|

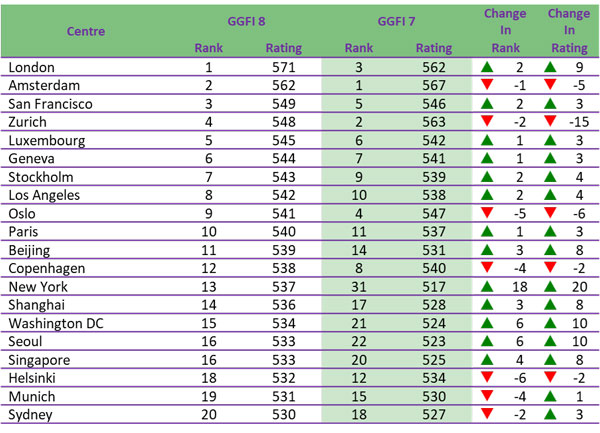

The eighth edition of the Global Green Finance Index (GGFI) evaluates the green finance offering of 80 financial centres. The GGFI serves as a valuable measure of the development of green finance for policy and investment decision-makers. The top 20 centres in GGFI 8 are shown in the table below.

|

GGFI 8 Headlines

- London has overtaken Amsterdam to take first place in GGFI 8. Amsterdam is second, with San Francisco overtaking Zurich to take third place.

- Western European centres continue to dominate the top 10 centres in the index, taking eight of the top 10 places. San Francisco and Los Angeles take the other two spots.

- London may have benefitted from both recent UK government action on green finance, including the issue of the first UK sovereign green bond, and from its position as host of COP 26.

- New York has gained 18 places in the rankings to 13th place - the biggest rise across the index.

- Asia/Pacific centres again performed strongly, with Beijing, Shanghai, Seoul, and Singapore all consolidating gains.

- These changes show the competitive challenge to Western European centres as North American and Asia/Pacific centres focus more intensely on green finance.

- The margins separating centres at the top of the index continue to tighten. Among the top 10 centres the spread of ratings is 25 out of 1,000, compared to 29 out of 1,000 in GGFI 7.

GGFI 8 includes a supplement exploring the role of financial centres in green finance, and in particular the contribution of emission trading schemes to the development of sustainable economies.

Full details of GGFI 8 can be found at www.greenfinanceindex.net.

Professor Michael Mainelli, Executive Chairman of Z/Yen Group, said: “As we prepare for COP 26 in the UK, it is heartening to see competition to be a top green financial centre intensify. Western Europe’s domination of the Global Green Finance Index is under continuing pressure from Asia/Pacific and North American financial centres, proving that helping to solve environmental issues, particularly climate change, is fundamental to global finance proving its worth to society. It may not be long before the real centres of green finance have moved significantly eastward.”