Whenever it is time to reflect on business progress, I find myself looking for all the positive things that have evolved. This time around, it is even more vital to be thankful for the small joys that life brings. Q1 was challenging for many, but the uniting of people across the world has served as a beacon of hope for the future. Together we are stronger.

In Q1, the team focused on working closely with our colleagues, clients, and members to ensure that the key initiatives remain on track, as well as developing initiatives from 2021. The progress made in the ESG segment is a testament to the collective effort of all involved. The contracts had a smooth roll despite the heightened market volatility. During the March 2022 roll, over EUR 700mn in open interest shifted to the June expiry. We saw the most active day for the product, with over 8,000 contracts traded, corresponding to EUR 1.3bn in traded notional. We are confident that the product continues to develop as more end clients become active, using the product as an efficient long-term hedging tool or generating alpha.

Another segment that saw increased client activity was the FI ETF options segment. The segment traded c. 136k contracts across several of the underlyings. The Emerging Markets underlying had c.80k contracts trade as clients looked to access the liquidity pool. Q1 saw more frequent trading and an increase in active accounts, which hopefully lays the foundation for the rest of the year.

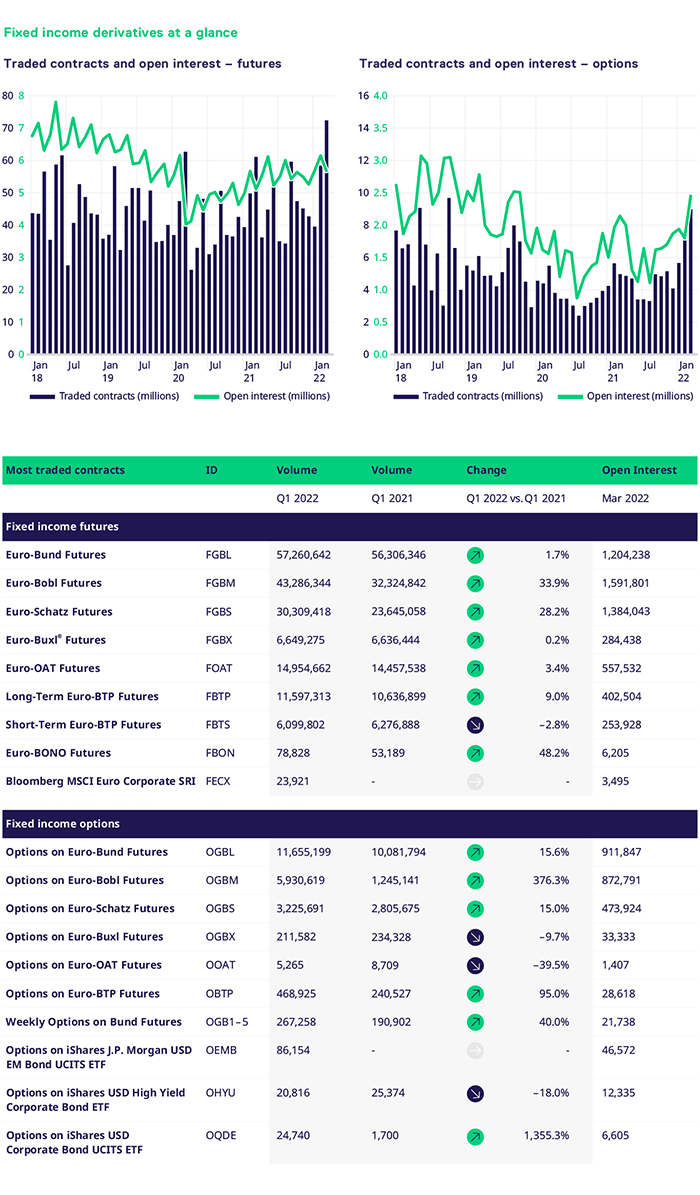

Geopolitical risks and heightened volatility across asset classes led to an increase in activity across the portfolio. The increase in uncertainty, coupled with risks to the upside in inflation, naturally led to increased volumes in the futures portfolio. In the German segment, volumes were higher across the board, with the belly outperforming relative to the rest of the curve. Bobl and Schatz saw the largest quarter-on-quarter (Q/Q) increases, with volumes 33.9% and 28.2% higher. The Italian and French segments set new records, with 18.1m and 14.96m contracts traded. Q/Q, this translated to an increase of 9% and 3.4%.

Inflation remains a key concern as it puts pressure on Central Banks to accelerate tapering, raise rates more swiftly and reduce monetary stimulus. The backup in yields and increased level of realized volatility have underpinned our volumes. Additionally, in quarter one, the two-way price action in markets and divergence amongst central banks supported volumes in our options portfolio. As the forwards began to rise, edging yields higher, volumes in Bunds and Bobl options saw an increase of 15.6% and 376%, respectively, compared to Q1 2021. Weekly Bund options continued to see solid volume development, increasing by 40%. The Italian segment performed well, witnessing an increase of 95%. The front end of the curve further saw an increase in volumes, ending the quarter 15% higher than Q1 2021. The long end of the curve underperformed relative to the rest, seeing a reduction in volumes of 9%, with 211k contracts trading.

As we head into the second quarter, we can only hope that a resolution is found to the conflict in Ukraine. Like many, I hope that this will be resolved swiftly. The team will continue to work with all our stakeholders to ensure that our markets function smoothly, and key initiatives will continue to be worked on. With the French presidential elections due to unfold, there is enough event risk in Europe to anticipate that elevated levels of volatility will persist in the coming weeks and months ahead.