GlobalData has announced the latest Financial and Legal Adviser League Tables, in terms of the total value and volume of merger and acquisition (M&A) deals they advised on during Q1-Q3 2025. See the rankings and findings below.

Financial Advisers

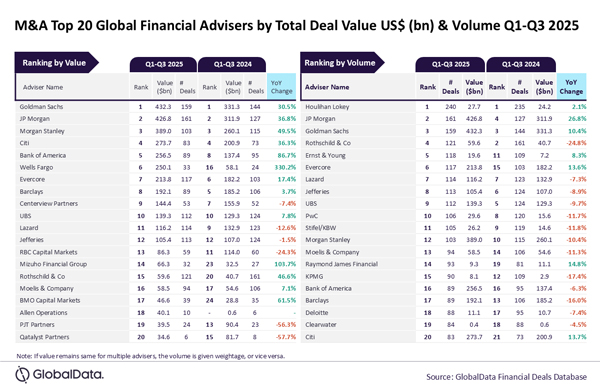

Goldman Sachs and Houlihan Lokey top M&A financial advisers by value and volume during Q1-Q3 2025

Goldman Sachs and Houlihan Lokey have emerged as the top mergers and acquisitions (M&A) financial advisers by value and volume during Q1-Q3 2025 in the latest Financial Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Goldman Sachs achieved the leading position in terms of deal value by advising on $432.3 billion worth of deals. Meanwhile, Houlihan Lokey led in terms of volume by advising on a total of 240 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Interestingly, both Goldman Sachs and Houlihan Lokey were also the top advisers by value and volume during Q1-Q3 2024. In fact, Houlihan Lokey outpaced its peers by a big margin in terms of volume as it was the only adviser with more than 200 deals during Q1-Q3 2025.

Meanwhile, Goldman Sachs led by value but faced close competition from JP Morgan. The investment banks had their own notable share of involvement in big-ticket deals. During Q1-Q3 2025, JP Morgan advised on 79 billion-dollar deals* of worth around $411 billion while Goldman Sachs advised on 84 billion-dollar deals worth around $419 billion.”

JP Morgan occupied the second position in terms of value, by advising on $426.8 billion worth of deals followed by Morgan Stanley with $389 billion, Citi with $273.7 billion and Bank of America with $256.5 billion.

Meanwhile, JP Morgan occupied the second position in terms of volume by advising on 161 deals followed by Goldman Sachs with 159 deals, Rothschild & Co with 121 deals and Ernst & Young with 118 deals.

*Deals valued ≥ $1 billion

Legal Advisers

Kirkland & Ellis top M&A legal adviser during Q1-Q3 2025

Kirkland & Ellis has emerged as the top mergers and acquisitions (M&A) legal adviser during Q1-Q3 2025 in terms of both value and volume in the latest Legal Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Kirkland & Ellis achieved the leading position by advising on 384 deals worth $414.1 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Kirkland & Ellis was also the top adviser during Q1-Q3 2024 by both value and volume. The Chicago-based law firm outpaced its peers by a significant margin in terms of volume. In fact, it was the only adviser that managed to advise on more than 300 deals during Q1-Q3 2025.

“Kirkland & Ellis was also involved in several big-ticket deals, which helped it top the table by value. It advised on 69 billion-dollar deals*, which also included 10 mega deals valued more than $10 billion.”

Wachtell, Lipton, Rosen & Katz occupied the second position in terms of value, by advising on $400.4 billion worth of deals followed by Latham & Watkins with $368.3 billion, Skadden, Arps, Slate, Meagher & Flom with $329.8 billion and Paul, Weiss, Rifkind, Wharton & Garrison with $279.3 billion.

Meanwhile, Latham & Watkins occupied the second position in terms of volume by advising on 241 deals followed by CMS with 221 deals, White & Case with 191 deals, and A&O Shearman with 144 deals.

*Deals valued ≥ $1 billion