Market briefing

Zubin Ramdarshan, Head of Equity & Index Product Design, Eurex

Facts & figures

News

Eurex expands its pioneering role in sustainable investing

Eurex extends its pioneering role in ESG derivatives by adding the first exchange traded ESG options on a European benchmark to its product range. Launch of the new options, which are based on the leading STOXX® Europe 600 ESG-X Index, is scheduled for 21 October.

After the successful launch of Total Return Futures (TRFs) on Indices, Eurex has further expanded its offering to include TRFs on 255 euro-denominated equities (ETRFs) on 7 October. Included in the new offering is an innovative basket trade feature to replicate portfolio trading strategies.

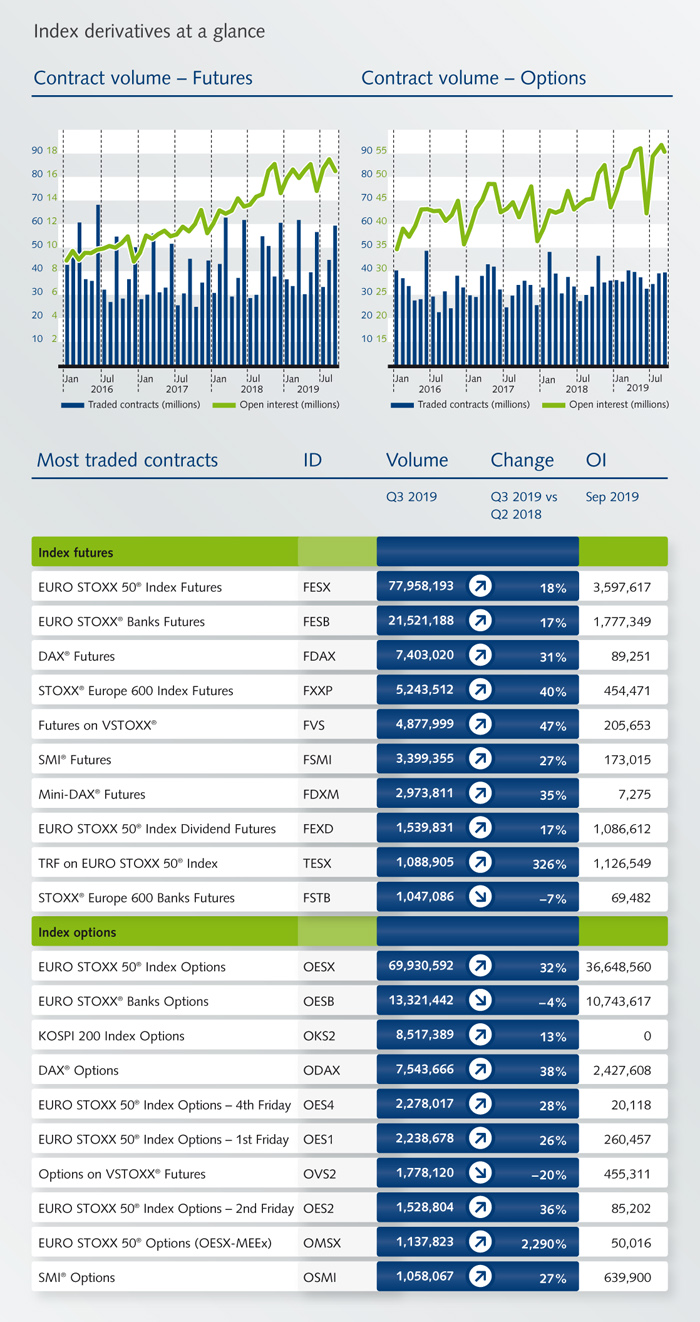

In addition to the regular third Friday expiries (OESX), Eurex also offers EURO STOXX 50® Index options with month-end-expirations (OMSX), expiring on the last trading day of each month. Month-end expirations are attractive for buy-side clients such as pension funds as they coincide with important reference dates. Four different market makers provide constant bid/offer prices. In 2019, 2.3 million month-end options traded in the first nine months. In notional terms, traded volume stands at 80 billion EUR. In September, traded volume was 297,000 contracts with an ADV of 14,169.

On 20 Sep 2019, we reached a milestone on Eurex EnLight, our selective RfQ platform. Eurex executive board member Randolf Roth takes the opportunity to explain what this means to us.

It has been 200 days since Eurex extended its trading hours on select liquid benchmark products. As of 25 September 2019, more than 5.7 million contracts have been traded during the Asian time zone. Find out more from the link below.