GFCI 36 Headlines

- The 36th edition of the Global Financial Centres Index (GFCI 36) was published today by Z/Yen Group in partnership with the China Development Institute (CDI). The launch event for GFCI 36 was held in Busan at an international symposium hosted by Busan Finance Center.

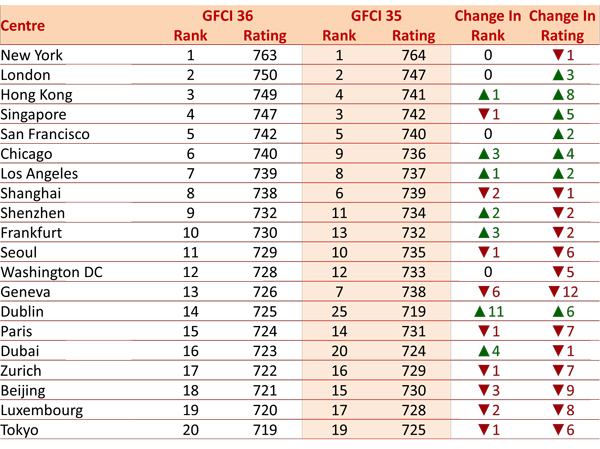

- New York held onto the top position in the index and has now been in first place since GFCI 24, published in September 2018.

- London remains second, and Hong Kong has regained third position, overtaking Singapore in fourth position.

- San Francisco remains at number five, with Chicago and Los Angeles overtaking Shanghai to place sixth and seventh, with Shanghai now in eighth position. Shenzhen and Frankfurt complete the top 10.

- There is little change in the ranking of the leading centres, with only Dublin improving more than four rank places - up 11. This continues to suggest no major changes in the economic outlook across the leading economies in the world, with slow but continued growth and inflation falling.

- The average rating across all centres was down 0.42%, suggesting little change in confidence in the financial sector, with the average rating for centres in Latin America & The Caribbean up 0.65% - the only region in which ratings increased.

- New York retains its leading position in the Fintech ranking, followed by London. Shenzhen overtook San Francisco to take third position by just one rating point.

- Hong Kong has joined Washington DC, Los Angeles, Chicago, Singapore, and Seoul in the top 10 FinTech centres, replacing Shanghai, which has dropped to 15th position.

- For this edition of the GFCI, we have researched the key challenges facing international financial centres in the medium term. Geo-Political challenges are clearly seen as the most important risk, mentioned by over 20% of respondents. Competition from other centres and regulatory requirements were mentioned by 15% and 14% of respondents respectively.

The top 20 centres in GFCI 36 are shown in the table below:

Full details of GFCI 36 can be found at www.globalfinancialcentres.net.

Mike Wardle, Chief Executive of Z/Yen, said: “Geo-political risks are identified as the greatest challenge facing financial centres and their development. However, confidence in leading international financial centres remains strong, and many leading financial centres improved or maintained their rating in GFCI 36, with a high degree of stability in the rankings.”