Market briefing

Overall the month of May was very quiet across the Eurex Fixed Income (FIC) derivatives portfolio, with the only positive rays of light being the weekly bund options volume seeing an increase of 1.5% and FIC ETF options 543% respectively. Risk sentiment was low for the month and we saw a reduction in both volumes and open interest (OI). Having said this, we have started to see a pick up in volumes and OI at the beginning of June as the EUR curve steepened. This has been primarily driven by the excess flatteness and the apparent lack of appetite by the ECB to further flatten core curves as markets are biased towards further steepening. At the front end of the curve, we have seen a further pick up in Schatz volumes, both in futures and options, mainly driven by moves witnessed in the swaption space (swaption vol versus cap/floor vol). In recent weeks, we have seen bund vol increase from 2.5% to 4.5% as futures sold off on the back of a strong rally in stocks. However, low levels of delivered over the long term could suppress volatility levels.

Lee Bartholomew, Head of Fixed Income Product R&D, Eurex

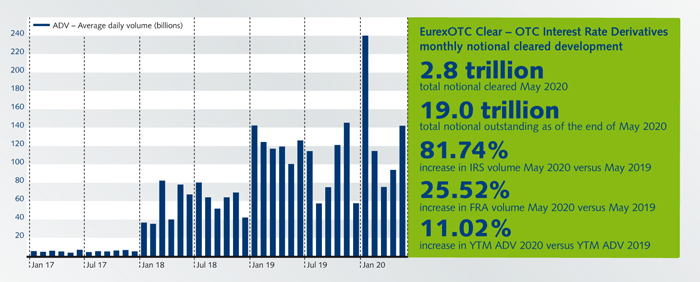

Facts & figures