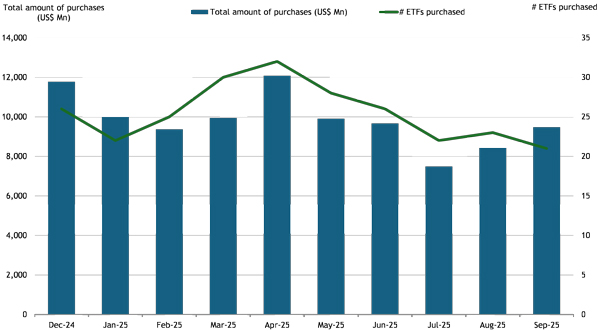

ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that September saw a modest decline in overseas ETF activity among Korean retail investors. In September, 21 of the top 50 overseas securities purchased by Korean retail investors were ETFs listed in the United States. This represents a slight decline from 23 ETFs in August, 22 in July, and 26 in June, indicating a modest cooling in ETF concentration among top overseas picks.

In terms of trading volume, Korean retail investors purchased $9.48 billion in overseas ETFs during September. The peak month so far in 2025 was April, with a record $12.08 billion in ETF purchases.

Key Highlights:

- Korean retail investors bought $9.48 billion in overseas ETFs in September.

- 21 of the top 50 overseas purchases were U.S.-listed ETFs.

- 14 of the top 21 ETFs provided leveraged or inverse exposure, reflecting continued interest in tactical trading strategies.

- The largest single purchase was $2.31 billion of the SPDR S&P 500 ETF Trust (SPY).

Note: All dollar values are in USD unless otherwise noted. Source, Korea Securities Depository.

Overseas ETFs purchased by Korean retail investors by month in 2025

|

Dec-24 |

Jan-25 |

Feb-25 |

Mar-25 |

Apr-25 |

May-25 |

Jun-25 |

Jul-25 |

Aug-25 |

Sep-25 |

||

|

# ETFs purchased |

26 |

22 |

25 |

30 |

32 |

28 |

26 |

22 |

23 |

21 |

|

|

Total amount of ETF purchases (US$ Mn) |

11,773 |

9,992 |

9,366 |

9,942 |

12,076 |

9,904 |

9,664 |

7,489 |

8,433 |

9,478 |

|

Source, Korea Securities Depository.

Top 10 overseas ETFs purchased in September

|

ETF Name |

Purchase Amount in USD |

|

SPDR SP 500 ETF TRUST |

2,309,646,578 |

|

DIREXION DAILY SEMICONDUCTORS BULL 3X SHS ETF |

1,270,621,395 |

|

DIREXION DAILY TSLA BULL 2X SHARES |

1,014,291,656 |

|

INVESCO QQQ TRUST SRS 1 ETF |

923,877,586 |

|

VANGUARD SP 500 ETF SPLR 39326002188 US9229084135 |

766,934,392 |

|

VOLATILITY SHARES TRUST 2X ETHER ETF NEW SPLR 974476707 US92864M4006 |

529,392,000 |

|

GRANITESHARES 2.0X LONG NVDA DAILY ETF |

352,984,078 |

|

DIREXION SEMICONDUCTOR BEAR 3X ETF |

341,381,977 |

|

INVESTMENT MANAGERS SERIES TRUST II TRADR 2X SHORT |

272,379,279 |

|

T-Rex 2X Long MSTR Daily Target ETF |

191,951,639 |

Source, Korea Securities Depository.

The ETF industry in Korea has 1,434 ETFs, with assets of $190.53 Bn, from 39 providers listed on the Korea Exchange at the end of September 2025. 22.66% of the ETFs provide leverage or inverse exposure which account for 6.99% of the assets in the ETF industry in Korea.

Asset Growth in Korea ETF industry as of the end of September