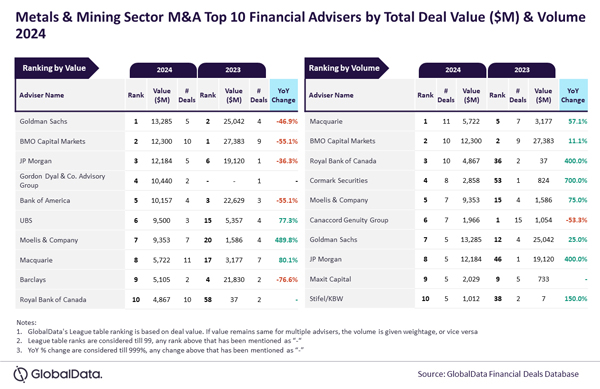

Financial Advisers

Goldman Sachs and Macquarie top M&A financial advisers in metals & mining sector in 2024

Goldman Sachs and Macquarie were the top mergers and acquisitions (M&A) financial advisers in the metals & mining sector during 2024 by value and volume, respectively, according to the latest financial advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Deals Database has revealed that Goldman Sachs achieved the leading position in terms of value by advising on $13.3 billion worth of deals. Meanwhile, Macquarie led in terms of volume by advising on a total of 11 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Many among the top 10 advisers by value experienced massive double-digit decline in the total value of deals advised by them in 2024 compared to 2023. In fact, Goldman Sachs registered a year-on-year decline of 46.9% in value but despite that it managed to occupy the top spot. Three of the five deals advised by Goldman Sachs during the year were billion-dollar deals* and these helped it secure the top spot by value. It is also noteworthy that the average value of these three deals was more than $4 billion.”

“In contrast, most of the top 10 advisers by volume registered growth in the number of deals advised by them in 2024 compared to 2023. Macquarie also registered growth as well as an improvement in its ranking. It went ahead from occupying the fifth position by volume in 2023 to top the chart by this metric in 2024.”

BMO Capital Markets occupied the second position in terms of value, by advising on $12.3 billion worth of deals, followed by JP Morgan with $12.2 billion, Gordon Dyal & Co. Advisory Group with $10.4 billion and Bank of America with $10.2 billion.

Meanwhile, BMO Capital Markets occupied the second position in terms of volume with 10 deals, followed by Royal Bank of Canada with 10 deals, Cormark Securities with eight deals and Moelis & Company with seven deals.

*≥ $1 billion

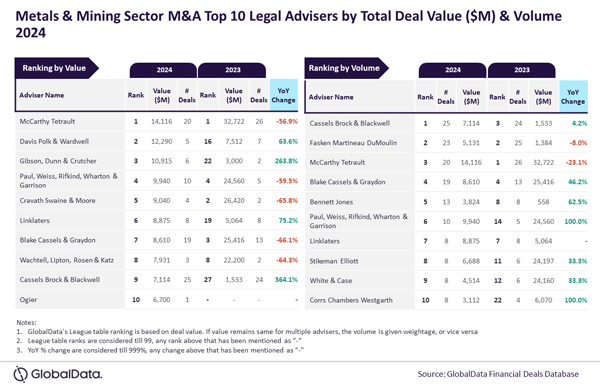

Legal Advisers

McCarthy Tetrault and Cassels Brock & Blackwell top M&A legal advisers in metals & mining sector in 2024

McCarthy Tetrault and Cassels Brock & Blackwell were the top mergers and acquisitions (M&A) legal advisers in the metals & mining sector during 2024 by value and volume, respectively, according to the latest legal advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Deals Database has revealed that McCarthy Tetrault achieved the leading position in terms of value by advising on $14.1 billion worth of deals. Meanwhile, Cassels Brock & Blackwell led in terms of volume by advising on a total of 25 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Cassels Brock & Blackwell, which was the third leading adviser by volume in 2023, occupied the top spot by this metric in 2024. Notably, the rankings for the top three advisers by volume in 2023 were reversed in 2024. In addition to leading by volume, Cassels Brock & Blackwell also secured the ninth spot by value for the year.”

“Meanwhile, McCarthy Tetrault, which led by value in 2023, successfully retained its top position in 2024. The firm also secured third place in terms of volume for the year.”

Davis Polk & Wardwell occupied the second position in terms of value, by advising on $12.3 billion worth of deals, followed by Gibson, Dunn & Crutcher with $10.9 billion, Paul, Weiss, Rifkind, Wharton & Garrison with $9.9 billion and Cravath Swaine & Moore with $9 billion.

Meanwhile, Fasken Martineau DuMoulin occupied the second position in terms of volume with 23 deals, followed by McCarthy Tetrault with 20 deals, Blake Cassels & Graydon with 19 deals and Bennett Jones with 13 deals.