Market briefing

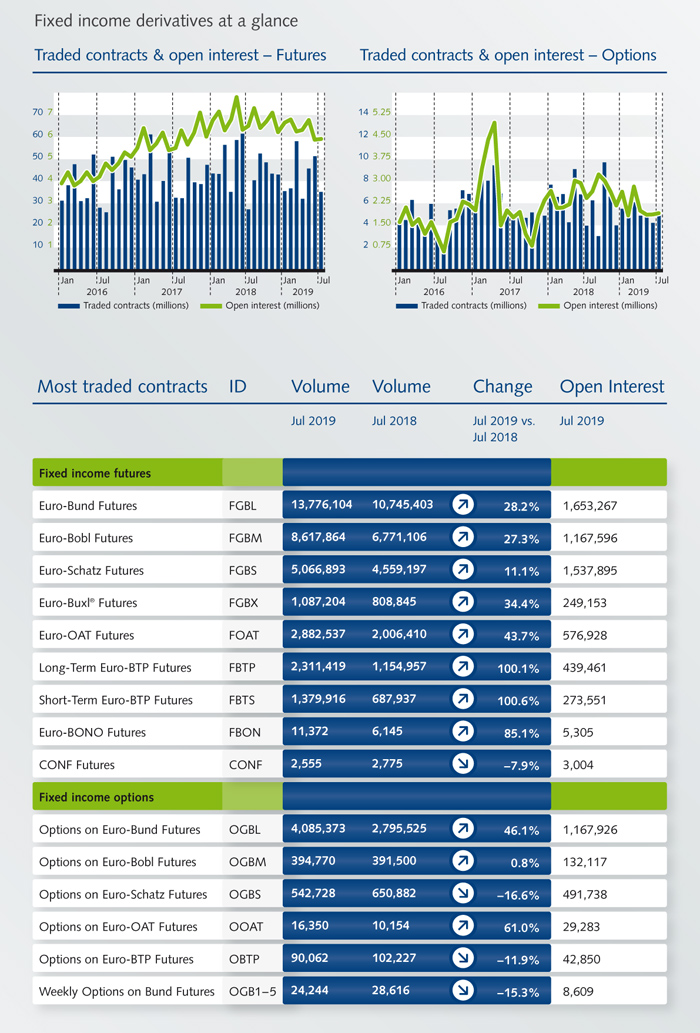

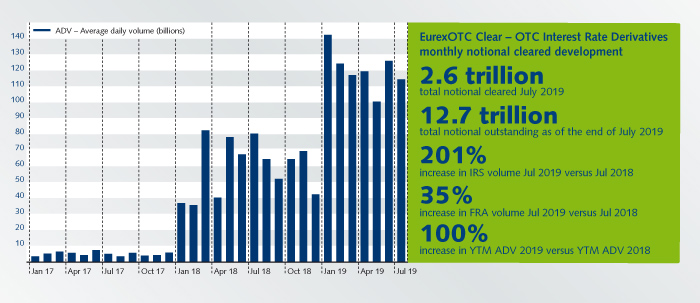

Fixed income markets saw European government bonds continue to rally in July as Central Banks increasingly evaluated dovish monetary policy to combat a weakening growth outlook and low inflation. The increased volatility during the usually quiet holiday period saw Eurex fixed income futures and options volumes 30 percent higher than July 2018.

Read the full market briefing by Lee Bartholomew, Head of Fixed Income Product R&D, Eurex

Facts & figures

News

Customer Survey: Tell us your needs

We are remodelling the functionalities on our website to better fit to your wishes and needs. Design with us the future by telling us what is important for you and which product parameters do you search and use. The survey should take less than 5 minutes to complete. Help us improve! Click here.

Introduction of the new "GC Pooling Cheapest-To-Deliver (CTD) Basket"

On 12 August 2019, Eurex Repo will introduce a new ring-fenced GC Pooling Basket in combination with new trade types, enabling members to fund, with minimized risk, the cheapest-to-deliver out of future delivery obligations for trades within the fixed income futures contract. The GC Pooling CTD Basket will contain German and French Government Bonds as deliverables of the next three futures expiries and will be automatically updated in case of an inclusion or exclusion of a deliverable security. Find out more here.

TriOptima record compression

TriOptima, a leading infrastructure service that lowers costs and mitigates risk in OTC derivatives markets, today announced that it has reduced notional outstanding at Eurex Clearing by 26% following a record compression run on 26 June 2019.

IBOR Reform - Challenge of transition

In the second part of the IBOR video series Marco Meijer, Senior Interest Rate Strategist Europe, BNP Paribas, discusses the challenges of the transition to the new risk-free rates.

IBOR Q&A

Need help with the transition to new risk-free reference rates? What are the next steps? What measurements are planned to switch from EONIA to €STR? How are you affected by this reform and what do you need to do? Our IBOR reform website has answers to these questions and provides you with a number of services and helpful tools as well as an overview of frequently asked questions.

Prisma Margin Estimator in Cloud - calculate your margin easily

The Cloud Prisma Margin Estimator (Cloud PME) is Eurex Clearing's cloud-based solution for margin simulations under Prisma, Eurex Clearing's margin methodology. The service is free of charge and specifically tailored for end users who wish to simulate margin requirements for Exchange Traded Derivatives (ETDs) or OTC interest rate swaps with or without cross margining. You can try our GUI or API now.