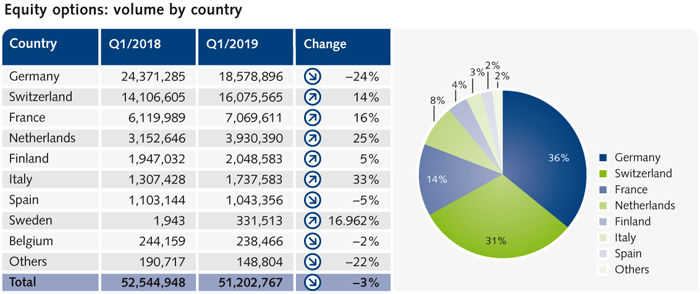

Equity options:

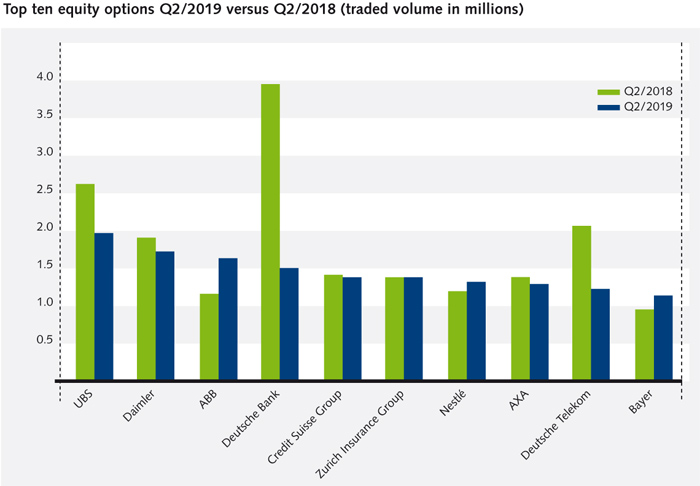

Considering the overall low volatility environment at a broader index level, we could observe several company specific events and news offering trading opportunities in the single equity segment. Those specific events are reflected in stable or increased volumes in Q2 in options such as Daimler and Bayer. The overall lower trading activities where mainly driven by specific drops in traded volumes such as Deutsche Bank and Deutsche Telekom.

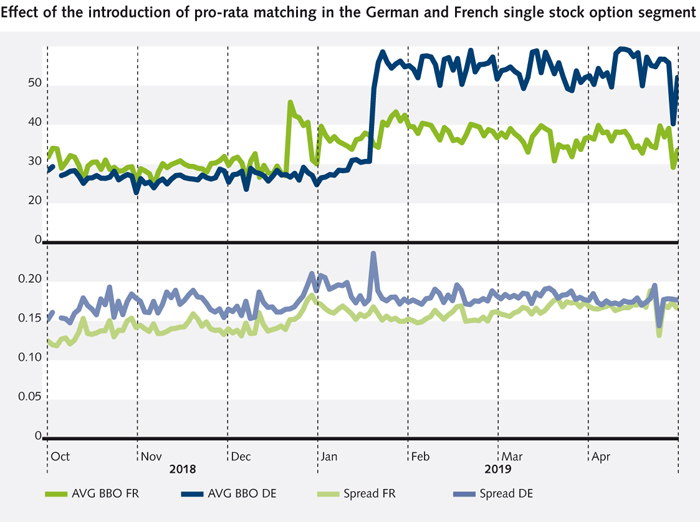

At the beginning of this year, we changed the matching algorithm for the single equity options segment and introduced the premium dependent tick size. The goal of this change was to increase the available volume on the best bid/ask level in the book and to pool liquidity on one price point. The evaluation after six month shows a successful outcome that is illustrated by the example of the German and French segment in the graph below. The average available volume on the best bid/ask level (BBO) has doubled in the German segment and in the French segment we observed an increase of 25%. At the same time, the average spread stayed at the same level.

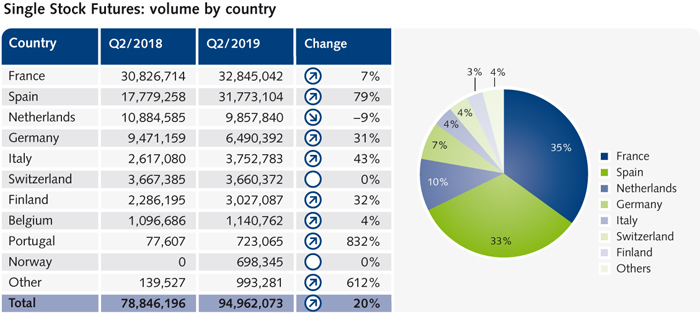

Single Stock Futures:

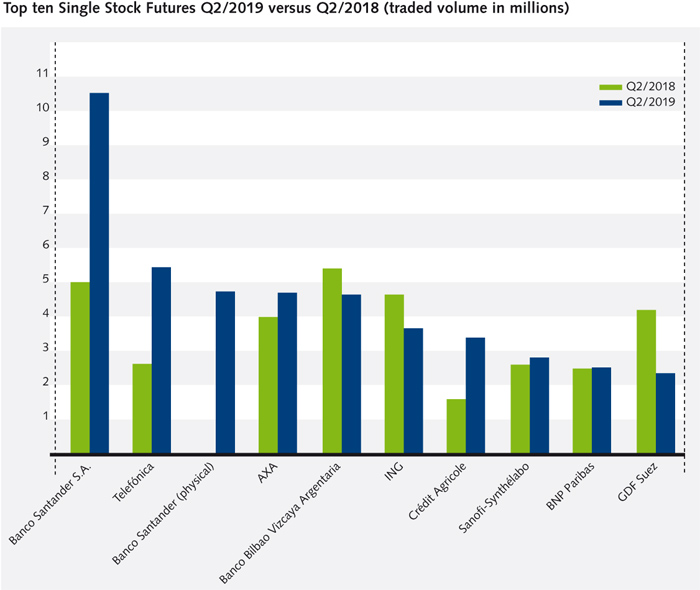

Q2/2019 vs Q2/2018 showed an increase of traded volume in the Single Stock Futures segment (SSF) of 20%. Most of the contracts were traded in Spanish underlyings, where the increase has been around 80%, Banco Santander and Telefonica even doubled their volume. The Single Stock Futures in the Italian underlyings had an increase of 43%, driven by Intesa Sanpaolo (+55%) and Unicredit (+80%).

In addition to the existing cash settled SSFs, Eurex launched physical delivered SSFs on all EURO STOXX 50® Index components in April. This was based on the high demand in the already traded physical delivered SSFs on Spanish underlyings. The volume of around 700,000 traded contracts (excluding the Spanish volume) in the first months of launch has prompted us to plan to roll out additional underlyings in the following month.

Stock Tracking Futures on Eurex – a new flavor to equity financing:

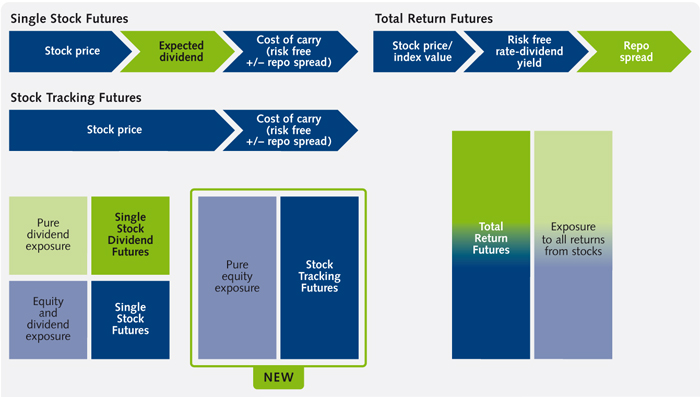

On 29 July 2019, Eurex will launch Stock Tracking Futures on the constituents of the EURO STOXX 50® Index. Traditional Single Stock Futures (SSF) embed a dividend risk/exposure if the estimated dividend payment of the underlying stocks differs from the actual dividend paid. This is an undesired effect for stock performance investors.

The Stock Tracking Futures (STF) adjust for regular dividend payments during its lifetime, thus reduces dividend ("change") risk (daily settlement price will be derived from the underlying stock + cost of carry). On ex-date, the gross dividend amount will be reduced from the previous day settlement price of the STF via the Price Correction Process. This ensures the dividend price move in the stock does not affect the value of open positions in the futures contract. The "start of day position" of each client will be booked out at the original previous day settlement price and booked back in at the dividend-adjusted previous day settlement price. The resulting margin payments offset the impact of the dividend payment on the variation margin.

STFs generate pure equity return for investors. The new product offers a new instrument for investors for either stock replacement or equity financing strategies. The offering thus completes Eurex's Delta One equity product suite:

Pro-rata matching:

As of beginning of the year we changed the matching algorithm for the single equity options segment and introduced the premium dependent tick size. The goal of this change was to increase the available volume on the best bid/ask level in the book and to pool liquidity on one price point. The evaluation after six month shows a successful outcome that is illustrated by the example of the German and French segment in the graph below. The average available volume on the best bid/ask level (BBO) has doubled in the German segment and in the French segment we observed an increase of 25%. At the same time the average spread stayed on the same level.

For a full list of Eurex Exchange's equity derivatives, please visit the Eurex website.

.jpg)