GlobalData has announced the latest updates to its Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the consumer sector during H1 2024. See the rankings and findings below.

Financial Advisers

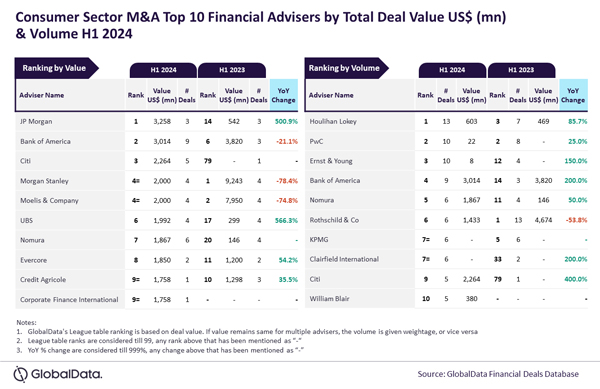

JP Morgan and Houlihan Lokey top M&A financial advisers in consumer sector during H1 2024

JP Morgan and Houlihan Lokey were the top mergers and acquisitions (M&A) financial advisers in the consumer sector during the first half (H1) of 2024 by value and volume, respectively according to the latest financial advisers league table by GlobalData, which ranks financial advisers by the value and volume of M&A deals on which they advised.

An analysis of GlobalData’s Deals Database reveals that JP Morgan achieved the leading position in terms of value by advising on $3.3 billion worth of deals. Meanwhile, Houlihan Lokey led in terms of volume by advising on a total of 13 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Both JP Morgan and Houlihan Lokey registered improvement in terms of value and volume ranking by the respective metrics in H1 2024 compared to H1 2023.

JP Morgan’s ranking by value took a big jump from 14th position in H1 2023 to the top spot in H1 2023. This can be attributed to the fact that the average size of deals advised by JP Morgan, which was just $180.7 million in H1 2023, stood much higher at $1.1 billion in H1 2024. Meanwhile, Houlihan Lokey was able to improve its ranking by volume from third position in H1 2023 to the top position in H1 2024.”

Bank of America occupied the second position in terms of value, by advising on $3 billion worth of deals, followed by Citi with $2.3 billion, whereas Morgan Stanley and Moelis & Company jointly occupied the fourth position with $2 billion worth of deals each.

Meanwhile, PwC occupied the second position in terms of volume with 10 deals, followed by Ernst & Young with 10 deals, Bank of America with nine deals and Nomura with six deals.

Legal Advisers

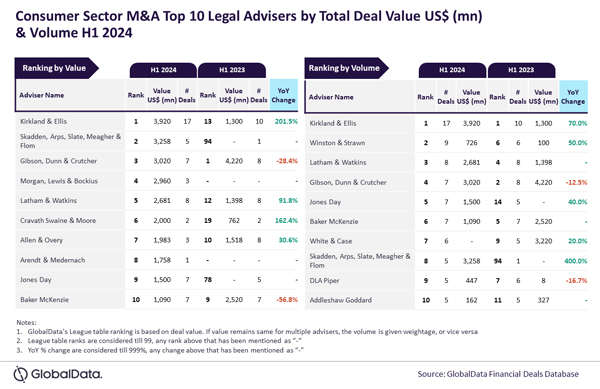

Kirkland & Ellis top M&A legal adviser in consumer sector in H1 2024

Kirkland & Ellis was the top mergers and acquisitions (M&A) legal adviser in the consumer sector during the first half (H1) of 2024 by both value and volume, according to the latest legal advisers league table by GlobalData, which ranks legal advisers by the value and volume of M&A deals on which they advised.

An analysis of GlobalData’s Deals Database reveals that Kirkland & Ellis achieved the leading position by advising on 17 deals of worth $3.9 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Kirkland & Ellis was the only adviser to hit the double-digit deal volume during H1 2024. Interestingly, even during H1 2023, not only was Kirkland & Ellis the top adviser by volume, but it was also the only adviser with double-digit deal volume.

“Moreover, it showcased major improvement in terms of value as well as its ranking in H1 2024 compared to H1 2023. Kirkland & Ellis, which was at the 13th position by value in H1 2023, went ahead to lead the chart in H1 2024.”

Skadden, Arps, Slate, Meagher & Flom occupied the second position in terms of value, by advising on $3.3 billion worth of deals, followed by Gibson, Dunn & Crutcher with $3 billion, Morgan, Lewis & Bockius with $3 billion and Latham & Watkins with $2.7 billion.

Meanwhile, Winston & Strawn occupied the second position in terms of volume with nine deals, followed by Latham & Watkins with eight deals, Gibson, Dunn & Crutcher with seven deals and Jones Day with seven deals.