The 15th edition of the Global Green Finance Index (GGFI) evaluates green finance offerings from 95 financial centres. The GGFI serves as a valuable measure of the development of green finance for policy and investment decision-makers.

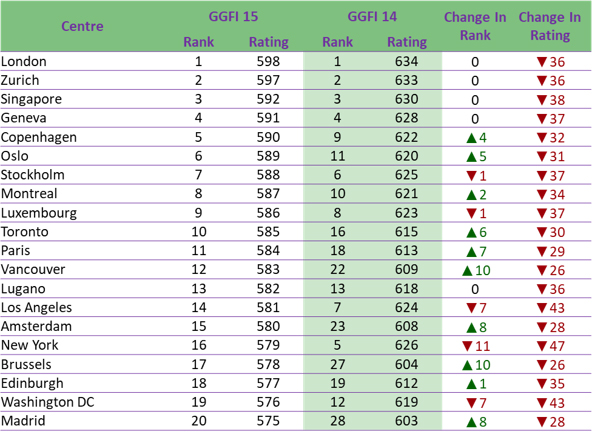

The top 20 centres in GGFI 15 are shown in the table below.

GGFI 15 Headlines

- London retained its first position in the index, while Zurich, Singapore, and Geneva retained second, third, and fourth positions.

- Oslo and Toronto entered the top 10 in this edition of the index, replacing New York and Los Angeles.

- Western European centres take seven of the top 10 places, with Canadian centres taking two. Singapore is the only Asia/Pacific centre in this leading group. No US centres feature in the top 10.

- The margins separating centres at the top of the index are small. Among the top 10 centres the spread of ratings is only 13 points out of 1,000.

- Fifteen centres rose 10 or more places in the rankings. Six centres fell 10 or more places.

- There has been a continuing drop in confidence in the development of green finance in financial centres. In the last edition of the index, the average rating was down 1.96%, whereas in this edition the average rating is down 5.91% compared with GGFI 14, with all centres dropping in the ratings. This may reflect changes in the outlook for the economy generally and the change in government direction in the US.

- Green Loans, Renewable Energy Investment, and Social and Impact Investment are rated as the areas of green finance with most impact, while ESG Analytics, Renewable Energy Investment, and Sustainable Infrastructure are seen as the areas of most interest.

- Policy and Regulatory Frameworks, Public Awareness, and Renewables are listed by respondents as the major drivers of green finance.

In the supplement to this edition of the GGFI, we provide an update on the development of sovereign sustainability-linked bonds (SSLBs) and their potential to provide support in emerging economies in particular. We also review recent changes in the frameworks governing their issuance provided by international, national, and regional authorities.

We researched 127 financial centres for GGFI 15. Full details of GGFI 15 can be found at www.greenfinanceindex.net

Professor Michael Mainelli, Chairman of the Z/Yen Group, said:

“Green finance is crucial in driving delivery on climate and sustainability goals. US influence, demonstrated by the effect on GFCI 15 from the new administration pulling back from climate commitments shows how shallow green finance waters remain. As the tide of support has receded from North America, we see an opportunity for Asia to join Europe as leaders in financial support for planetary improvement.”