Once again, we experienced high trading activities and achieved another weekly volume record. This performance is a proof of our commitment to provide our customers with the best price quality and market depth during Asian trading hours. The figures in detail:

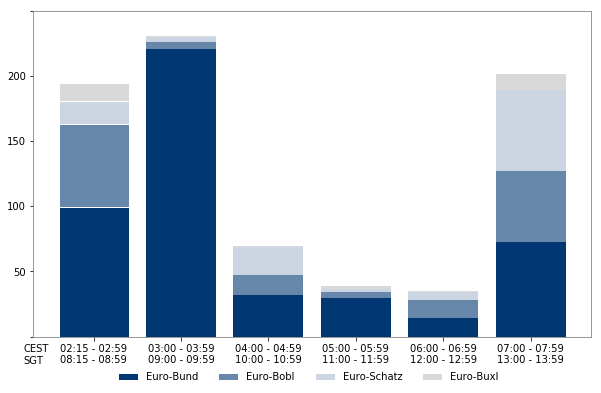

Key figures Fixed Income roll (30 May – 5 June)

- Over 160 members traded during the roll, about two thirds of all members were active during Asian hours

- Largest portion of trading was in the second hour after the opening (30 percent)

- Average daily volume (ADV) of 73,172 traded contracts with a total of 365,000 traded contracts (single counted), highest weekly volume since the launch of the trading hours extension

- Volume during June roll increased by 72 percent compared to March roll (4 – 8 March)

- High trading volume on Euro-Bund Futures (61 percent) during Asian trading hours, followed by Euro-Bobl Futures (20 percent) and Euro-Schatz Futures (15 percent)

Hourly trading distribution (traded contracts in thousands)

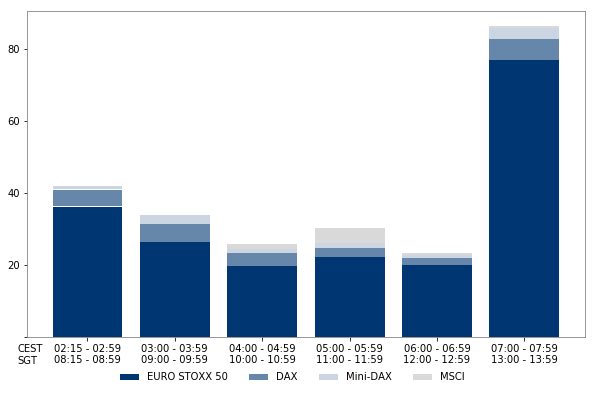

Key figures Equity Index roll (17 June – 21 June)

- Distribution of trading activities was relatively even during Asian trading hours

- ADV of 35,000 traded contracts is comparable to the previous Equity Index derivatives roll

- High trading volume on EURO STOXX 50 Futures (83%)

Hourly trading distribution (traded contracts in thousands)

Further information