ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that Leveraged and Inverse ETFs and ETPs suffered net outflows of US$138 million during November. Total assets invested in leveraged and inverse ETFs and ETPs decreased from US$77.5 billion at the end of October to $77.2 billion, according to ETFGI’s November 2019 Leveraged and Inverse ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

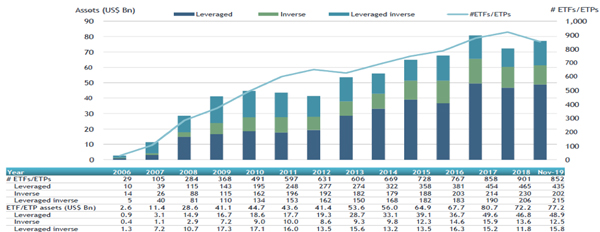

- Assets invested in leveraged and inverse ETFs/ETPs decreased by 0.4% during November 2019 to $77.2 billion.

- During November, leveraged and inverse ETFs/ETPs listed globally saw net outflows of $138 million.

- The majority of assets were invested in Leverage ETFs/ETPs with $48.9 billion, followed by Leveraged/Inverse products with assets of $15.8 billion, then Inverse with $12.5 billion.

“During November the S&P 500 gained 3.6% as global markets were resistant to fears of inflation and showed optimism on the trade talks. Global equities as measured by the S&P Global BMI were up 2.5% and the S&P Emerging BMI gained 0.1%.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

At the end of November 2019, the Global leveraged/inverse ETF/ETP industry had 852 ETFs/ETPs. Of these 852 ETFs/ETPs, 435 were leveraged products, while 202 were inverse listings, and 215 were leveraged inverse. The largest market for leveraged and inverse ETFs/ETPs was in the United States, which, at the end of November 2019, had assets of $48.1 billion invested in 281 ETFs/ETPs.

Global leveraged/inverse ETF and ETP asset growth as at the of end of November 2019

During November, globally listed leveraged and inverse ETFs/ETPs suffered net outflows of $138 million and net outflows year-to-date reached $2.90 billion. The top 20 leveraged and inverse ETFs/ETPs by Year-to-Date net new assets collectively gathered $15.91 billion year-to-date to November. TheNEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund (1357 JP) gathered $2.43 billion alone, the largest net inflow year-to-date to November.

Top 20 ETFs/ETPs by YTD net new assets November 2019: Leveraged and Inverse

|

Name |

Country Listed |

Ticker |

Assets (US$ Mn) |

ADV (US$ Mn) Nov-19 |

NNA |

Leverage |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund |

Japan |

1357 JP |

2,428.47 |

160.21 |

2,209.10 |

Leveraged Inverse |

|

VelocityShares Daily 2x VIX Short Term ETN |

US |

TVIX US |

891.77 |

240.93 |

2,004.69 |

Leveraged |

|

ProShares UltraPro Short QQQ |

US |

SQQQ US |

1,222.63 |

264.20 |

1,493.33 |

Leveraged Inverse |

|

VelocityShares Daily 3x Long Natural Gas ETN |

US |

UGAZ US |

923.70 |

419.32 |

1,316.83 |

Leveraged |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

US |

VXX US |

928.17 |

475.93 |

1,264.57 |

Leveraged |

|

ProShares Ultra VIX Short-Term Futures |

US |

UVXY US |

579.45 |

205.19 |

1,001.86 |

Leveraged |

|

ProShares UltraShort S&P500 |

US |

SDS US |

1,080.97 |

117.92 |

654.13 |

Leveraged Inverse |

|

Daiwa ETF Japan Nikkei225 Inverse Index |

Japan |

1456 JP |

595.00 |

0.14 |

642.92 |

Inverse |

|

ProShares UltraPro Short S&P 500 |

US |

SPXU US |

612.36 |

98.98 |

551.27 |

Leveraged Inverse |

|

ProShares Short S&P500 |

US |

SH US |

1,930.97 |

79.48 |

494.66 |

Inverse |

|

Direxion Daily S&P 500 Bear 3X Shares |

US |

SPXS US |

501.04 |

84.56 |

480.22 |

Leveraged Inverse |

|

CSOP Hang Seng Index Daily -2x Inverse Product |

Hong Kong |

7500 HK |

484.25 |

56.04 |

468.70 |

Leveraged Inverse |

|

Samsung KODEX 200 Futures Inverse 2X ETF |

South Korea |

252670 KS |

674.13 |

117.05 |

408.90 |

Leveraged Inverse |

|

Direxion Daily Semiconductors Bear 3x Shares |

US |

SOXS US |

239.21 |

81.96 |

385.92 |

Leveraged Inverse |

|

Direxion Daily Gold Miners Bear 3x Shares |

US |

DUST US |

339.89 |

91.10 |

382.79 |

Leveraged Inverse |

|

Lyxor UCITS ETF CAC 40 DAILY DOUBLE SHORT |

France |

BX4 FP |

328.98 |

23.32 |

325.37 |

Leveraged Inverse |

|

Xtrackers ShortDAX Daily UCITS ETF - 1C |

Germany |

XSDX GY |

579.17 |

5.97 |

303.26 |

Inverse |

|

Simplex - Nikkei Average Bear Double Exchange Trade Fund |

Japan |

1360 JP |

381.23 |

21.43 |

292.81 |

Leveraged Inverse |

|

NEXT NOTES Nikkei TOCOM Leveraged Crude Oil ETN |

Japan |

2038 JP |

304.62 |

3.49 |

260.40 |

Leveraged |

|

ProShares UltraShort QQQ |

US |

QID US |

323.06 |

46.52 |

249.97 |

Leveraged Inverse |