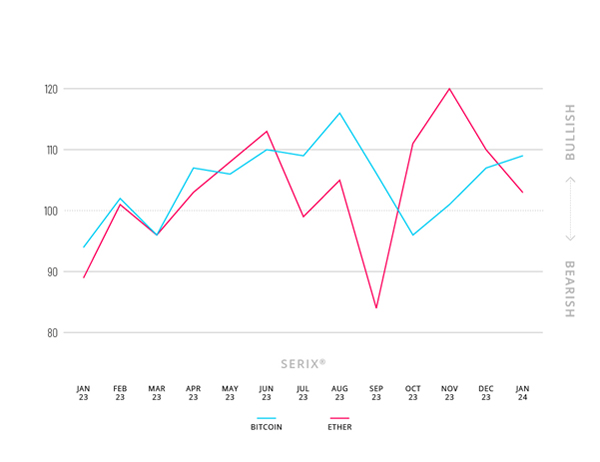

- Spectrum's SERIX sentiment indicator for bitcoin reached 109 points, while ether dropped from 120 to 103 points last month

- SEC’s decision to approve bitcoin spot ETFs fuelled demand for bitcoin-related investments

- In January 2024 order book turnover on Spectrum was €311.5 million

Spectrum Markets (“Spectrum”), the pan-European trading venue for securities, has published its SERIX sentiment data for European retail investors for January, revealing contrasting trends in trading behaviour on products linked to the two most prominent cryptocurrencies, bitcoin and ether.

Notably, the SERIX sentiment for bitcoin (BTC) continued an upward trajectory started in November last year, reaching 109 points in January 2024. Conversely, the ether (ETH) SERIX sentiment index followed a divergent path during the same period, declining to 103 points.

On January 11th the United States Securities and Exchange Commission (SEC) approved ETFs on bitcoin, which opened the investment universe for many investors including institutional investors. A similar decision on ether is still uncertain. Following this announcement from the SEC, bitcoin-related trading on Spectrum surged to 2.5 times the monthly average in 2023.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment (see below for more information on the methodology), which means that both SERIX sentiment indices on cryptocurrencies are still bullish, but with different tendencies.

Spectrum Markets expanded its product offering to include turbo warrants on both cryptocurrencies in May 2022. This allows retail investors to gain exposure to changing prices without needing to maintain a separate crypto wallet, and in a regulated trading environment.

With this decision, Spectrum Markets was the first regulated trading venue to make cryptocurrency-linked derivatives available on a pan-European basis, 24 hours a day and five days a week. However, the approval of the ETF wrapper in the US paves the way for large pockets of institutional money to enter the asset class.

Market opinion

“Spectrum experienced a spike in activity on products linked to bitcoin in the hours following the SEC’s decision to approve the first bitcoin ETF, as retail investors took advantage of our 24-hour trading to quickly respond to the anticipated news, within a regulated environment,” comments Michael Hall, Head of Distribution at Spectrum Markets.

“We support the SEC’s decision, as enabling US investors to access bitcoin via a highly-regulated and transparent wrapper like an ETF, addresses the growing demand for enhanced regulatory standards around the world on the asset class. Meanwhile, in the EU, a bitcoin ETF is still not possible under existing regulation as UCITS regulations do not allow a single reference price for an ETF underlying. To stay competitive with the US, EU rules must be adjusted in order to prevent the diversion of flows, executed in Europe, abroad,” says Hall.

Spectrum’s January data

In January 2024, order book turnover on Spectrum was €311.5 million, with 32.1% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

87.4% of the order book turnover was on indices, 3.8% on currency pairs, 5.2% on commodities, 2.4% on equities and 1.2% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (39%), NASDAQ 100 (24.2%), and DOW 30 (11.7%).

Looking at the SERIX data for the top three underlying markets, the DAX 40 sentiment increased slightly from 97 to 99. Similarly, the NASDAQ 100 and DOW 30 both remained bearish at 98, from 98 and 96 respectively in the previous month.

|

Calculating SERIX data The Spectrum European Retail Investor Index (SERIX), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets. The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment: SERIX = (% bullish trades - % bearish trades) + 100 Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link). |