The 38th edition of the Global Financial Centres Index (GFCI 38) was published today by Z/Yen Group in partnership with the China Development Institute (CDI).

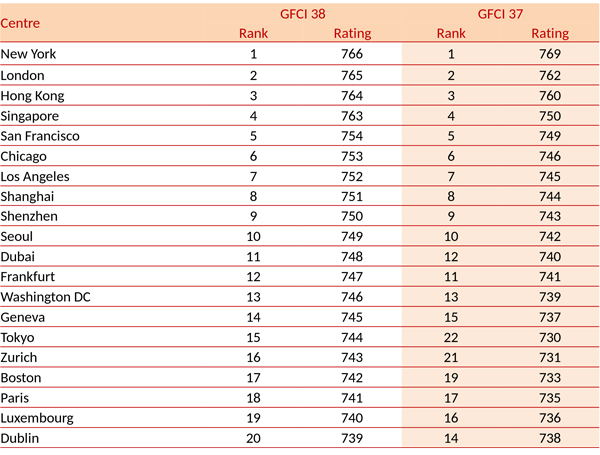

- New York held onto the top position in the index and has now been in first place since GFCI 24, published in September 2018.

- London remains in second place and has further closed the gap in the ratings with New York. Hong Kong retains third position ahead of Singapore.

- Only one rating point now separates each of the top four centres in the index.

- San Francisco, Chicago, Los Angeles, Shanghai, Shenzhen, and Seoul are unchanged in fifth to tenth positions.

- In the top 20 centres, Dubai is up one place to 11th position and Frankfurt down one place to 12th. Tokyo and Zurich entered the top 20, replacing Beijing and Amsterdam.

- The rating for almost all centres improved very slightly, with the average rating across all centres up 0.6%. The largest increase in average ratings was in Eastern Europe & Central Europe, at 1.36% and the lowest was in the Middle East & Africa where average ratings rose by 0.22%.

- Hong Kong takes top position in the separate FinTech ranking, followed by Shenzhen, with New York falling to third place. Singapore has overtaken London to take fourth position. Chinese and US centres continue to feature strongly, with six US centres and six Chinese centres in the FinTech top 20.

- We have researched views on the aspects of regulation that are most important to the development of financial centres. The most important factor was predictability, followed by flexibility, the quality of regulation, and the speed of regulatory response. Cost was identified as the least important aspect by those responding to the survey.

The top 20 centres in GFCI 38 are shown in the table below:

Full details of GFCI 38 can be found at www.globalfinancialcentres.net.

Professor Michael Mainelli, Chairman of Z/Yen, said:

“The extremely close ratings of centres in the index shows the intensity of competition among leading financial centres from the highest rated to the lowest. Most are now separated by only a single point on a 1,000 point scale. The common core competitive component is regulation. Predictability and flexibility of regulation provide a secure platform for financial markets to grow, far ahead of cost as a basis for competition.”