GlobalData has announced the latest Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in the construction sector during Q1-Q3 2025. See the rankings and findings below.

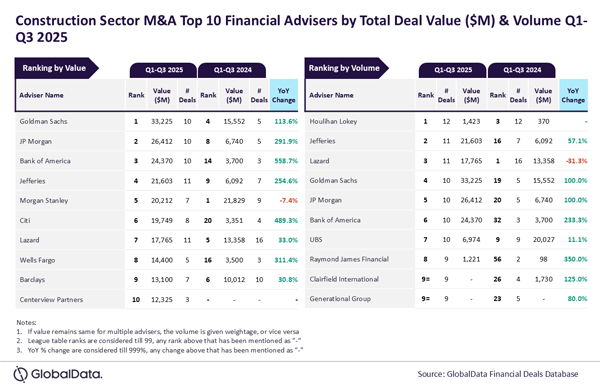

Financial Advisers

Goldman Sachs and Houlihan Lokey top M&A financial advisers in construction sector during Q1-Q3 2025

Goldman Sachs and Houlihan Lokey were the top mergers and acquisitions (M&A) financial advisers in the construction sector during the first three quarters (Q1-Q3) of 2025 by value and volume, respectively, according to the latest financial advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Goldman Sachs achieved the leading position in terms of value by advising on $33.2 billion worth of deals. Meanwhile, Houlihan Lokey led in terms of volume by advising on a total of 12 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The total value of deals advised by Goldman Sachs more than doubled quarter-on-quarter (QoQ) during Q1-Q3 2025 and subsequently its ranking by value improved from the fourth position to the top position. Eight of the 10 deals advised by Goldman Sachs during Q1-Q3 2025 were billion-dollar deals* that also included a mega deal valued more than $10 billion. The involvement in these big-ticket deals helped the investment bank register a jump in terms of value as well as ranking by this metric.

“Meanwhile, Houlihan Lokey’s ranking by volume improved from the third position during Q1-Q3 2024 to the top position during Q1-Q3 2025.”

JP Morgan occupied the second position in terms of value, by advising on $26.4 billion worth of deals, followed by Bank of America with $24.4 billion, Jefferies with $21.6 billion and Morgan Stanley with $20.2 billion.

Meanwhile, Jefferies occupied the second position in terms of volume with 11 deals, followed by Lazard with 11 deals, Goldman Sachs with 10 deals and JP Morgan with 10 deals.

*Value ≥ $1 billion

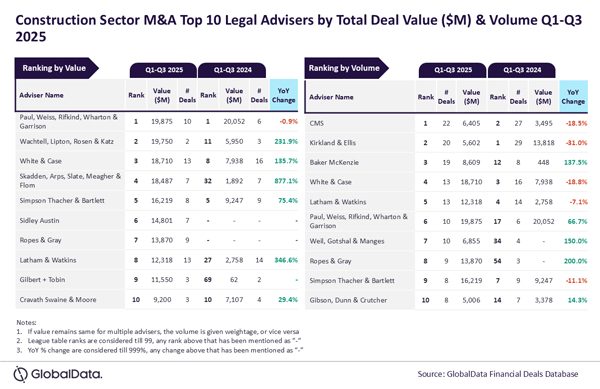

Legal Advisers

Paul, Weiss, Rifkind, Wharton & Garrison and CMS top M&A legal advisers in construction sector during Q1-Q3 2025

Paul, Weiss, Rifkind, Wharton & Garrison and CMS were the top mergers and acquisitions (M&A) legal advisers in the construction sector during the first three quarters (Q1-Q3) of 2025 by value and volume, respectively, according to the latest legal advisers league table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Paul, Weiss, Rifkind, Wharton & Garrison achieved the leading position in terms of value by advising on $19.9 billion worth of deals. Meanwhile, CMS led in terms of volume by advising on a total of 22 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Paul, Weiss, Rifkind, Wharton & Garrison was the top adviser by value during Q1-Q3 2024 and retained its leadership position by this metric during Q1-Q3 2025. Interestingly, the total value of deals advised by it mostly remained at the same level during Q1-Q3 2025 compared to Q1-Q3 2024. Apart from leading by value, the American multinational white-shoe law firm also occupied the sixth position by volume during Q1-Q3 2025.

“Meanwhile, CMS’ ranking by volume improved from the second position to the top position despite registering a year-on-year decline in the total number of deals advised by it.”

Wachtell, Lipton, Rosen & Katz occupied the second position in terms of value, by advising on $19.8 billion worth of deals, followed by White & Case with $18.7 billion, Skadden, Arps, Slate, Meagher & Flom with $18.5 billion and Simpson Thacher & Bartlett with $16.2 billion.

Meanwhile, Kirkland & Ellis occupied the second position in terms of volume with 20 deals, followed by Baker McKenzie with 19 deals, White & Case with 13 deals and Latham & Watkins with 13 deals.