Market briefing

Firstly, I would like to send all of our members my sincerest regards in these extraordinary times and thank them for their continued support. April was a mixed month for European Fixed Income (FIC) markets. Overall, our volumes were down across the German benchmarks except for our Schatz options, which saw a growth of 198.4%. The options were primarily driven by flows emanating from OTC markets in the cap/floor versus swaption space. With Euribor's high relative to the same period last year, investors looked to position themselves in the spread between the two in the front end. The Italian and French segments continued to be well supported, with volume growths of 32% and 111.4% respectively in options as intra-month volatility spiked to circa 17% in BTP's. [...]

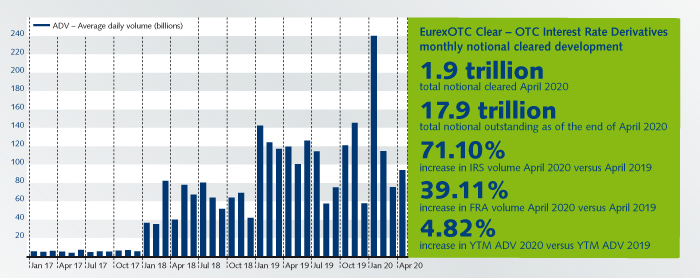

Facts & figures

News

The coronavirus pandemic delayed the UMR deadlines, but the challenge has not disappeared. The delay allows compliance to prepare themselves adequately and allows putting a complete solution in place. Read Frank Odendall’s latest article on how CCP cleared repo can help to manage collateral requirements now and in the future.

Randolf Roth reviews the major milestones achieved by the RfQ platform over the last 12 months and provides an outlook on upcoming functionalities.

Events

With its focus on derivatives, trading and risk management across asset classes, the Derivatives Forums have rapidly become industry-leading events across several European locations. Naturally, we can't host the forum in Amsterdam as initially planned. However, we've transformed the Amsterdam forum into a half-day virtual forum, quenching your thirst for knowledge.

With 2020, a new decade is upon us and with COVID-19, this decade may look completely different from what we ever had imagined. Therefore, even though it’s tempting to look back, let’s look forward. The first Digital Derivatives Forum will focus on the impact, challenges and opportunities the new decade will bring to financial market participants as change is shaping our industry at an unprecedented pace.

As uncertainty surrounding Brexit continues and the impacts of the recent market volatility are analyzed, it's essential for banks and their end clients to understand their clearing options, and how they can achieve greater capital and cross margining efficiencies by transferring their OTC Interest Rate Derivatives portfolios to a CCP based in the EU27.

Industry experts will share their insights on the topic and discuss key operational challenges you need to consider when preparing for a portfolio transfer.