Market briefing

Global equity markets generally drifted for most of July before finishing weakly. The focus recently has been towards the extraordinary fixed income landscape that sees new records on the notional of negative yielding debt. This not only spans government debt and investment grade credit but also some corners of the ‘high-yield’ universe. It’s clear irony, but also a worrying distortion brought about by years of accommodative central bank policy.

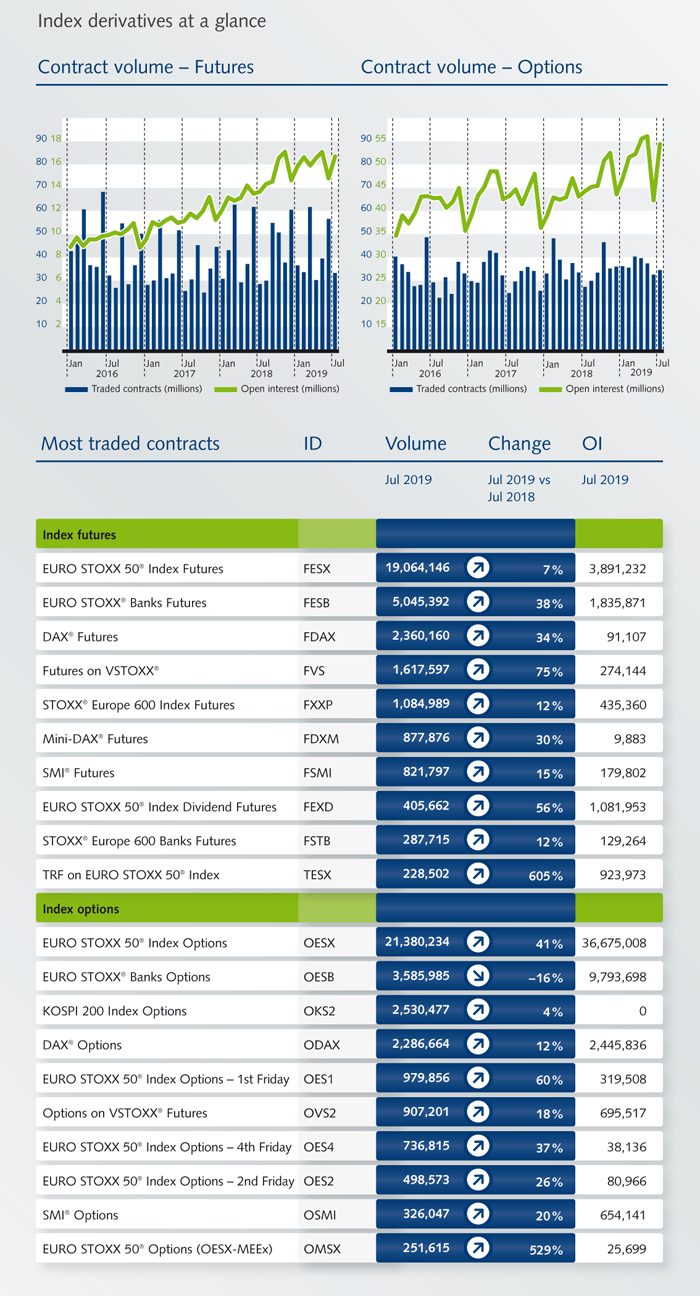

All this has led to a certain mistrust of conventional investment markets and a spike in year-on-year demand for derivative hedging. We saw significant increases in volumes across all our benchmark derivative products: EURO STOXX 50®, Banks sector, DAX® and mini-DAX®, VSTOXX® and the SMI®. We also introduced Stock Tracking Futures on the largest 50 European blue-chips, a product designed for clients looking to extract the pure equity performance by adjusting for dividends. And, for our heavily traded Banks sector futures, we reduced the calendar tick size. The purpose here is to reduce the costs for open interest holders who roll passively.

Looking ahead, there are once again some red flags in alternative asset classes: gold is at multi-year highs, bitcoin has enjoyed a strong bounce off the bottom and equity markets feel as fragile as ever to any negative Presidential tweets! In this current environment we can expect demand for derivative hedging on Eurex to remain elevated.

Zubin Ramdarshan, Head of Equity & Index Product Design, Eurex

Facts & figures

News

Survey - tell us your needs

We are remodeling the functionalities on our website to better fit to your wishes and needs. Design with us the future by telling us what is important for you and which product parameters do you search and use. The survey should take less than 5 minutes to complete. Help us improve! Survey - tell us your needs

Ticking the box: tick size reduction for futures calendar spreads for EURO STOXX®/STOXX® Europe 600-Banks Futures

On 22 July 2019 Eurex will reduce the tick size for standardized futures strategies (futures calendar spreads) for the EURO STOXX®/STOXX® Europe 600-Banks Futures (FESB/FSTB). We spoke to Zubin Ramdarshan, head of Equity & Index Product Design at Eurex, about the planned change.

Hedge Funds Club: interview with Flow Traders on our MSCI offering

The Hedge Funds Club had a chat with Roeland Pot, Managing Director of Flow Traders in Hong Kong about the derivatives markets, changing regulations and new business opportunities. The interview was first published on the Hedge Funds Club website on 15 July in partnership with Eurex.

Removing risk components from single stock futures with Eurex’s new Stock Tracking Futures

On 29 July, Eurex launched Stock Tracking Futures on all the EURO STOXX 50® index components. We spoke to Sascha Semroch, product developer in Equity & Index Product Design

at Eurex, about the new futures.

ESG Market Briefing

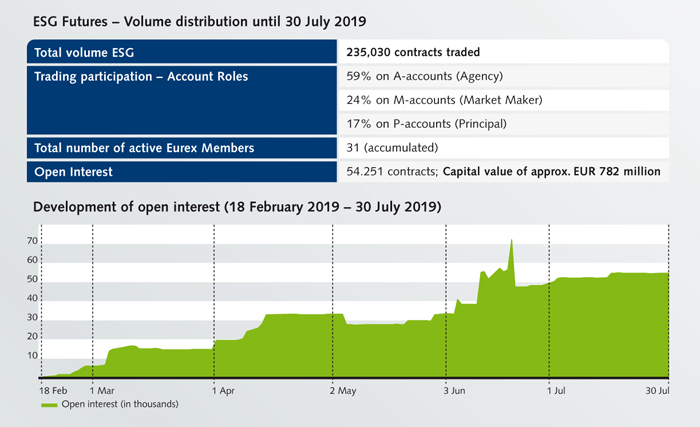

Our STOXX® Europe 600 ESG futures have facilitated trading and hedging of socially responsible investment portfolios and are an important step in the construction and easy implementation of ESG mandates. These unique ESG futures are also essential to create opportunities for asset managers to retain flexibility when managing cash within ESG funds. By late July 2019, open interest in ESG futures has grown to an open interest value of 786 million euros. Read more

Introduction of 43 Single Stock Dividend Futures

On 15 July, Eurex launched 43 additional Single Stock Dividend Futures, bringing the total number of available futures to 221. With the additional futures, Eurex enables investors to manage and hedge dividend exposure far beyond the traditional blue-chip stocks.

Prisma Margin Estimator in Cloud - calculate your margin easily

The Cloud Prisma Margin Estimator (Cloud PME) is Eurex Clearing’s cloud-based solution for margin simulations under Prisma, Eurex Clearing’s margin methodology. The service is free of charge and specifically tailored for end users who wish to simulate margin requirements for Exchange Traded Derivatives (ETDs) or OTC interest rate swaps with or without cross margining.