CCData is delighted to announce the release of its latest Exchange Benchmark. The benchmark, now a cornerstone of the industry, provides a robust framework for ranking and assessing the risk associated with digital asset exchanges (AA-F). The latest iteration also includes an enhanced framework for ranking derivatives exchanges.

The decline of FTX in November, in combination with recent banking challenges, has emphasized the importance of transparency in the centralised exchange industry, leading to increased regulatory scrutiny. In response, CCData has enhanced the underlying framework and methodology of its benchmark, ensuring that it remains at the forefront of industry best practices and effectively addresses the evolving regulatory landscape.

Download the report to discover the latest Exchange Rankings. You can also access the full press release here.

Key findings:

-

Bitstamp retained its position as the highest-ranked Centralised Exchange, as did Uniswap in the Decentralised Exchange Rankings. Kraken achieved the top spot in CCData's industry-first derivatives rankings.

-

In March 2023, 71% of total volumes were from Top-Tier exchanges based on updated grading, compared to 92% in October 2022. The number of Top-Tier exchanges has decreased since October 2022 due to more stringent ranking thresholds.

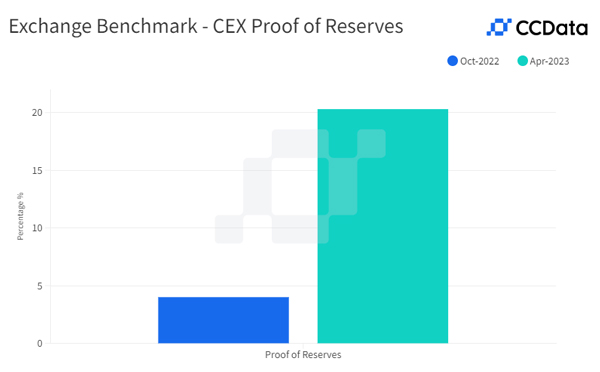

- Transparency is increasing in the centralised exchange industry. After the collapse of FTX, 20% of exchanges have adopted Proof of Reserves or an alternative, with 13% being audited or incorporating Proof of Liabilities, to respond to growing concerns from market participants.

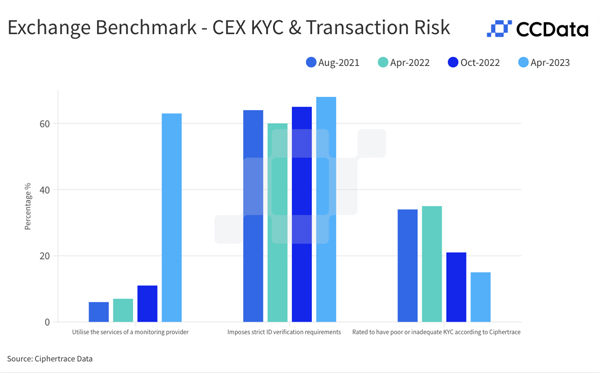

- Exchange KYC practices are improving. In April 2023, 15% of analysed exchanges were deemed to have inadequate KYC practices according to Ciphertrace, which is an improvement from 21% in October 2022 and 35% in April 2022. This is partly due to the closure of underperforming exchanges.

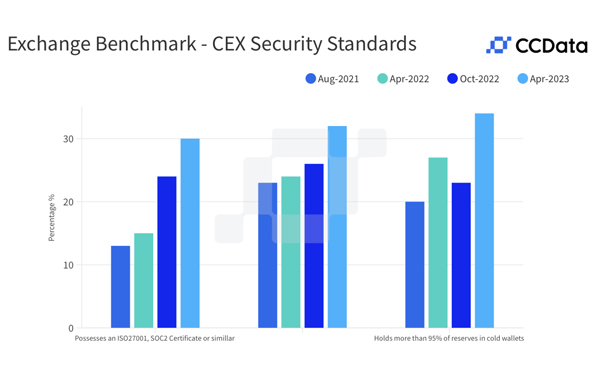

- Security standards for centralised exchanges are improving. The number of exchanges that possess an ISO 27001, SOC2 certificate, or similar, has increased from 24% in October 2022 to 30% in April 2023. Furthermore, 34% now employ the service of a custody provider, up from 26% in October 2022.

- Security vulnerabilities remain prevalent in DEXs, with 43.2% of assessed DEXs having been hacked before, with 68.4% of these hacks occurring in the past 12 months. Of the 19 DEXs that were hacked, 12 lost over $1,000,000.

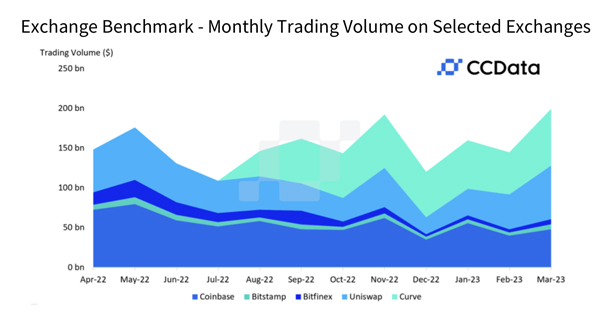

- TVL in assessed DEXs decreased to $16.9 billion from $21.7 billion in October 2022, however, ADV remained stable. Uniswap and Curve surpassed top centralised exchanges like Coinbase and Bitstamp post-FTX collapse, indicating users are increasingly looking to alternative trading venues like DEXs.

Transparency is increasing across the centralised exchange industry.

Following the collapse of FTX, a prominent trend in the digital asset exchange sector has been the implementation of Proof of Reserves in response to growing concerns from market participants. As a result, 20% of exchanges have adopted Proof of Reserves or an alternative, with 13% being audited or incorporating Proof of Liabilities.

Exchange KYC practices are on the rise.

In April 2023, 15% of analysed exchanges were deemed to have inadequate KYC practices according to Ciphertrace. While this is in part due to the closure of poor, underperforming exchanges, it is an improvement from 21% in October 2022 and 35% in April 2022.

Centralised exchanges' security standards improve with increased use of certificates and custodian services.

The number of exchanges that possess an ISO 27001, SOC2 certificate, or similar, has increased from 24% in Oct 2022 to 30% in April 2023. Furthermore, 34% now employ the service of a custody provider, increasing from 26% in October 2022.

DEX TVL falls to $16.9B from $21.7B in Oct. 2022 despite addition of new DEXs

Meanwhile, Average Daily Volume (ADV) remained stable, with leading DEXs Uniswap and Curve surpassing top centralised exchanges like Coinbase and Bitstamp post-FTX collapse. As centralized exchanges' ADVs slow, users are drawn to DEXs for their security benefits. The decreased TVL and steady volumes demonstrate DEXs' maturation as efficient markets for trading digital assets.