|

|

ETP News

22nd October – 3iQ

Canada’s First Public Bitcoin Fund Reaches $ 100 Million Mark

23rd October - Grayscale

Grayscale adds a ‘cool $300M’ in a day and $1B this week

27th October - Grayscale

More Than Half of US Investors Interested in Bitcoin, Grayscale Survey Finds

2nd November – 3iQ

3iQ Receives Receipt for The Ether Fund Preliminary Prospectus and Amended and Restated Preliminary Prospectus

4th November - Grayscale

Grayscale Trust sees largest-ever weekly inflow, nears 500K BTC in total

9th November – ETC Group

ETC Group’s bitcoin ETP crashes through $100m barrier

10th November – 3iQ

Bitcoin Fund by 3iQ Completes Offering

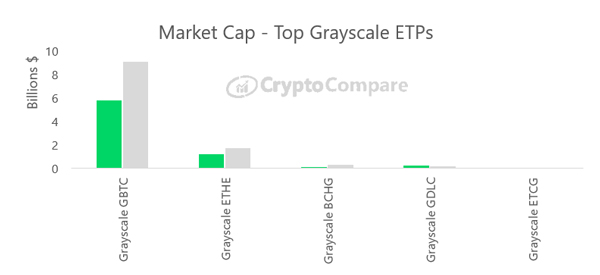

Market Cap

Following the Bitcoin bull run throughout the past month, many ETP products have seen substantial increases in both trading volumes and market cap.

Grayscale’s Bitcoin Trust Product (GBTC) currently represents the highest market cap of all ETP products at $9.1bn. This is an increase of 56% compared to 30 days prior. The OTC-traded product set a record of $215 million in weekly inflows over the last month.

Their Ethereum Trust product (ETHE) followed with a market cap of $1.7bn (+40% since 30-days prior).

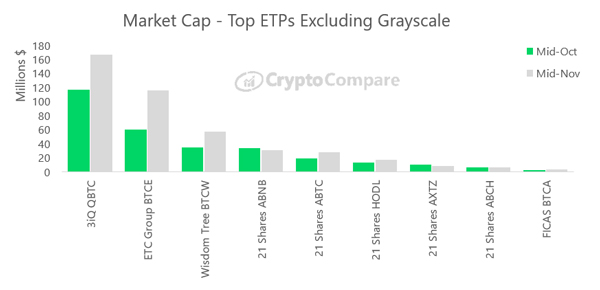

Excluding Grayscale’s OTC-traded products, the largest ETP by market cap is currently 3iQ’s Bitcoin Fund product (QBTC), which is traded predominantly on the Toronto Stock Exchange. Its market cap surpassed $105mn in October, and now stands at $167mn (+58% since 30-days prior).

ETC Group’s BTCE product is currently the second largest and saw the greatest increase in market cap, nearly doubling to $116mn (+93% since 30-days prior) while BTCW by WisdomTree experienced a 65% increase to $79mn.

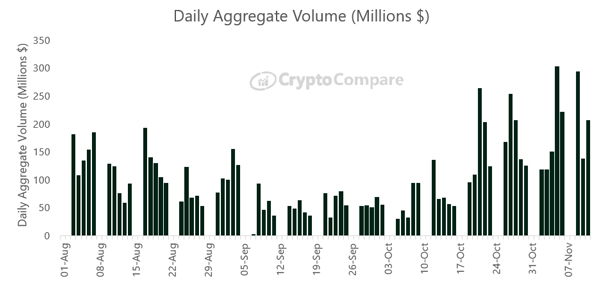

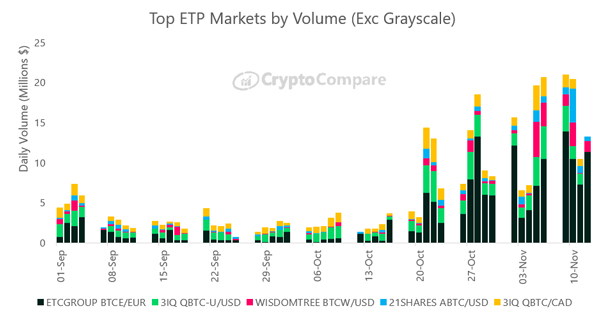

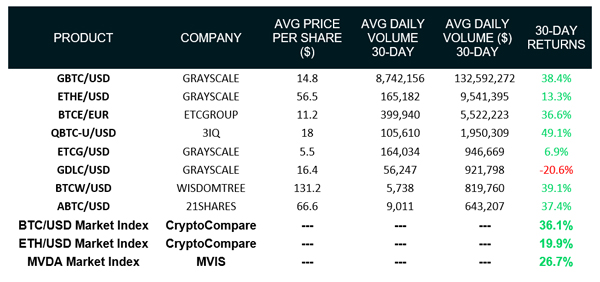

ETP Trading Volumes

Daily ETP volumes have increased by an average of 53.5% in November. Following the Bitcoin price rally throughout last month, average daily volumes now stand at $173.5mn compared to $113mn in October.

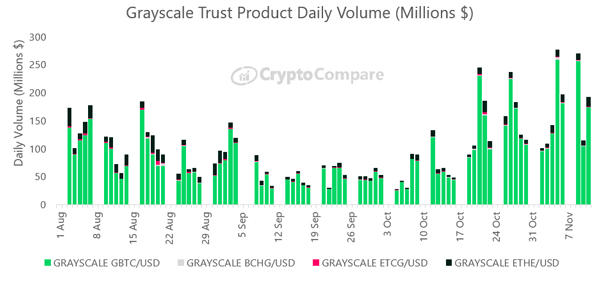

Grayscale’s Bitcoin Trust product volume has increased 68% on average to $162mn in November thus far. GBTC still represents the vast majority of Grayscale’s product volume, followed by its Ethereum Trust product (ETHE), trading $10.9mn/day in November (up 42% vs October’s average).

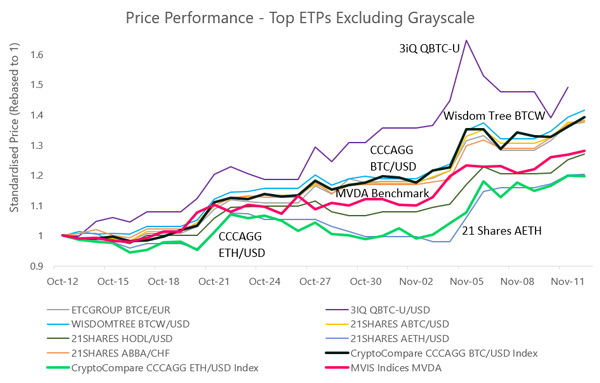

ETP trading activity for non-OTC products has also seen a significant boost in volume in November – ETC Group’s BTCE which trades on Deutsche Börse XETRA has tripled its volume to $8.87mn/day (+212% since October’s average) while 3iQ’s QBTC-U volume has increased 52.8% to reach $2.29mn/day.

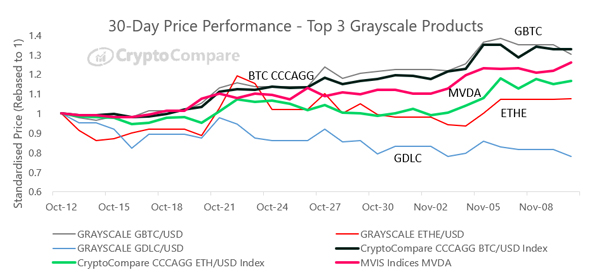

3iQ’s QBTC-U product experienced the highest 30-day returns at 49.1%, followed by WisdomTree’s BTCW product (39.1%) and Grayscale’s GBTC (38.4%) product. All of these products had above market returns compared to CryptoCompare’s CCCAGG BTC/USD index (36.1%) as well as the MVDA market index (26.7%).

Grayscale’s Digital Large Cap Fund (GDLC) experienced a 30-day loss of 20.6% over the last 30-days.

Among the top eight ETPs by volume, five ETP products (GBTC, BTCE, QBTC-U, BTCW, ABTC) outperformed the MVDA index, which is a market cap-weighted index that tracks the performance of a basket of the 100 largest digital assets. The index serves as a benchmark and universe for the other MVIS CryptoCompare Digital Assets Indices.