Market briefing

First and foremost, I would like to take this opportunity to express my sincere gratitude to our members for helping to provide liquidity in a thoroughly challenging first quarter. It is testament to Eurex’s broad and diverse members that we have been able to serve our customers in these unprecedented circumstances.

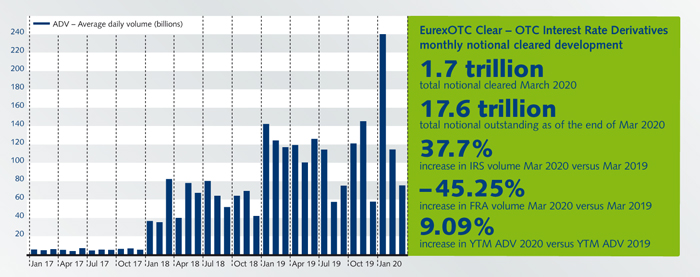

Overall, the first quarter saw an increase in volumes versus Q1 2019. This was primarily driven by the sudden outbreak of COVID-19, which led to an immediate global monetary policy response, with central banks cutting rates and reinstating or reinforcing their quantitative easing measures. At the same time, European countries implemented lock-down policies to prevent further spreading. [...]

Facts & figures

News

As central clearing takes a more prominent place in the market, Phil Simons from Eurex Clearing discusses its role in managing its member’s risks and increasingly large collateral pools.

In these volatile times, many investors turned to ETFs to manage their exposure across various asset classes. Read our ETF Options commentary to learn how this affected option volatility.

The business continuity of the exchange is essential to the continuity of its members and their clients. Find out more about our policies, our opinions on how to keep markets efficient, and how we will continue to be a trusted market partner under these testing circumstances.

Japan’s Financial Services Agency (FSA) has granted Eurex Clearing a license as a “foreign financial instruments clearing organization.” This enables Eurex’s central counterparty to offer its clearing services not only in the European Union and the U.S. but also in Japan. The service extension into one of the largest Fixed Income markets is driven by client demand and will support the strong momentum of Eurex Clearing’s EU-based liquidity pool for Euro Swaps.

Since the launch of Eurex EnLight in March 2018, more than 2.3 million contracts have been traded on the RFQ platform. Eurex EnLight is a fully integrated exchange RFQ platform combining off-book liquidity with on-exchange efficiency. Learn more on how to benefit.

Events

The third Derivatives Forum in Frankfurt, held on 27 February in the beautiful surroundings of the "Gesellschaftshaus Palmengarten", was a huge success. It was organized by Eurex, featuring eleven renowned co-sponsors and 550 participants from more than 180 buy- and sell-side firms, regulators and associations.