GlobalData has announced the latest updates to its Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the European region during Q1 2025. See the rankings and findings below.

Financial Advisers

Goldman Sachs and PwC top M&A financial advisers in Europe in Q1 2025

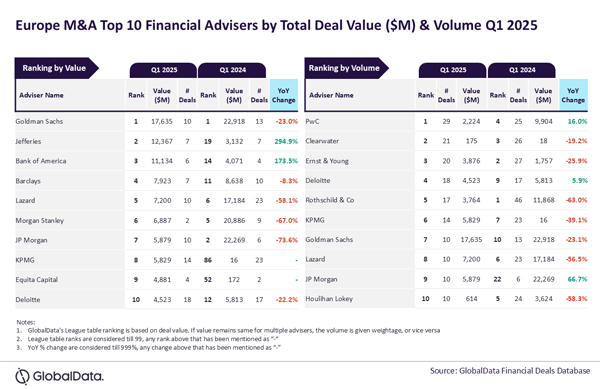

Goldman Sachs and PwC were the top mergers and acquisitions (M&A) financial advisers in Europe during the first quarter (Q1) of 2025 by value and volume, respectively, according to the latest financial advisers league table by GlobalData, a leading data and analytics company.

GlobalData’s Deals Database has revealed that Goldman Sachs achieved its leading position in terms of value by advising on $17.6 billion worth of deals. Meanwhile, PwC led in terms of volume by advising on a total of 29 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “PwC registered improvement in the total number of deals advised by it during Q1 2025 compared to Q1 2024. Resultantly, it went ahead from occupying the fourth position by volume in Q1 2024 to top the chart by this metric in Q1 2025.

“Meanwhile, Goldman Sachs, which was the top adviser by value in Q1 2024, also managed to retain its leadership position by this metric in Q1 2025 as well. Despite a fall in the total value of deals advised by it in Q1 2025 compared to Q1 2024, Goldman Sachs stayed much ahead of its peers. During Q1 2025, it advised on five billion-dollar deals*. Involvement in these big-ticket deals helped Goldman Sachs secure the top spot by value. Apart from leading in terms of value, it also occupied the seventh position by volume in Q1 2025."

An analysis of GlobalData’s Deals Database reveals that Jefferies occupied the second position in terms of value, by advising on $12.4 billion worth of deals, followed by Bank of America with $11.1 billion, Barclays with $7.9 billion, and Lazard with $7.2 billion.

Meanwhile, Clearwater occupied the second position in terms of volume with 21 deals, followed by Ernst & Young with 20 deals, Deloitte with 18 deals, and Rothschild & Co with 17 deals.

*Valued more than or equal to $1 billion

Legal Advisers

Kirkland & Ellis and CMS top M&A legal advisers in Europe in Q1 2025

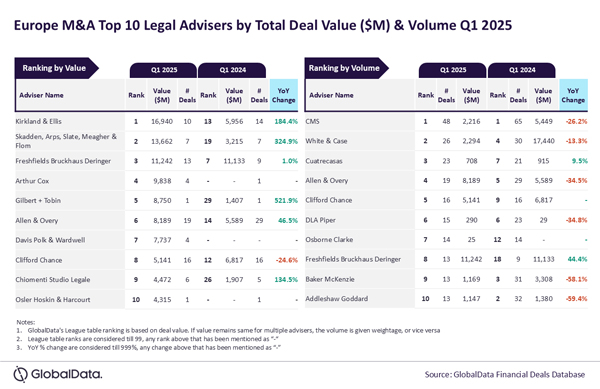

Kirkland & Ellis and CMS were the top mergers and acquisitions (M&A) legal advisers in Europe during the first quarter (Q1) of 2025 by value and volume, respectively, according to the latest legal advisers league table by GlobalData, a leading data and analytics company.

GlobalData’s Deals Database has revealed that Kirkland & Ellis achieved its leading position in terms of value by advising on $16.9 billion worth of deals. Meanwhile, CMS led in terms of volume by advising on a total of 48 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Despite a decline in the number of deals advised by CMS in Q1 2025 compared to Q1 2024, it managed to maintain its lead and remain much ahead of its peers in terms of deal volume. In fact, it fell short of only two deals from hitting the 50-deal volume mark during Q1 2025.

“Meanwhile, Kirkland & Ellis registered more than a double-fold jump in the total value of deals advised by it during Q1 2025 compared to Q1 2024. Resultantly, its ranking by value also took a leap from 13th position in Q1 2024 to the top position in Q1 2025. Involvement in three billion-dollar deals during the quarter played a pivotal role for Kirkland & Ellis in registering the massive growth in value as well as improvement in its ranking by this metric.”

An analysis of GlobalData’s Deals Database reveals that Skadden, Arps, Slate, Meagher & Flom occupied the second position in terms of value, by advising on $13.7 billion worth of deals, followed by Freshfields Bruckhaus Deringer with $11.2 billion, Arthur Cox with $9.8 billion, and Gilbert + Tobin with $8.8 billion.

Meanwhile, White & Case occupied the second position in terms of volume with 26 deals, followed by Cuatrecasas with 23 deals, Allen & Overy with 19 deals, and Clifford Chance with 16 deals.

*Valued more than or equal to $1000 million