GlobalData has released the latest Financial and Legal Adviser League Tables, in terms of the total value and volume of merger and acquisition (M&A) deals they advised on during 2025.

Financial Advisers

Morgan Stanley and Houlihan Lokey top M&A financial advisers by value and volume

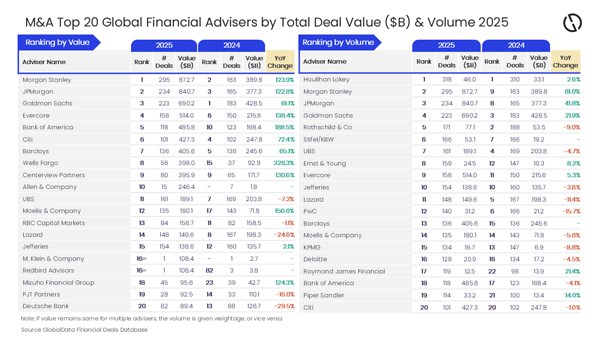

Morgan Stanley and Houlihan Lokey have emerged as the top mergers and acquisitions (M&A) financial advisers by value and volume during 2025 in the latest Financial Advisers League Table by GlobalData, a leading intelligence and productivity platform.

An analysis of GlobalData’s Financial Deals Database reveals that Morgan Stanley achieved the leading position in terms of the deal value by advising on $872.7 billion worth of deals. Meanwhile, Houlihan Lokey led in terms of volume by advising on a total of 318 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “More than one-third of the total number of deals advised by Morgan Stanley during 2025 were billion-dollar deals, and the involvement in these big-ticket deals helped it secure the top spot. Out of the 118 billion-dollar deals* 18 were mega deals valued at or more than $10 billion. Apart from leading by value, the global financial services firm also held the second position by volume with 295 deals.

“Meanwhile, Houlihan Lokey was the top adviser by volume in 2024 and managed to retain its leadership position by this metric in 2025 as well. Moreover, the investment bank was the only adviser with more than 300 deals during the review period.”

JPMorgan occupied the second position in terms of value, by advising on $840.7 billion worth of deals, followed by Goldman Sachs with $690.2 billion, Evercore with $514 billion, and Bank of America with $485.8 billion.

Meanwhile, JPMorgan occupied the third position in terms of volume by advising on 234 deals, followed by Goldman Sachs with 223 deals, and Rothschild & Co with 171 deals.

*Deals valued ≥ $1 billion

Legal Advisers

Latham & Watkins and Kirkland & Ellis top M&A legal advisers by value and volume

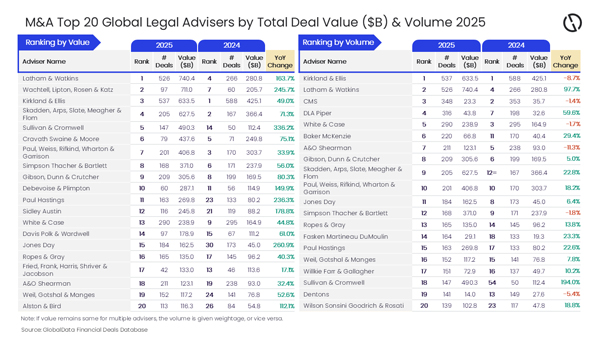

Latham & Watkins and Kirkland & Ellis have emerged as the top mergers and acquisitions (M&A) legal advisers by value and volume during 2025 in the latest Legal Advisers League Table by GlobalData, a leading intelligence and productivity platform.

An analysis of GlobalData’s Financial Deals Database reveals that Latham & Watkins achieved the leading position in terms of the deal value by advising on $740.4 billion worth of deals. Meanwhile, Kirkland & Ellis led in terms of volume by advising on a total of 537 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Kirkland & Ellis was the top adviser in 2024 by volume and managed to retain its leadership position in 2025 as well but faced close competition from Latham & Watkins. Both the law firms were the only two advisers with more than 500 deals during 2025. While Kirkland & Ellis led with 537 deals, Latham & Watkins followed closely to occupy the second spot with 526 deals.

“Of the 526 deals advised by Latham & Watkins during 2025, 108 were billion-dollar deals* that also included 17 mega deals valued at or more than $10 billion. The involvement in these big-ticket deals helped Latham & Watkins top the table by value in 2025.”

Wachtell, Lipton, Rosen & Katz occupied the second position in terms of value by advising on $711 billion worth of deals, followed by Kirkland & Ellis with $633.5 billion, Skadden, Arps, Slate, Meagher & Flom with $627.5 billion and Sullivan & Cromwell with $490.3 billion.

Meanwhile, CMS occupied the third position in terms of volume by advising on 348 deals followed by DLA Piper with 316 deals, and White & Case with 290 deals.

*Deals valued ≥ $1 billion