FTSE Group (“FTSE”), the award winning global index provider, and QS Investors, LLC, an independent investment firm providing asset management and advisory services to institutional clients, today jointly announce the expansion of the FTSE Diversification Based Investing (DBI) Index Series to include emerging markets. With the addition of an Emerging Markets Index, the series now offers truly global coverage.

Like the FTSE DBI Developed indices, launched in September 2010, the FTSE DBI All Emerging Markets Index is non-market capitalization weighted. Instead, the FTSE DBI indices are weighted to promote diversification across countries and industry sectors. They seek higher absolute and risk-adjusted returns compared to market cap-weighted indices with less downside risk. The investment philosophy behind the FTSE DBI Index Series is that both geography and industry are the primary drivers of global equity risk and return; and that market sentiment can lead to momentum effects, causing concentration risk in market-cap weighted indices. A macro diversified portfolio helps to avoid this concentration risk and should lessen downside risk. Using a transparent, rules-based formula, the indices diversify exposure by re-weighting countries and industries to avoid concentration risk and momentum effects. Risk assessment occurs annually and index rebalancing occurs quarterly.

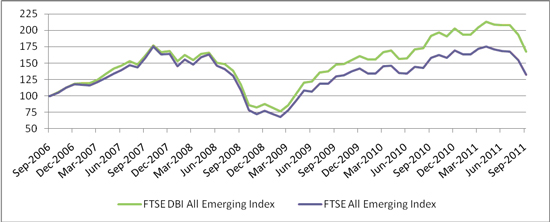

The index is derived from the FTSE All Emerging Markets Index Series, which is market-cap weighted and made up of large and mid-cap companies within Advanced and Secondary Emerging Markets, as categorized by FTSE’s transparent, rules-based Country Classification Process. Over the past five years, the FTSE DBI All Emerging Index has consistently outperformed its benchmark, as demonstrated by the graph below:

FTSE DBI ALL EMERGING INDEX 5-YEAR PERFORMANCE

“DBI seeks to address macro and behavioural inefficiencies by developing a diversified exposure to macro risk factors, so expanding this approach to emerging markets is a natural extension of the FTSE DBI Index series,” said James Norman, President, QS Investors, LLC. “With so much uncertainty in global markets, we believe adding a diversified approach to emerging markets exposure can potentially add value to investors’ portfolios.”

“FTSE is the leading provider of non-market cap weighted benchmarks, offering an extensive range of alternative weighted and risk based strategy indices” said Mark Makepeace, CEO, FTSE Group. “We are delighted to be extending the FTSE DBI Index Series with QS Investors, and will continue to develop our indices to meet the needs of the market.”