Market briefing

Just when investors thought it was safe to step away for a well-earned August holiday, the markets decided to get interesting! Most of the negative equity returns struck in the first half of August as markets absorbed the one-two punch of an escalating Sino-American trade war with neither side backing down, combined with the US 2yr / 10yr yield curve inversion.

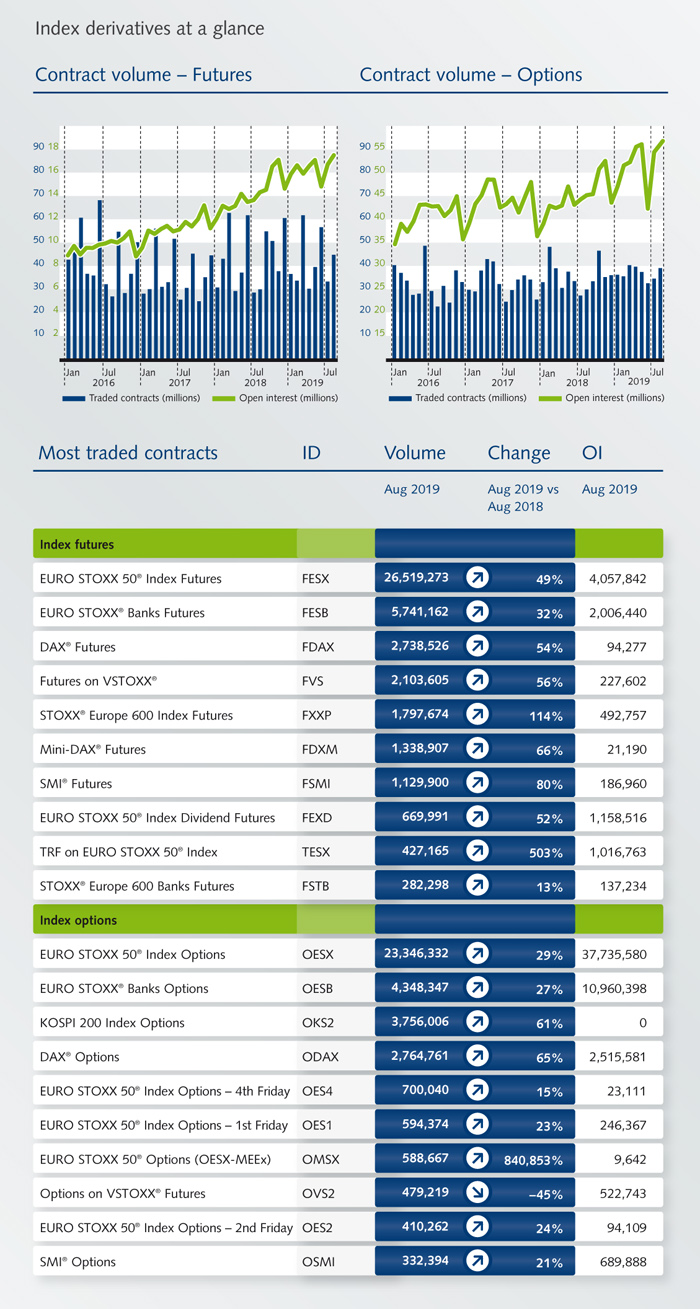

Facts & figures

News

Six months after their launch in February, our Environmental Social Government (ESG) derivatives have reached 235,000 traded contracts and recently peaked at EUR 782 million in open interest. Time for a first review with Michael Peters, Member of the Eurex Executive Board.

The European market for exchange traded funds (ETF) has grown substantially. Providing the broadest choice of ETF derivatives in Europe, Eurex offers interesting market opportunities to implement option strategies on this portfolio with more than 30 of the most liquid ETFs in Europe. We spoke with Matthew Riley, Equity & Index Sales EMEA, about possibilities and opportunities.

Eurex's Daily Expiry Futures on the KOSPI 200 Options reached a record trading day on 7 August with 694,155 contracts traded (single count) as market volatility increased due to ongoing geopolitical issues. Find out more.

The VSTOXX® continues to strengthen its position as the benchmark for European volatility. The recent spikes in implied volatility stemming from renewed trade war tensions have led VSTOXX® futures (FVS) to set a monthly record of over 2.1 million contracts traded in August. The new record is over 15% higher than the previous monthly high of 1.8 million contracts in October 2018.

For more information, please visit our website or contact Brandon Berry on T (212) 309-9314.

Buy-side client flows have started to increase as more participants become aware of Eurex offerings. It now represents 25% of Eurex’s MSCI derivatives flow with over 250 buy-side managers active on MSCI products.

With UMR rules coming into play over the next 2 years, we expect this flow to become stronger. Eurex has partner with sell side players in core regions and the expansion of Eurex buy-side outreach in Korea, China, Australia, Brazil, Mexico, Middle East will add flows bringing in more hedge funds globally.

Additionally, Eurex will introduce a suite of new derivatives using MSCI Dividend Point Indexes: MSCI EM Dividend Point Index, MSCI EAFE Dividend Point Index and the MSCI World Dividend Point Index. These new products will enable market participants to hedge their dividend exposure around the globe.

For more information, please visit our website or please contact Rachna Mathur or T (212) 309-9308.

Eurex EnLight now offers the capability to do a "Working Delta" negotiation for situations where the requester may want to grant the responder more flexibility to hedge themselves before the deal is final. Please follow the link for the new Working Delta tutorial videos.

.jpg)