Market briefing

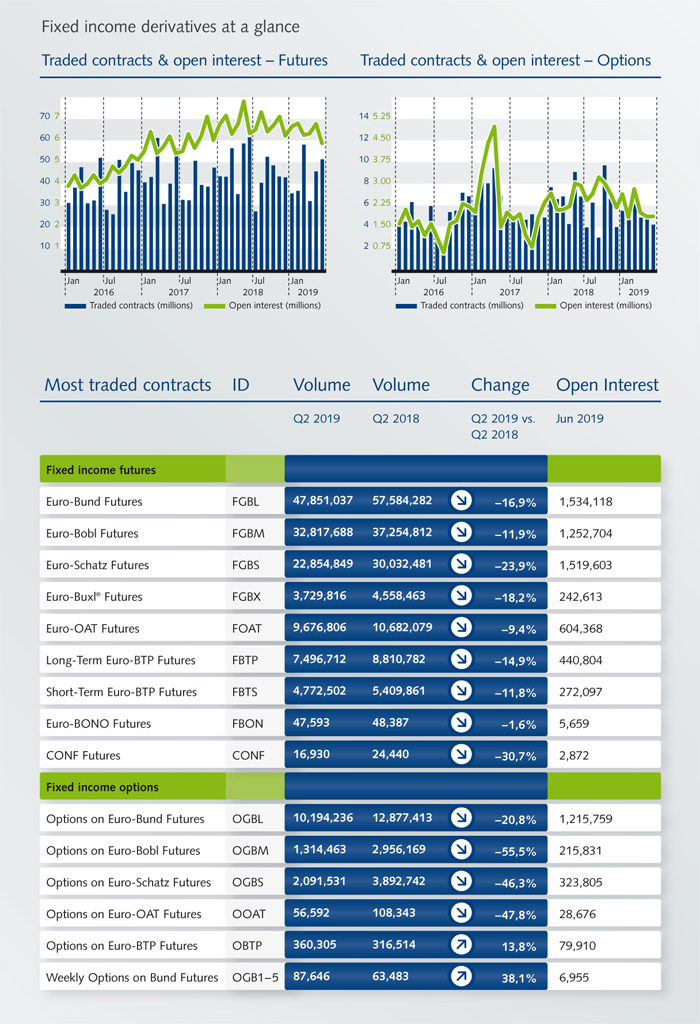

Overall, European Fixed Income markets continue to face headwinds from geopolitical and global event risks, namely the U.S./China trade tensions. This has helped suppress volumes across European Fixed Income, with weaker data weighing on yields and sentiment, albeit moves in futures being more of a slow grind higher in price terms.

Facts & figures

News

Transitioning to alternative rates – The countdown is on

The industry has just over two years to begin trading a range of financial products – including loans, floating-rate notes and derivatives products – benchmarked to alternative risk-free rates following the transition away from Libor. Eurex explores how, by being proactive at the earliest opportunity, banks can best manage the burden of preparation ahead of the impending 2021 deadline.

IBOR reform is the biggest change in the capital markets since the introduction of the Euro two decades ago. For the past decade, the global regulatory community has driven a reform of the interbank offered rates (IBORs) in order to renew confidence in these critical benchmarks. Eurex & Eurex Clearing introduce their new section on their respective websites, providing updates on the transition from EONIA to €STR, valuable links and updates on related initiatives.

Watch a short video of Lee Bartholomew, Head of Fixed Income Derivatives Product R&D at Eurex, discussing what measures Eurex is taking to prepare itself and its customers for the reform.

For derivatives market participants, the focus for 2019 is very much a mix of regulatory compliance and mitigating geopolitical change. In a DerivSource Q&A, Phil Simons, Global Head Fixed Income Sales – Derivatives, Funding & Financing and Ricky Maloney, Head of Buy-Side Sales at Eurex, look at how to balance the need for liquidity and margin efficiency with regulatory compliance in this ever-changing industry. This interview was first published on DerivSource.com on 25 June 2019.

Eurex Clearing's ISA Direct – a direct clearing membership for the buy side – gains traction: Swiss Life Asset Managers is the first buy-side client using the central counterparty's ISA Direct service for OTC Interest Rate Derivatives with ABN AMRO acting as clearing agent. With this model, Eurex addresses changes in the regulatory landscape and contributes to the safety, robustness and efficiency of the overall market.

Barclays has joined EurexOTC Clear to support Eurex in expanding its distribution network in the U.S. In so doing, Barclays is the first European bank to offer Eurex’s OTC clearing services through its U.S. registered futures commission merchant (FCM) to U.S. clients. The first transaction has been already successfully cleared.

BNY Mellon has become the first agent lender to centrally clear a securities lending transaction on behalf of a buy-side client through Eurex Clearing’s Lending CCP platform.

Once again, Eurex achieved another weekly volume record during the Asian trading hours in the roll month June. In this focus article, you will find the key figures comparing the March vs the June Eurex Fixed Income and Equity Index rolls during the extended trading hours.