Global deal activity (mergers & acquisitions (M&A), private equity (PE) and venture financing) experienced an 8.4% decline year-on-year (YoY) in January 2025 with decrease in deal volume observed across all the regions. Asia-Pacific and Europe faced the sharpest declines, while certain markets like India, Japan, and Germany saw growth according to GlobalData, a leading data and analytics company.

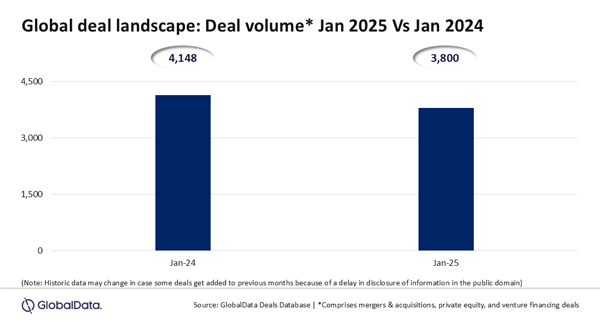

An analysis of GlobalData’s Deals Database revealed that a total of 3,800 were announced globally during January 2025, which is a fall from 4,148 deals announced globally during the same period in the previous year.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The decline in deal activity across all the regions reflects the current challenges and uncertainties. Asia-Pacific and Europe experienced the most significant downturns, with their respective deal volume declining by 10.2% and 14.5% YoY during January 2025.”

On the other hand, the total number of deals announced in North America, Middle East and Africa, and South and Central American regions were down by 1.9%, 5.5% and 23.8%, respectively.

Among the select key markets, China, the UK, Canada, South Korea, France and Australia experienced YoY decline in their deal volume by 30.4%, 20.5%, 18.9%, 28.3%, 16.7% and 17.3% respectively, while markets such as India, Japan, and Germany showed improvement in deal activity by 27.3%, 35% and 8.2%, respectively.

Meanwhile the trend remained a mixed bag across the different deal types under coverage. Venture financing deals volume saw YoY decline of 9.4% during January 2025 while the number of M&A deals fell by 8.6%. However, private equity deals experienced improvement in volume by 4.5% during the review period.

Bose concludes: “The data reveals a challenging landscape for global deal activity, with a broad decline in deal volumes, particularly in certain key markets. In this shifting environment, it will be crucial for investors to stay vigilant, closely monitor these trends, and adjust their strategies to effectively navigate the evolving market dynamics.”